Temasek’s GenZero explores three ‘carbon scenarios’ in new paper

The scenarios are not predictions or forecasts. Instead, they are narratives about possible futures for stakeholder education.

Temasek-owned investment firm GenZero has launched a paper examining possible future pathways for carbon markets and the role of carbon finance in accelerating climate action.

Titled “GenZero Carbon Scenarios – An Exploration of the Future of Carbon Markets”, the 56-page paper aims to unpack the complexities of the carbon market landscape.

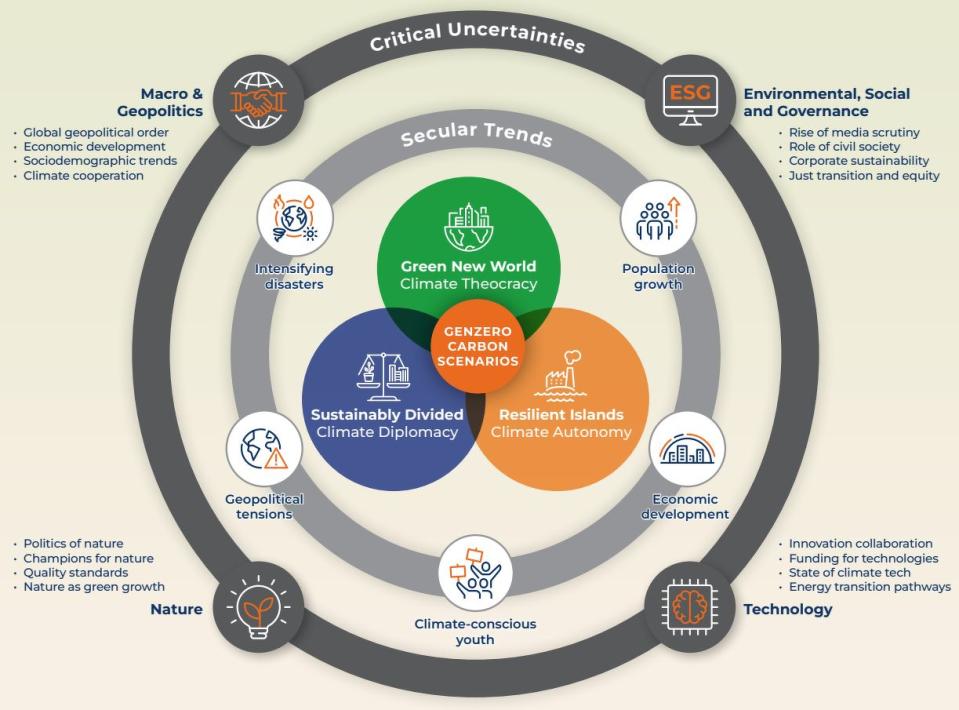

Carbon pricing is an essential tool to accelerate climate action, and carbon markets are a flexible and effective way to put a price on carbon, says GenZero. However, the outlook for carbon markets is highly uncertain. By examining the driving forces shaping carbon markets, the scenarios help to reveal assumptions and stretch the thinking about how carbon markets could look like in the future.

The scenarios could also encourage discussions around no-regrets actions that can enhance the impact of carbon markets, irrespective of how they evolve, says the two-year-old decarbonisation-focused firm.

The paper discusses three possible scenarios for carbon markets, named Green New World, Sustainably Divided and Resilient Islands.

These scenarios are not predictions or forecasts, says GenZero chief executive officer Frederick Teo. Instead, they are narratives about possible futures to help stakeholders understand how key driving forces can impact outcomes differently.

According to GenZero, this can help industry participants chart out strategies and take actions to be more future-ready.

Three scenarios

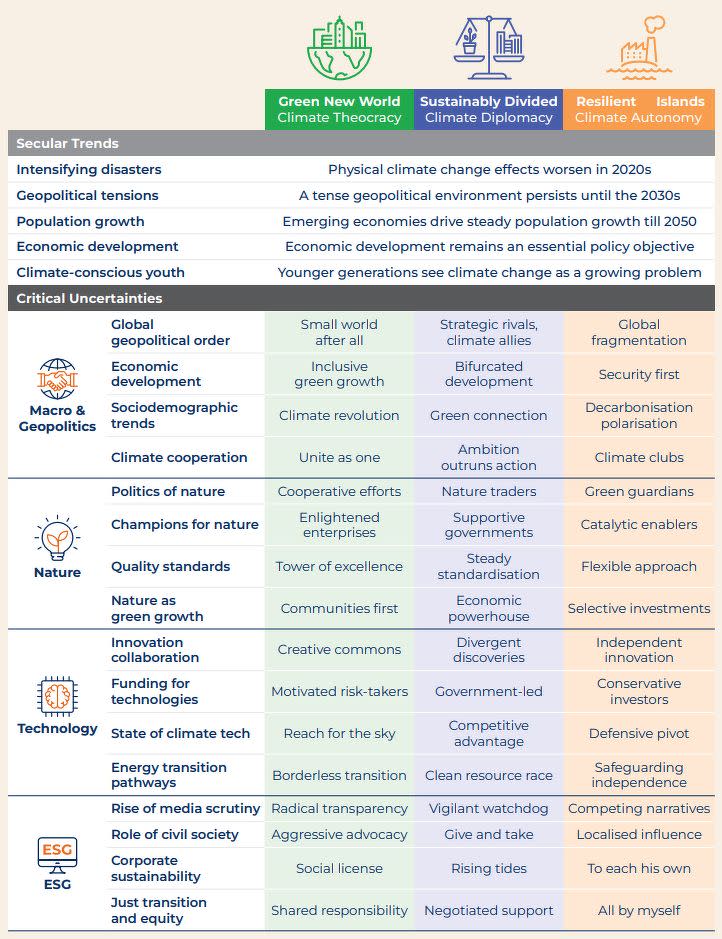

Under the Green New World scenario, which GenZero terms a “climate theocracy”, climate cooperation becomes a top global priority as the world is faced with devastating impacts of climate change.

Here, collaboration drives cross-border optimisation of renewable energy and accelerates energy system decarbonisation. Climate-conscious consumers push governments and corporations to meet high environmental standards.

International organisations establish harmonised sustainability frameworks, imposing a high-quality bar for carbon markets in the mid-2030s.

The focus on quality diverts carbon finance away from projects that deliver cost-effective mitigation at scale, such as avoided deforestation. Instead, focus goes towards carbon removals that are more clearly quantifiable and permanent, such as direct air capture. In this scenario, carbon becomes a valuable commodity and is actively traded in a low-volume but high-price global market.

Under the Sustainably Divided scenario, which GenZero calls “climate diplomacy”, geopolitical contestation results in a “bifurcated” decarbonisation despite extreme weather events.

Here, ideological differences hinder the adoption of global standards, causing decarbonisation pathways and narratives to diverge along geopolitical fault lines.

A bifurcated carbon market emerges in the late-2020s with a focus on high-quality solutions in the West and scalable solutions in the East. The desire for inter-bloc collaboration is initially limited, but eventually rekindled due to resource constraints and increased climate disasters, says GenZero.

By the late-2030s, there is alignment on quality principles between buyers in the West and project developers in the East, enabling carbon markets to bridge the geopolitical gap and facilitate partnerships on high-quality climate solutions.

Finally, under the Resilient Islands scenario, which GenZero refers to “climate autonomy”, climate disasters strain international cooperation and result in fragmented climate action.

A rising sense of nationalism fuels protectionism, and countries hesitate to commit to international initiatives. This spills over into sustainability and climate change.

Frustrated by slow global action in the 2020s, the younger generations of today put increasing pressure on governments and businesses to act. Governments begin taking unilateral action in the early 2030s; with limited prospects for global collaboration on climate, there is a rising focus on resilience and adaptation.

Without centralised oversight, however, sustainability efforts become fragmented. Numerous definitions emerge of what counts as legitimate climate action. Some countries implement effective carbon market schemes and bilateral carbon trading emerges where key quality principles align, offering a limited path for collaboration in a tense geopolitical landscape, says GenZero.

Five takeaways

The scenarios reveal five key takeaways about carbon markets.

First, the carbon markets are likely to remain a key lever for climate action but could look very different depending on how quickly and cooperatively we decarbonise.

Also, the absence of harmonised quality standards means shared quality principles are essential to accelerate investments and confidence in carbon projects

Next, carbon markets can provide a neutral platform to facilitate collaboration on climate action even amid broader geopolitical tensions.

In addition, low-integrity projects can have outsized negative impacts and hold us back from delivering sustained impact at scale.

Finally, “narrow” quality definitions can potentially hinder the development of many carbon project types and the broader carbon markets to incentivise near-term decarbonisation, says GenZero.

Consequently, the paper proposes three strategic imperatives for carbon market participants. These include supporting the development of regulatory oversight in carbon markets, providing clarity on the role of carbon markets in decarbonisation pathways and leveraging digitalisation as a tool to enable integrity at scale and restore confidence.

It is critical to get the carbon market on the right track, says Teo. Not doing so can have “immense repercussions” on our ability to address climate change, he adds.

“Across all possible scenarios, the importance of regulatory support and meta-standards continues to be a unifying thread underpinning the global pathway to net zero… We need a concerted effort across governments, private sector and civil society to help harmonise initiatives, ensure continued progress and secure the success of carbon markets for the future,” says Teo.

Series of papers

The paper builds on GenZero’s inaugural whitepaper from December 2023, which addressed common “misconceptions” around carbon markets and highlighted ways to drive climate mitigation at scale.

Launched at the COP28 Singapore Pavilion in Dubai, the 30-page “Carbon Markets 2.0 — Addressing Pain Points, Scaling Impact” report explored the state of the carbon markets and the obstacles from both the demand and supply sides.

GenZero also offered eight recommendations to “unleash the full potential of carbon markets”, including refining carbon credit taxonomies and incentivising corporate participation.

More recently, GenZero released in March a joint legal paper with local law firm Allen & Gledhill LLP examining the importance of clarifying the legal characterisation of voluntary carbon credits (VCCs).

Titled “The Legal Character of Voluntary Carbon Credits: A Way Forward”, the paper offered a possible characterisation of VCCs as intangible property in Singapore. It also calls for governments to articulate a position and provide market participants with a “sound commercial basis” to transact and manage risk when buying and selling VCCs, among other actions.

GenZero will host the second edition of its flagship sustainability event, the GenZero Climate Summit, from April 15 to 17.

Hosted in conjunction with Temasek’s annual flagship sustainability event, Ecosperity Week, the GenZero Climate Summit will focus on the theme of “The Next Steps”, spotlighting the pivotal and concrete course of actions required to overcome challenges and accelerate decarbonisation globally.

This year’s summit features two dedicated practitioner-focused events: the Tech Forum on April 15 and the Senior Legal Roundtable on April 17.

Notable speakers include Dilhan Pillay Sandrasegara, executive director and chief executive officer of Temasek International; Margaret Kim, chief executive officer of Gold Standard; and Catherine McKenna, founder and CEO of Climate and Nature Solutions, among others.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Classify voluntary carbon credits as intangible property, say Temasek’s GenZero, Allen & Gledhill

Carbon market players attempt to recoup trust after global scandal

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance