Tesla Q4 Preview: Where From Here?

Earnings season has finally arrived, and investors are eager for companies to finally pull back the curtain and reveal what has happened behind the scenes.

A poster child for growth stocks, Tesla TSLA, is set to release quarterly results after the trading session on January 25th.

We’re all familiar with Tesla, which has revolutionized the entire EV (electric vehicle) industry. Currently, the company carries a Zacks Rank #5 (Strong Sell) paired with an overall VGM Score of “B.”

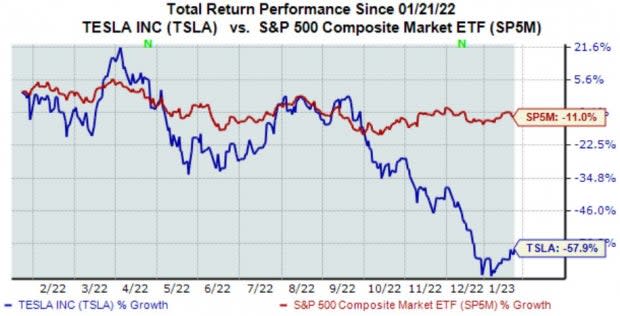

Below is a chart illustrating the performance of Tesla shares over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

How does everything else shape up for the EV titan heading into the print? Let’s take a closer look.

Q4 Deliveries

For starters, Tesla’s total EV deliveries for the quarter is watched like a hawk, a metric widely responsible for determining the trajectory of shares.

It's a vital metric because it shows how many EVs Tesla has been able to produce and place in the hands of its customers.

Earlier in January, Tesla reported Q4 total EV deliveries of roughly 405,000. From a glance, this would be fantastic, representing yet again another quarter of record deliveries for the EV titan.

Still, the reported figure fell short of estimates, causing Tesla shares to witness extreme volatility. Our consensus estimate stood at 407,855.

The worse-than-expected EV deliveries number came in a quarter that was already negatively impacted by COVID-19 disruptions, which caused its Shanghai location to cut back production.

However, with shares already pricing in the less-than-expected Q4 deliveries, there’s a chance of great upside following any positive remarks from the company.

Quarterly Estimates

Analysts have been bearish in their earnings outlook, with five downward estimate revisions hitting the tape over the last several months. Still, the Zacks Consensus EPS Estimate of $1.14 suggests an improvement of more than 30% Y/Y.

Image Source: Zacks Investment Research

Top line growth is also apparent, with the Zacks Consensus Sales Estimate of $24.8 billion indicating a 40% Y/Y increase.

Valuation

Following the rough stretch of price action, Tesla’s valuation multiples have returned to earth; TSLA shares currently trade at a 3.6X forward price-to-sales ratio, well beneath the 6.5X five-year median.

Image Source: Zacks Investment Research

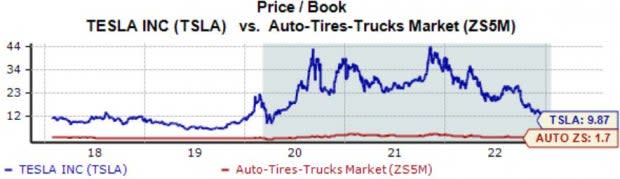

Further, Tesla’s current price-to-book works out to be 9.9X, again nowhere near the steep 16.4X five-year median.

Image Source: Zacks Investment Research

Quarterly Performance

Despite higher costs eating into margins, Tesla has consistently posted better-than-expected earnings, exceeding the Zacks Consensus EPS Estimate in seven consecutive quarters by double-digit percentages.

Still, top-line results have come under expectations as of late, with the EV titan falling short of revenue estimates in back-to-back quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

Tesla TSLA shares have been punished over the last several months thanks to COVID-19 disruptions, whispers of softening EV demand, and a recent delivery miss.

In addition, analysts have taken a bearish stance on the company’s earnings outlook, pushing Tesla down into a Zacks Rank #5 (Strong Sell).

Still, the company’s valuation multiples have pulled back to more reasonable levels, and it remains forecasted to post solid year-over-year growth in both earnings and revenue.

Heading into the quarterly release, Tesla is a Zacks Rank #5 (Strong Sell) with an Earnings ESP Score of -1.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance