Tech war: China's semiconductor industry weathers tough year amid tighter US sanctions

China's semiconductor sector weathered a tough year that saw an escalation of US tech sanctions that restricted its access to advanced chip making tools and artificial intelligence (AI) processors, although industry spirits were buoyed by a breakthrough from local tech champion Huawei Technologies.

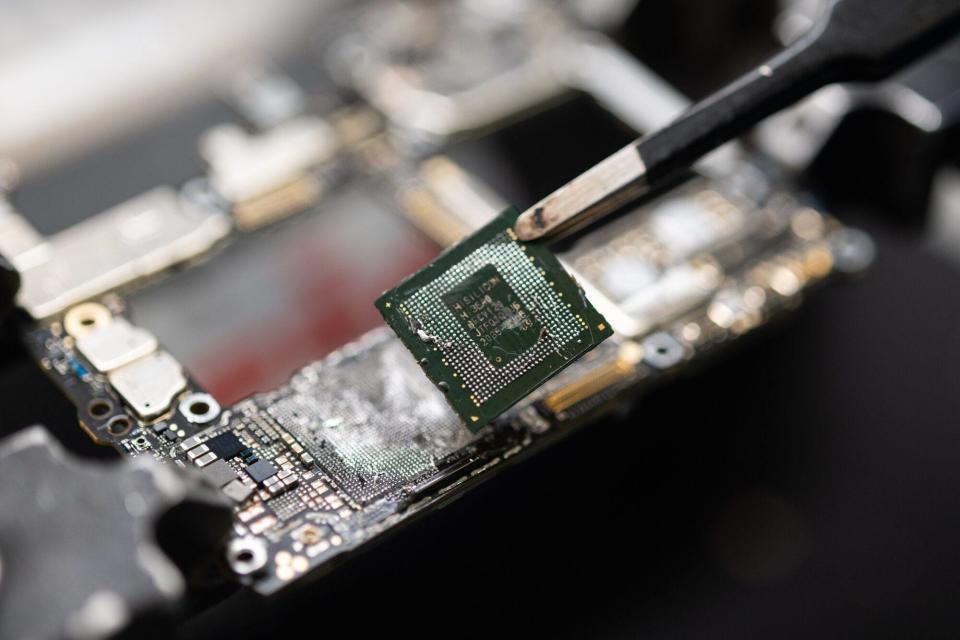

Six weeks after sanctions-hit Huawei staged a surprise comeback with a 5G smartphone based on a 7-nanometre (nm) processor manufactured by Chinese foundry Semiconductor Manufacturing International Corp (SMIC), Washington ratcheted up its China export controls to cover a slew of process gear needed for semiconductor wafer fabrication, including lithography, etching, deposition, implant and cleaning.

The October rules, which tightened already-stringent regulations issued a year earlier over national security concerns, also aimed to hobble China's artificial intelligence (AI) development capability by cutting it off from less advanced Nvidia data centre chips.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

The latest rules also came after successful US efforts since January to woo Japan and the Netherlands to join it in restricting exports of advanced semiconductor tools to China, moves aimed at curbing Beijing's ability to leverage foreign tech for military applications.

The US moves exposed weak links in China's chip supply chain, but they also provided the motivation for renewed efforts at achieving self-sufficiency in semiconductors. Industry insiders said the US sanctions created a rare opportunity for domestic tool makers to get their gear qualified by Chinese wafer fabs, which until now have predominantly been equipped with foreign-made production equipment.

Backed by state-funding for the self-reliance drive, the pace of the domestic replacement of less-advanced foreign-made tools and parts accelerated, despite leaving a few hard nuts to crack, such as lithography machines.

Despite China's steady progress in some chip-making tools, it is far behind in high-end lithography systems, crucial for making advanced integrated circuits, and only available from suppliers in Japan and the Netherlands. Li Jinxiang, deputy-secretary general of the China Electronic Production Equipment Industry Association, told a forum in August that no Chinese-made lithography machines were capable of commercial wafer fabrication, adding that developing such equipment would not be easy.

However, progress could be made in 2024. Shanghai Zhangjiang Group, the state-owned backer of Shanghai Micro Electronics Equipment (SMEE), said in a WeChat post last week that SMEE, which was added to a US trade blacklist in December 2022, has achieved a breakthrough with China's first 28-nm lithography system.

It was the first official confirmation of SMEE reaching the 28-nm lithography milestone, which has been the subject of intense speculation over the past few years. Chinese media reports on the breakthrough were censored.

Despite being far behind leading-edge EUV lithography systems made by Dutch firm ASML, the development was seen as a significant achievement because China is focused on mature chip technology, and 28-nm will pave the way for upgrades to more complex lithography systems.

Due to Western restrictions on purchasing advanced tools, China is expected to continue its investments in mature process nodes, according to a report by semiconductor industry association SEMI.

China currently has 44 semiconductor wafer fabs in operation and a further 22 under construction, Taiwan-based IC research company TrendForce said in a recent note. By the end of 2024, the capacity for mature chip production - defined as 28-nm and older technologies - will be expanded at 32 Chinese fabs.

Consequently, China's legacy chipmaking capacity is set to take off, with China's global share of mature capacity expected to reach 39 per cent by 2027, up from 31 per cent in 2023, according to TrendForce. The massive expansion has triggered concerns from the EU and US, with the US commerce department last week launching a survey into US firms' sourcing and reliance on legacy chips made in China.

A Huawei Kirin 9000s chip fabricated in China by SMIC. Photo: Bloomberg alt=A Huawei Kirin 9000s chip fabricated in China by SMIC. Photo: Bloomberg>

In 2024, market headwinds will also prove a challenge to Chinese chip makers, as the global market looks for a rebound following double-digit year-on-year revenue declines in 2023 due to softening chip demand and elevated inventory of consumer and mobile devices.

China's chip market also took a hit this year after the country's post-pandemic recovery lost steam.

Despite the technology breakthroughs with Huawei, SMIC saw its third quarter revenue decline 15 per cent year on year while net profits fell 80 per cent amid weaker consumer electronics spending in the home market.

Hua Hong Semiconductor, China's number two logic fab after SMIC, saw its third-quarter revenue slide 9.7 per cent year on year, as it slid into the red with a loss of US$25.9 million compared with a profit of US$65.4 million a year earlier.

As of early December, more than 19,000 Chinese semiconductor-related companies had deregistered their businesses, a figure that is a proxy for bankruptcies, the highest number since 2019, according to Chinese media reports, citing company registry website Qichacha.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance