Tesla 2024 Annual Shareholder Meeting: Elon Gets Paid and the Company Moves to Texas

Tesla's annual shareholder meeting took place June 13, 2024. Elon Musk talked to shareholders about the company's future and progress on real-world AI, electric vehicles, energy and more. Most notably, shareholders ratified a 2018 performance-based compensation packaged for Musk that had recently been voided in a court case in Delaware. This had more than $50 billion worth of stock options on the line for Musk, which he was originally awarded after leading the company through a more than tenfold increase in value. Shareholders approved the compensation for a second time with 77% of the vote.

Additionally, shareholders voted to approve a measure to move Tesla's incorporation from Delaware to Texas, where it is headquartered, in response to the judicial interference with the original shareholder vote. Below is a summary of the other news Musk revealed in the shareholder meeting, including the full results of the shareholder vote.

For updates on Tesla and other news impacting the stock market, subscribe to the Market Minute newsletter.

News

Much of the shareholder meeting was focused on the company’s development and intent in their artificial intelligence (AI) projects, including Full-Self Driving (FSD) and the Optimus humanoid robot. Below, the progress of these projects are summarized. Some other reveals during the shareholder meeting include:

Earlier in June, Elon approved plans for volume production of the semi truck.

Cybertruck production has reached 1,300 per week.

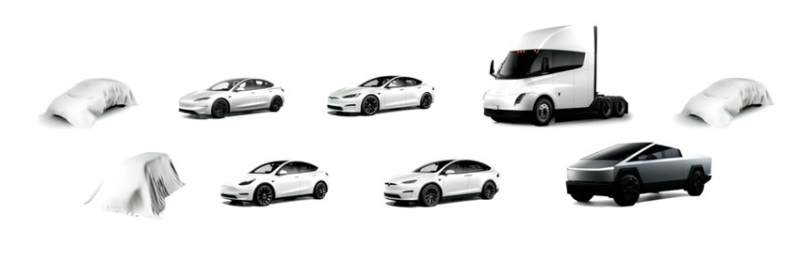

Three new vehicles were shown under cover in the presentation, teasing upcoming products.

Supercharger network continues to grow, with Tesla planning to deploy more this year than the rest of the industry combined.

Musk claimed, without details of where, that new markets will be opening up this and next year for Tesla: "We want Tesla everywhere."

Superchargers are available to other companies, with Tesla providing them with adapters and access.

The company is tracking for 200-300% year-over-year growth in energy storage deployment. This part of the business is currently limited by Megapack ("iteration 2") and Powerwall production (Powerwall 3). Megapack 3 a couple years away.

Tesla will revisit its referral program next quarter, which ended on April 30.

The company will allow FSD transfers for existing customers for one more quarter, Elon stated in response to a shareholder question.

For news that may affect Tesla and the wider market, sign up for the Market Minute newsletter.

AI Updates

While Tesla is categorized as a consumer cyclical stock due to its auto business, Elon has repeatedly stated that this is the wrong way to look at the company. Much of the focus of the shareholder meeting was on the development of real-world AI, including in FSD and Optimus.

Full-Self Driving

In April, Tesla started doing 30-day free trials for FSD (Supervised). At the Q1 earnings call, Tesla released data showing exponential growth of FSD training data through this move.

Musk emphasized that Tesla is no longer constrained by computing power for FSD training, a significant milestone in the company’s journey towards autonomous driving. He stated that Tesla is ahead of Google, Meta and OpenAI in terms of real-world AI. During the recent NVIDIA earnings call, CEO Jensen Huang stated that Tesla is "far ahead" in self-driving technology.

With regards to full-self driving (FSD), Musk claimed the challenge now lies in figuring out how to effectively compare builds, as the fleet’s performance has become so exceptional that interventions are increasingly rare.

Musk spoke of a future where Tesla’s autonomous vehicles serve as a fleet of robotaxis, revolutionizing transportation and generating substantial revenue for the company. He compares the service to a combination of AirBNB and Uber, where you could rent your car out to the Tesla fleet at your discretion, while Tesla also has a fleet. More information is expected during the upcoming Robotaxi unveil event on August 8, 2024.

Optimus

Tesla now has two Optimus robots autonomously working in the Fremont factory, sorting and shipping battery cells. Musk announced that a major hardware revision for Optimus is expected by the end of the year or early next year, with limited production planned for 2025. The company aims to deploy thousands of these robots in its factories, where they will be tested and refined.

Musk also stated that Optimus will be highly interactive, capable of responding to verbal commands and learning new tasks simply by watching videos. At scale, he believes these robots will be a household companion – able to babysit your kids and more – that will cost $10,000 to produce and $20,000 to purchase.

As for competition in the humanoid robot space, Musk acknowledged the challenges faced by startups in the robotics industry, particularly in establishing a supply chain for such advanced technologies. He highlighted Tesla’s ability to design and manufacture its products from scratch as an advantage.

Despite noted challenges to get there, Musk remains optimistic about the future of Optimus, estimating that it could potentially become a $25 trillion market cap situation.

AI Chips and Inference Capacity

Musk also spoke about Tesla's proprietary chip design and its implications for AI inference capabilities. Musk explained that Tesla started from scratch in chip design, a decision that has allowed them to tailor their technology to the specific demands of their vehicles and AI applications. This approach has enabled Tesla to iterate through different hardware versions, each improving upon the last.

Currently, Tesla is training FSD and Optimus on Hardware 3, with plans to upgrade to Hardware 4, which boasts cameras with 4-5 times better resolution and 3-8 times more power than Hardware 3. However, the full potential of Hardware 3 is yet to be fully exploited.

Looking ahead, Musk announced the development of Hardware 5, also known as AI 5, which is expected to be 10 times more capable than HW4. This new hardware will be integrated in both Tesla's vehicles and Optimus in an estimated 18 months. The AI 5 chip promises a “staggering amount” of power-efficient compute, enhancing the reliability and performance of Tesla’s products.

Musk also discussed the potential inference opportunity for Tesla’s AI chips, drawing parallels with Amazon Web Services (AWS). He noted that Amazon initially used only 10% of their inference capacity, which was leveraged to quickly became a significant part of their business. Musk believes that Tesla’s AI chips could similarly become a major revenue driver, providing a powerful inference platform for a wide range of applications.

Sign up for the Market Minute newsletter for market news summarized and delivered right to your inbox.

Results of Tesla’s 2024 Shareholder Vote

Nearly all of the Board of Directors’ recommendations passed in the shareholder vote, including the two key measures on Elon’s 2018 compensation package and Tesla’s reincorporation from Delaware to Texas. Here are the full results of the vote, which shareholders could participate in at the meeting itself or by proxy.

Tesla Proposals

A Tesla proposal to elect two Class II directors to serve for a term of three years, or until their respective successors are duly elected and qualified.

James Murdoch; Kimbal Musk

Board Recommendation: FOR EACH COMPANY NOMINEE

Result: FORA Tesla proposal to approve executive compensation on a non-binding advisory basis.

Board Recommendation: FOR

Result: FORA Tesla proposal to ratify the appointment of PricewaterhouseCoopers LLP as Tesla's independent registered public accounting firm for the fiscal year ending December 31, 2024.

Board Recommendation: FOR

Result: FORA Tesla proposal to approve the redomestication of Tesla from Delaware to Texas by conversion.

Board Recommendation: FOR

Result: FORA Tesla proposal to ratify the 100% performance-based stock option award to Elon Musk that was proposed to and approved by our stockholders in 2018.

Board Recommendation: FOR

Result: FOR

Stockholder Proposals

A stockholder proposal regarding reduction of director terms to one year, if properly presented.

Board Recommendation: AGAINST

Result: FOR

A stockholder proposal regarding simple majority voting provisions in our governing documents, if properly presented.

Board Recommendation: AGAINST

Result: FOR

A stockholder proposal regarding annual reporting on anti-harassment and discrimination efforts, if properly presented.

Board Recommendation: AGAINST

Result: AGAINST

A stockholder proposal regarding adoption of a freedom of association and collective bargaining policy, if properly presented.

Board Recommendation: AGAINST

Result: AGAINST

A stockholder proposal regarding reporting on effects and risks associated with electromagnetic radiation and wireless technologies, if properly presented.

Board Recommendation: AGAINST

Result: AGAINST

A stockholder proposal regarding adopting targets and reporting on metrics to assess the feasibility of integrating sustainability metrics into senior executive compensation plans, if properly presented .

Board Recommendation: AGAINST

Result: AGAINST

A stockholder proposal regarding committing to a moratorium on sourcing minerals from deep sea mining, if properly presented (“Proposal Twelve”).

Board Recommendation: AGAINST

Result: AGAINST

Resources

To keep up to date on important events affecting Tesla and other companies, sign up for the free Market Minute Newsletter.

Money is always in motion. For help valuing stocks for your portfolio, get matched and speak with a financial advisor for free.

Photo credit: ©iStock.com/Sky_Blue

This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. This article IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT INTENDED TO PROVIDE LEGAL ADVICE, TAX ADVICE, ACCOUNTING ADVICE OR FINANCIAL ADVICE. Before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances. SmartAsset's services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

The post Tesla 2024 Annual Shareholder Meeting: Elon Gets Paid and the Company Moves to Texas appeared first on SmartReads by SmartAsset.

Yahoo Finance

Yahoo Finance