Tecnoglass (TGLS) Rises on High-Return Strategic Capex Updates

Tecnoglass Inc. TGLS unveiled its plan for investments across its manufacturing facility network, which is expected to propel installed production capacity by more than 35%.

Shares of this manufacturer of architectural glass, windows and associated aluminum products gained 2.8% during the trading session on Sep 15, 2022, following the news.

Key Takeaways

Tecnoglass has been working on upgrading its glass and aluminum facilities this year to speed up production capacity and automate operations. These investments across its vertically-integrated operations include further automating its glass and window assembly production lines, adding glass production lines and expanding its aluminum facilities, among other initiatives to generate high returns. These actions will improve efficiency throughout its operations while reducing material waste and overall lead times.

Facility investments are anticipated to boost operational capacity to $950 million in revenues by the end of second-quarter 2023. The company also expects to end 2022 with an installed production capacity equivalent to more than $800 million of annual revenues.

The company has been recording higher gross profits and adjusted EBITDA every year over the past four years and remains on track to deliver the same this year. As the company has evolved throughout these years, diversifying business with new customers, products, end markets and geographies, and the increased capacity from these actions will enable the company to meet the rising demand for its high-performance architectural glass, window and aluminum products.

Despite the ongoing macroeconomic challenges, TGLS remains confident, given strong demand, orders and invoicing trends through the third quarter of 2022. These enable the company to foresee robust growth for 2022 and 2023.

The total capital investment is expected to be $52 million, out of which $35 million has already been spent.

Pertaining to the company’s latest moves, Santiago Giraldo, chief financial officer, said, “The long-standing differentiating factors in our strategy and structural competitive advantages give us confidence to continue investing for future expected share gains and growth.” He further added, “Our tight working capital management, increasing mix of revenues from single-family remodel and renovation channels, expanding presence in high performing geographic markets, and prior high-return investments have already demonstrated the significant cash flow generating power of our business. We are poised to advance our premier position within our industry and continue to deliver solid returns in the years to come.”

Share Price Performance

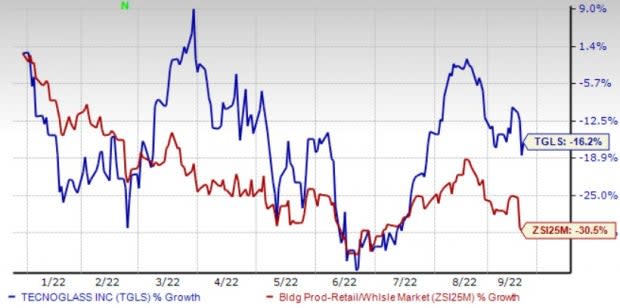

Image Source: Zacks Investment Research

Shares of TGLS have outperformed the Zacks Building Products – Retail industry year to date. Earnings estimates for 2022 and 2023 have increased 14.7% and 13.3%, respectively, over the past 60 days. The estimated figure reflects 47.7% and 12.5% year-over-year growth.

Zacks Rank & Other Key Picks

Tecnoglass currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other top-ranked stocks in the Zacks Retail-Wholesale sector are Cracker Barrel Old Country Store, Inc. CBRL, Ruth's Hospitality Group, Inc. RUTH and Arcos Dorados Holdings Inc. ARCO.

Cracker Barrel presently carries a Zacks Rank #2 (Buy). Cracker Barrel has a long-term earnings growth of 6.9%. Shares of the company have increased 28.4% in the past three months.

The Zacks Consensus Estimate for Cracker Barrel’s 2022 sales and earnings per share (EPS) suggests growth of 16.3% and 15.4%, respectively, from the year-ago period’s levels.

Ruth's Hospitality Group currently carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 35.2%, on average. Shares of the company have increased 5% in the past three months.

The Zacks Consensus Estimate for RUTH’s 2022 sales and EPS suggests growth of 18.1% and 24.8%, respectively, from the year-ago period’s levels.

Arcos Dorados presently carries a Zacks Rank #2. Arcos Dorados has a long-term earnings growth of 34.4%. Shares of the company have risen 6.3% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2022 sales and EPS suggests growth of 27.1% and 104.2%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cracker Barrel Old Country Store, Inc. (CBRL) : Free Stock Analysis Report

Ruth's Hospitality Group, Inc. (RUTH) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance