ThaiBev reports 1.2% dip in 1HFY2023 earnings of $634.7 mil

An interim dividend of 0.15 baht per share has been declared for the period, unchanged from last year.

Thai Beverage (ThaiBev) Y92 has reported a 1.2% y-o-y dip in its earnings of 16.12 billion baht ($634.7 million) for the 1HFY2023 ended March 31.

For the 2QFY2023, however, the group’s earnings grew by 3% y-o-y to 7.36 billion baht.

1HFY2023 earnings per share (EPS) fell by 2% y-o-y to 0.64 baht while EPS for the 2QFY2023 grew by 4% y-o-y to 0.29 baht.

In the 1HFY2023, total revenues from sales and services improved by 3.7% y-o-y to 148.3 billion baht in tandem with the resurgence of economic activity in Thailand and Vietnam.

The group’s spirits business saw its sales revenue dip by 0.04% y-o-y to 65.16 billion baht in the 1HFY2023 as total sales volume fell by 8.5% y-o-y from a high base in the 1HFY2022.

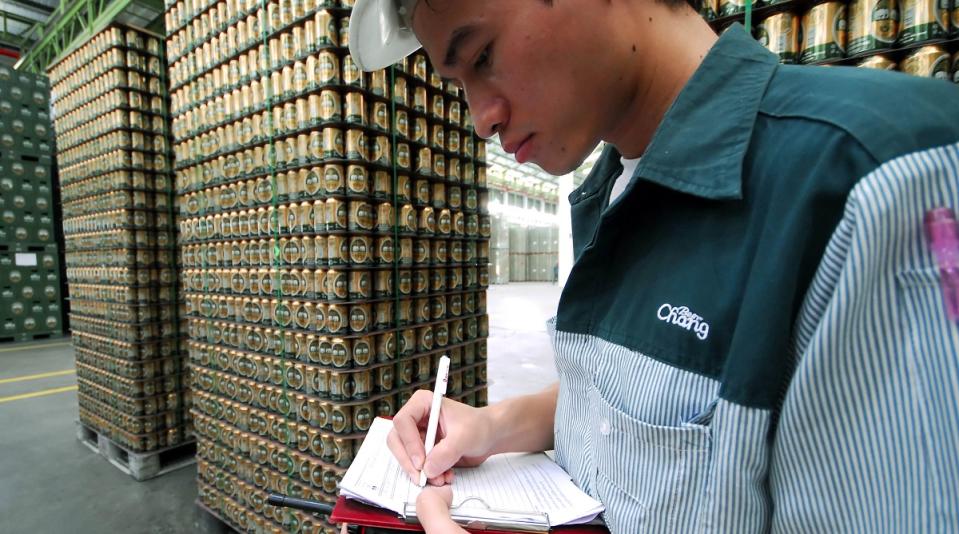

Its beer business reported a 4% y-o-y growth in sales revenue to 64.43 billion baht on the back of price increases.

The group’s non-alcoholic beverages (NAB) business saw sales revenue up by 15.1% y-o-y to 9.44 billion baht lifted by a 7.7% y-o-y increase in overall sales volume.

ThaiBev’s food business saw sales revenue grow by 21.8% y-o-y to 9.37 billion baht in line with the rise of dine-in traffic at restaurants.

The international business saw sales revenue increase by 6.5% y-o-y to 39.26 billion baht as international spirits sales rose by 19.8% y-o-y.

1HFY2023 gross profit grew by 5% y-o-y to 43.52 billion baht during the six-month period.

Operating profit, however, fell by 9% y-o-y to 16.54 billion baht as distribution costs and administrative expenses grew. The group also registered a net loss on foreign exchange (forex) of 53.5 million baht where there were none in the 1HFY2022.

1HFY2023 ebitda fell by 1.5% y-o-y to 27.83 billion baht despite the revenue increase due to the brand investment and marketing activities as well as cost pressures.

Net profit for the period fell by 3.2% y-o-y to 17.78 billion baht as the group’s beer and NAB businesses saw a decline from cost push and brand investment. The group’s spirits business was “resilient” with higher net profit y-o-y.

An interim dividend of 0.15 baht per share has been declared for the period, unchanged from the year before. This will be paid to ThaiBev’s shareholders on June 9.

As at March 31, cash and cash equivalents stood at 20.06 billion baht.

Shares in ThaiBev closed 1.5 cents lower or 2.44% down at 60 cents on May 11.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Marco Polo Marine announces 61% lower earnings to $4.2 million for 1HFY2022

Frasers Property reports 1HFY2023 earnings of $197.2 mil, 52.2% higher y-o-y

F&N reports earnings of $55.0 mil for the 1HFY2023, 19.8% lower y-o-y

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance