Swiss Growth Leaders With High Insider Stakes Featured On SIX Swiss Exchange

The Swiss market recently experienced a downturn, reflecting broader European trends as investors await pivotal U.S. economic data that could influence future interest rate decisions. Amid such market conditions, stocks with high insider ownership in Switzerland can offer intriguing stability and growth potential, as insiders typically have a vested interest in the company's long-term success.

Top 10 Growth Companies With High Insider Ownership In Switzerland

Name | Insider Ownership | Earnings Growth |

Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

VAT Group (SWX:VACN) | 10.2% | 21.2% |

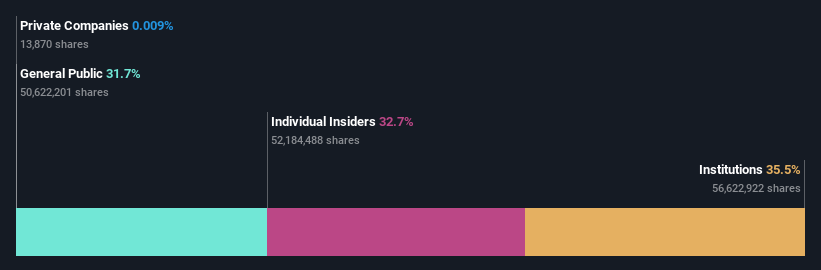

Straumann Holding (SWX:STMN) | 32.7% | 21% |

Swissquote Group Holding (SWX:SQN) | 11.4% | 14.0% |

COLTENE Holding (SWX:CLTN) | 22.2% | 20.9% |

Temenos (SWX:TEMN) | 17.4% | 14.7% |

Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Here we highlight a subset of our preferred stocks from the screener.

Sonova Holding

Simply Wall St Growth Rating: ★★★★☆☆

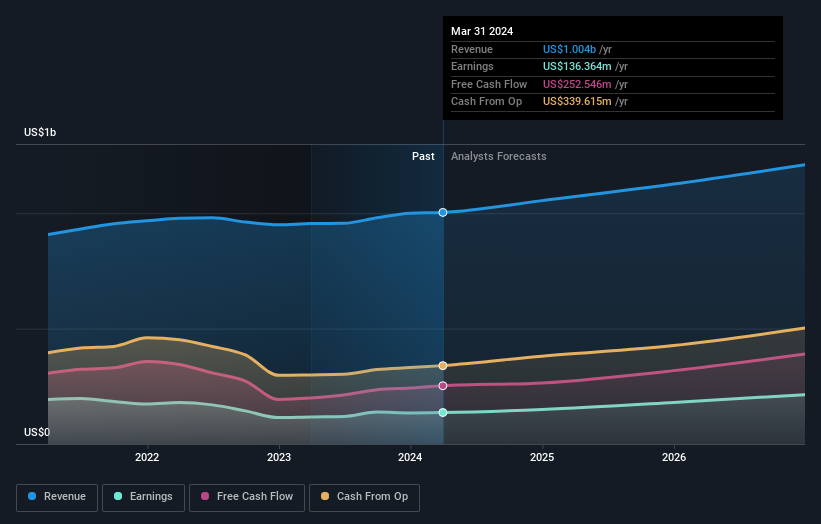

Overview: Sonova Holding AG is a company that specializes in manufacturing and selling hearing care solutions for both adults and children across various regions including the United States, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of CHF 16.18 billion.

Operations: The company generates revenue primarily through two segments: Cochlear Implants, which brought in CHF 282.40 million, and Hearing Instruments, accounting for CHF 3.36 billion.

Insider Ownership: 17.7%

Return On Equity Forecast: 26% (2027 estimate)

Sonova Holding AG, a Swiss growth company with high insider ownership, is trading at 39.6% below its estimated fair value and shows promising financial forecasts with earnings expected to grow by 9.91% annually. Although this growth rate does not qualify as significant, it still outpaces the broader Swiss market's forecast of 8.3%. The company holds a substantial level of debt but maintains a strong projected return on equity at 26.2%. Recent financial results for FY ended March 31, 2024, reported robust sales of CHF 3.63 billion and net income of CHF 609.5 million.

Take a closer look at Sonova Holding's potential here in our earnings growth report.

Our valuation report here indicates Sonova Holding may be undervalued.

Straumann Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Straumann Holding AG specializes in tooth replacement and orthodontic solutions globally, with a market capitalization of approximately CHF 17.44 billion.

Operations: Straumann's revenue is derived from its sales in various regions: CHF 1.20 billion from operations, CHF 451.27 million in Asia Pacific, CHF 793.05 million in North America, CHF 265.82 million in Latin America, and CHF 1.17 billion in Europe, Middle East and Africa.

Insider Ownership: 32.7%

Return On Equity Forecast: 24% (2026 estimate)

Straumann Holding AG, a Swiss company with high insider ownership, is valued 8.3% below its fair value and shows potential with expected earnings growth of 21% annually, outpacing the Swiss market forecast of 8.3%. Despite a decrease in profit margins from last year, revenue growth is anticipated to exceed the market average. The company's share price has been highly volatile recently. Straumann has actively participated in multiple international conferences, enhancing its industry presence and investor relations.

Temenos

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.49 billion.

Operations: The company generates its revenue by providing integrated banking software solutions to financial institutions across the globe.

Insider Ownership: 17.4%

Return On Equity Forecast: 26% (2027 estimate)

Temenos, a Swiss growth company with significant insider ownership, is trading 26.6% below its estimated fair value. It forecasts robust revenue growth at 7.6% annually, surpassing the Swiss market's 4.4%. However, it carries a high level of debt which could be concerning. Recent strategic moves include launching a share repurchase program and securing key client contracts like Haventree Bank for digital transformation through its SaaS solutions, enhancing business agility and performance scalability.

Dive into the specifics of Temenos here with our thorough growth forecast report.

The valuation report we've compiled suggests that Temenos' current price could be quite moderate.

Seize The Opportunity

Dive into all 16 of the Fast Growing SIX Swiss Exchange Companies With High Insider Ownership we have identified here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SWX:SOON SWX:STMN and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance