TD Ameritrade Shuts Doors to Retail Clients—How to Transition to a New Broker

We didn’t see that one coming. Seemingly out of nowhere, TD Ameritrade has decided to stop servicing retail clients in Singapore and focus on high-net-worth investors only.

According to a spokesperson from TD Ameritrade Singapore, the broker “has made a strategic decision to focus on meeting the needs of accredited investors” and “are committed to serving this unique market and providing these sophisticated local investors with access to the US markets”.

Whether you have an account with TD Ameritrade or not, I’m sure you have a ton of questions: How do I transfer my investments to another broker? Will my broker close too? Are my investments safe?

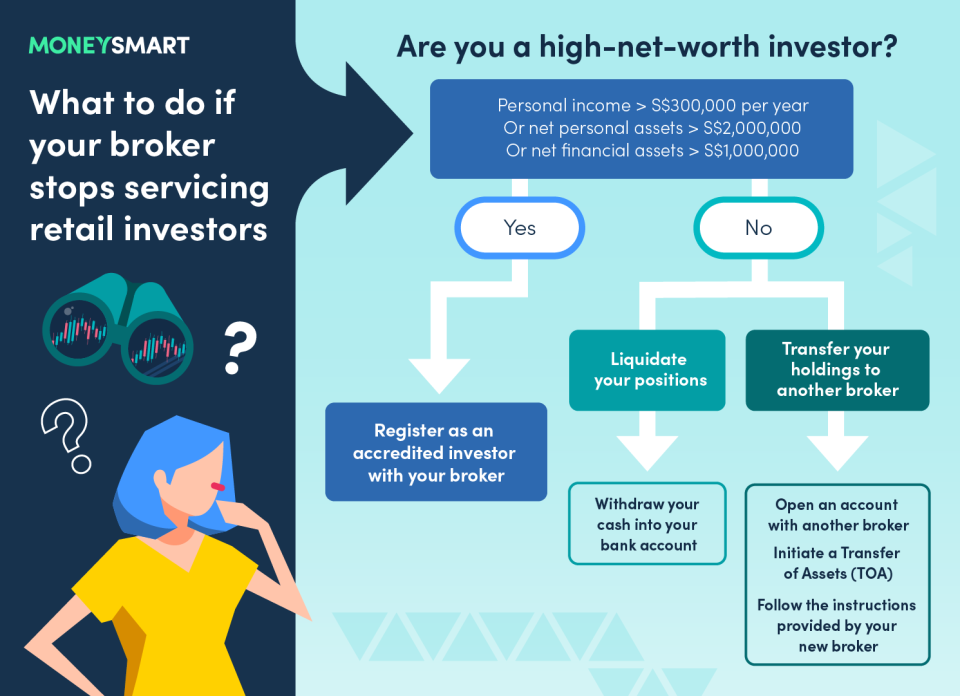

Fret not. Here’s our simple guide can help you out if you need to transition to a new broker.

Immediate Actions for TD Ameritrade Account Holders

If you have investments with TD Ameritrade, it’s important to take action before 27 Oct 2023. Beyond that, TD Ameritrade will implement a monthly account maintenance fee of USD $50.

But where and how does one start to take action. Here are some questions to ask yourself:

The good news is, if you act early, TD Ameritrade will waive or refund any transfer or wire fees you incur (till 31 December 2023). But this only applies to entire account transfers and/or wire withdrawals.

Which broker should I choose next?

Switching brokers can be annoying—trust me, I have experienced it before. That’s why we need to look at various factors before we decide.

Available markets: I’ve lost count of the times I’ve opened an account with a broker only to realise they don’t offer the stocks I want to trade. Each broker usually lists their available instruments on their website or sometimes on a separate document. Scan through it first.

Fees: Some brokerage accounts are riddled with hidden fees. These aren’t necessarily bad, but it can be a nasty surprise. Look out for things like platform, custody, inactivity, and maintenance fees. Try to go for brokers that offer zero fees or razor-thin spreads.

Trading platform: Many people loved TD Ameritrade for their thinkorswim platform. Open a demo account first with your next broker to experience their trading platform before going live.

Besides these points, it’s also crucial to ensure your broker is reputable and here to stay.

“Retail investors should look at brokers who have a long history in Singapore, who consistently settle trades on time, who have a strong balance sheet, have no regulatory warnings or fines, high staff turnover or “fast marketing”,” says Forbes.

“One observation is brokers promoting deals that are too good to be true, are not in the interest of retail investors, and investors should be wary of falling for false marketing. Generally speaking, these are the markers to watch out for before a broker moves from a going concern to a potential problem and retail customers should become worried.”

But of course, that doesn’t mean that you shouldn’t take advantage of legitimate promos.

As Leong says, “retail investors should keep an eye out for any attractive promotions offered, to lower their trading fees incurred and stretch every dollar of their investments.”

Which brokers can I choose from?

To make your job easier, here are some top picks of brokerages available through MoneySmart—most of them offer juicy welcome bonuses too.

MoneySmart Exclusive

Low Commission Fees

Tiger Brokers

MoneySmart Exclusive:

[FLASH DEAL]

Get $160 Cash via PayNow when you open a Tiger Brokers Account and fund OR transfer stocks (min, USD1,000) while enjoying Ultra-low US Options Fees as low as USD 0.65*! T&Cs apply.

Get an additional USD50 stock voucher from Tiger Brokers when you deposit USD10,000 OR an initial transferring stocks* (worth USD10,000).

PLUS get up to S$888 worth of prizes* and 8% p.a.* interest bonus from Tiger Brokers when you sign up, deposit and trade with Tiger Brokers! T&Cs apply.

Valid until 31 Oct 2023

More Details

Key Features

Seamless access to global markets including US, SG, HK, AU and China

US Fractional Shares trading available

Exclusive products such as Fund Mall, Maturity Bond, Tiger Vault, and more

Free and interactive educational materials, videos and features to embark on your investment journey with millions of traders in Tiger Community

Help desk assistance available 24/5 for any immediate customer service issues

Get an additional USD50 stock voucher from Tiger Brokers when you deposit US$10,000 OR an initial transferring stocks* (worth US$10,000).

Online Promo

Flexible pricing plans

Saxo

Online Promo:

Enjoy SGD188 commission credit* when you successfully open a Saxo account. T&Cs apply.

Existing TD Ameritrade clients? Transfer your securities to Saxo with no fees incurred.

Valid until 31 Oct 2023

More Details

Key Features

Earn up to 4.56%* interest on cash balances without any lock-in period. *Rates are provided on per-annum basis. See website for more details.

Commission rate for SGX stocks & ETFs remaining at 0.03%, the lowest rate in the market

Offers wide range of product portfolio across stocks, ETFs, bonds, commodities, options, futures, funds, FX, and CFDs. Earn cash rebates on your FX and CFD trades above threshold on specified plans.

Access more than 22,000+ stocks and 6,400+ ETFs across 37 exchanges worldwide such as NYSE, NASDAQ, SGX, and more

Higher account tiers offer improved trading conditions such as lower prices, priority customer support, direct access to trading experts, 1 to 1 access to Saxo’s in-house strategists at SaxoStrats, and access to events and VIP network

Your Saxo account gains you to access 3 types of trading platforms: the simple and fast SaxoInvestor, a comprehensive SaxoTraderGO, or the fully customisable and professional SaxoTraderPRO on desktop, mobile, and tablet

Provides comprehensive research and analysis tools and a 24/5 customer service

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Enjoy SGD188 commission credit* when you successfully open a Saxo account. T&Cs apply. Existing TD Ameritrade clients: Transfer your securities to Saxo with no fees incurred.

Online Promo

CMC Invest

Online Promo:

Enjoy 1 FREE share* and live US market data when you open a CMC Invest account, fund and trade. T&Cs apply.

PLUS transfer your positions into CMC Invest and get up to S$300 cash rebate. T&Cs apply.

Valid until 31 Dec 2023

More Details

Key Features

Access to thousands of shares, REITs and ETFs across 15 markets

24/5 Singapore-based customer support

Access to Sustainalytics ESG Risk Ratings feature

Customisable reports and widgets such as watchlist

Seamless investing – available desktop, mobile and tablet

TradingView charting package

Easy sign ups via SingPass

Free monthly trades in SG, US, UK, CA and HK

Free live US market data upon sign up

No platform, custody, settlement and inactivity fees

Safety and segregation of cash and securities with JPMorgan and BNP Paribas, respectively

No trading and transaction tax for HK stocks (waived off by CMC Invest)

Interactive Brokers

More Details

Key Features

Rated Lowest Margin Fees by StockBrokers.com.

SGD Margin rates as low as 3.923% (BM + 1.5%)

Offers one of the most competitive commission rates of US$1 on ETF trading

Gain access to over 3,000 global ETFs from 30+ exchanges worldwide including US, SG, HK, AU, and JP stock exchanges

Leverage an extensive repository of educational videos and online courses to learn how to invest in ETFs

Low commission fees

moomoo Singapore

More Details

Key Features

Lifetime commission-free in the U.S. stock market. T&Cs apply.

Trade stocks , ETFs, options, funds, futures and more

Over 100 drawing tools and indicators

Analyse stocks in one look with in-app stock screeners

Capture opportunities within sectors with in-app heat map tool

24 hour online customer support on trading days

Free Level 2 US Stock Market Data

Free Level 1 Singapore Market Data

Free Level 1 China A-share Market Data

Regulated by MAS and is the first digital brokerage to receive full SGX memberships.

MoneySmart Exclusive

Online Promo

No commission

Webull Singapore

MoneySmart Exclusive:

Get S$100 Cash via PayNow* when you successfully open a Webull Account, fund a min. of S$100 and execute a qualifying trade! T&Cs apply.

Get 6 free shares worth US$60-3000 when you use MoneySmart's link to fund and maintain any amount! T&Cs apply.

Plus, get cash rewards worth up to USD2000* when you activate Moneybull, meet the funding requirements by 16 Nov 2023 and maintain your deposit until 29 Feb 2024. T&Cs apply.

Valid until 31 Oct 2023

More Details

Key Features

0 Platform Fee for US Options & HK Trades*

Regular Savings Plan: Dollar-Cost Average your favourite US Stocks, ETF & Mutual Funds at your own pace.

Earn up to 5.18%* 7-Day USD Yield (P.A.) with Moneybull

Own a fractional share for as little as USD5

Invest in wide range of funds with different strategies like Equity, Fixed Income and Multi Asset with 0* subscription and redemption fee.

Full extended hours trading - 16 hours of trading in the US markets

Licensed and regulated by MAS

For even more options, compare the best online investment brokerages in Singapore.

Whichever broker you choose, always ensure that liquidating your positions, making withdrawals, and transferring your assets to another broker is seamless. Send the customer support team an email and ask about the process. That way, you’ll always live to trade another day.

Are my investments with other brokers safe?

Unfortunately, there’s a chance that we might see more brokers shutting their doors to retail investors in Singapore, according to Christopher Forbes, Head of CMC Invest (Singapore). He predicts that other brokers are likely to quietly leave Singapore in the coming 12-18 months.

Forbes’ reason for this? No broker is 100% safe. After all, TD Ameritrade was one of the most reputable brokers in the retail investment space. And if they’re closing doors to retail investors, any broker can too.

However, not all experts believe this to be true. Mr. Ian Leong, Chief Executive Officer, Tiger Brokers (Singapore), thinks that TD Ameritrade’s decision is quite singular based on their unique business considerations and does not expect other brokerages here to follow a similar path.

Whatever happens, the key is to stay informed and know what to do in the scenario that you’re forced to switch brokers—and that’s what MoneySmart is here to help you with.

If you know anyone who dabbles with investing, share this article with them!

The post TD Ameritrade Shuts Doors to Retail Clients—How to Transition to a New Broker appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post TD Ameritrade Shuts Doors to Retail Clients—How to Transition to a New Broker appeared first on MoneySmart Blog.

Original article: TD Ameritrade Shuts Doors to Retail Clients—How to Transition to a New Broker.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance