There's Reason For Concern Over D2L Inc.'s (TSE:DTOL) Massive 48% Price Jump

D2L Inc. (TSE:DTOL) shares have had a really impressive month, gaining 48% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 74% in the last year.

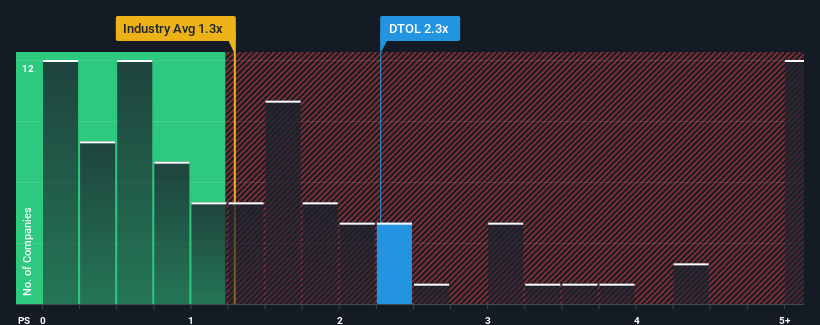

Following the firm bounce in price, when almost half of the companies in Canada's Consumer Services industry have price-to-sales ratios (or "P/S") below 1x, you may consider D2L as a stock probably not worth researching with its 2.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for D2L

How D2L Has Been Performing

Recent revenue growth for D2L has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on D2L will help you uncover what's on the horizon.

How Is D2L's Revenue Growth Trending?

In order to justify its P/S ratio, D2L would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 6.2% gain to the company's revenues. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 13% per annum during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 16% per annum, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that D2L's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

D2L's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that D2L currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for D2L with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance