Terraced factory at Kaki Bukit for sale at $9.2 mil

The five-storey factory occupies a land area of 8,570 sq ft zoned for Business 2 or heavy industrial use (Picture: Albert Chua/The Edge Singapore)

SINGAPORE (EDGEPROP) - A corner terraced factory located at 14 Kaki Bukit View is up for sale via an expression of interest (EOI) exercise with a guide price of $9.2 million. The five-storey single-user factory occupies a land area of 8,570 sq ft that is zoned for Business 2 or heavy industrial use with a gross plot ratio of 2.0. The land has a 60-year tenure with effect from July 9, 1996. Hence, it has about 33 years remaining on the lease.

The factory has a built-up area totalling 17,136 sq ft and is equipped with a cargo lift and a separate passenger lift. It also comes with a carpark that can accommodate up to eight cars. The ground floor has a ceiling height of 6m, while the remaining floors have a ceiling height of 4.5m.

A property title search shows that the building is owned by Barn & Potter, the manufacturer for homegrown aromatherapy and beauty care retailer Hysses. The brand had formerly operated under the name Mt Sapola until Cheryl Gan, who co-founded the brand with a Thailand-based partner, decided to strike out on her own and rebrand the Singapore business to Hysses in 2017. She now oversees operations as managing director of Hysses and Barn & Potter.

Read also: Pair of Business 2 factories in Tuas for sale at $25 mil

The companies are headquartered at 37 Kaki Bukit View, a four-storey terraced industrial property just a stone’s throw away from 14 Kaki Bukit View. Gan acquired the former in December 2019 and subsequently shifted there from the companies’ previous premises in Tai Seng. Two years later, Gan acquired 14 Kaki Bukit View in February 2022 and began using part of the building as additional storage space for Hysses and Barn & Potter.

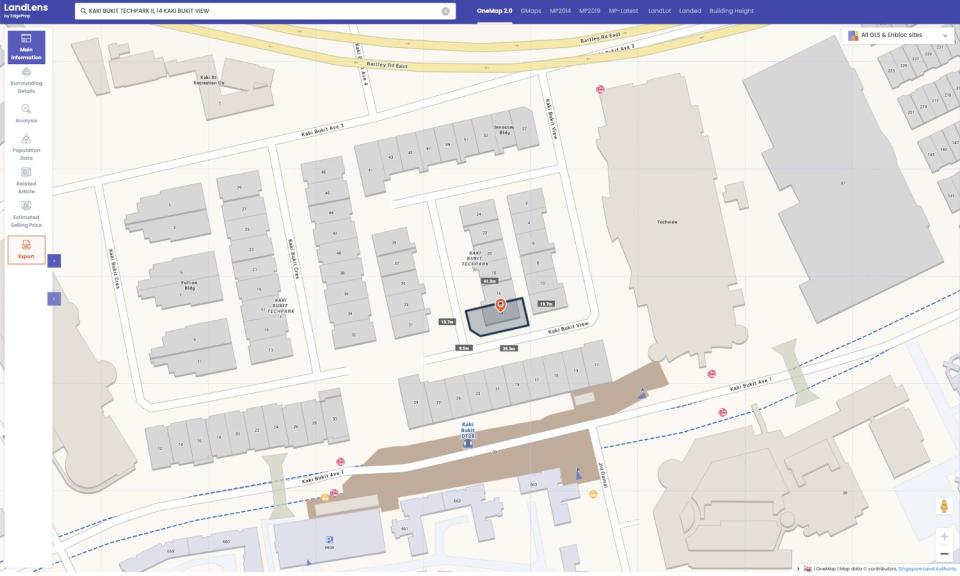

Location map for 14 Kaki Bukit View (Source: EdgeProp LandLens)

Approved for food factory use

After buying the property, Gan decided to apply for approval to change the property’s use to food factory. “I was thinking of venturing into F&B, and thought the factory would be a good place to set up this new business,” she explains.

Written permission was obtained from URA for the change of use earlier this year, says Haden Hee, a PropNex Realty realtor who has been appointed to market 14 Kaki Bukit View. He notes that obtaining such approval is no minor feat, considering the property is not located within an established food zone and sign-offs are required from multiple authorities including URA, the Singapore Food Agency (SFA), the Land Transport Authority, and the Public Utilities Board, among others. “If one of these bodies doesn’t grant approval, you wouldn’t be able to proceed. You need all the stars to align, in a way,” he adds.

Given the lengthy administrative process, it took over a year to obtain the written permission. In the meantime, Gan’s priorities have shifted as Hysses continues to grow. Last October, the brand opened its flagship store in the Kampong Glam area, occupying two back-to-back shophouses at 56 Haji Lane and 87 Arab Street. Caveats show that the 999-year leasehold shophouses were bought in September 2021 for $6.7 million. Positioned as an immersive retail space that displays Hysses’ products and philosophy, the store marks a significant change from the brand’s other outlets located in shopping malls. “With the Haji Lane store, we had the freedom and space to share our brand story more extensively,” Gan reflects.

She is now seeking to sell 14 Kaki Bukit View, with the funds generated to be potentially channelled towards more bricks-and-mortar stores that can serve as experiential touchpoints for the brand.

Gan expects the approval for food factory usage to boost the property’s appeal among potential buyers. Hee concurs, noting that as Singapore steps up its efforts to achieve its “30 by 30” food security initiative aimed at having 30% of its nutritional needs produced locally by 2030, demand for food factories remains strong. As such, he anticipates keen interest from both end-users in food-related industries as well as investors seeking to lease out the property to such tenants.

Read also: Industrial rents up 2.1% q-o-q in 2Q2023; occupancy rises to 89.1%

To complete the change of use and receive the SFA licence required by food manufacturers, certain works will need to be carried out at the factory to meet requirements such as the installation of grease filters and exhaust pipes. Subject to negotiations with the future owner, Gan is open to undertaking the works ahead of handing over the property, allowing the future owner to have a move-in-ready food factory.

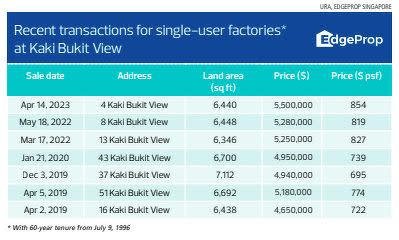

Hee says the asking price for 14 Kaki Bukit View, which works out to $1,074 psf based on the land area, is an attractive proposition compared to other properties recently transacted in the vicinity. Last month, a five-storey intermediate terraced factory at 5 Kaki Bukit Place was put on the market with a guide price of $5.35 million, or $1,116 psf on its land area of 4,795 sq ft. In May, an industrial property at 34 Kaki Bukit Place was sold for $9 million or $1,297 psf on the land area. In June, an industrial property at 40 Kaki Bukit Crescent changed hands for $9.05 million or $1,342 psf on the land area.

Possible conversion into workers’ dormitory

Another plus factor for the property is its connectivity: It is just a three-minute walk to Kaki Bukit MRT Station on the Downtown Line. Hee believes this proximity to public transport also makes 14 Kaki Bukit View an ideal property for conversion into a workers’ dormitory.

Currently, URA allows up to 49% of the gross floor area in industrial properties in select areas to be allocated towards workers’ dormitories. For 14 Kaki Bukit View, Hee says this could roughly translate to up to 80 beds, subject to obtaining the relevant approvals.

The use of the property for a workers’ dormitory will preclude its use as a food factory per URA and SFA guidelines, he notes. He sees this as an attractive proposition for other businesses. “Rents for dorm beds in central areas are hitting $700 per month. At 80 beds, the owner could generate rental income of $56,000 per month, while still having the remaining 51% of the building for their own primary usage.”

The EOI exercise for 14 Kaki Bukit View will close on Sept 4.

Check out the latest listings for Industrial Real Estate properties

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance