Swedish Growth Companies With High Insider Ownership In June 2024

As of June 2024, the Swedish market, like many global counterparts, reflects a cautious optimism amid fluctuating economic indicators and political uncertainties across Europe. In such a landscape, growth companies with high insider ownership can offer investors potential resilience and alignment of interests between shareholders and management. High insider ownership often indicates confidence from those who know the company best—its leaders—which can be particularly reassuring in times of broader market unpredictability.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 43.4% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Underneath we present a selection of stocks filtered out by our screen.

Betsson

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Betsson AB (publ) operates an online gaming business across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of approximately SEK 16.13 billion.

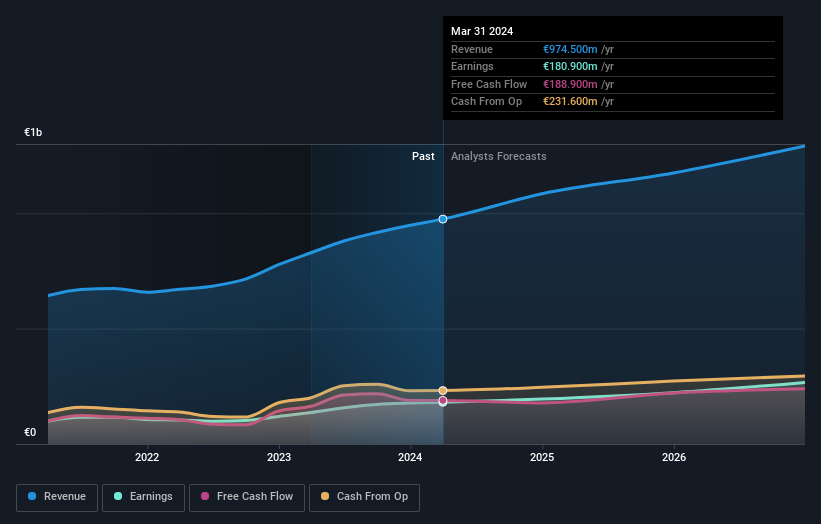

Operations: The company generates revenue primarily from its Casinos & Resorts segment, which brought in €974.50 million.

Insider Ownership: 10.9%

Earnings Growth Forecast: 14.0% p.a.

Betsson, a Swedish company with high insider ownership, has shown promising financial performance with a 32.9% earnings growth over the past year and substantial insider buying in the last three months. Recent adjustments to share limits and articles of association could impact future operations. Despite an unstable dividend track record, Betsson's revenue and earnings are expected to grow at 9.9% and 14% per year respectively, outpacing the Swedish market forecasts. Trading significantly below estimated fair value suggests potential upside for investors.

Click here and access our complete growth analysis report to understand the dynamics of Betsson.

Our expertly prepared valuation report Betsson implies its share price may be lower than expected.

Humble Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humble Group AB operates in the refining, development, and distribution of fast-moving consumer goods both in Sweden and internationally, with a market capitalization of SEK 4.37 billion.

Operations: The company's revenue is divided into four main segments: Future Snacking (SEK 935 million), Sustainable Care (SEK 2.24 billion), Quality Nutrition (SEK 1.51 billion), and Nordic Distribution (SEK 2.62 billion).

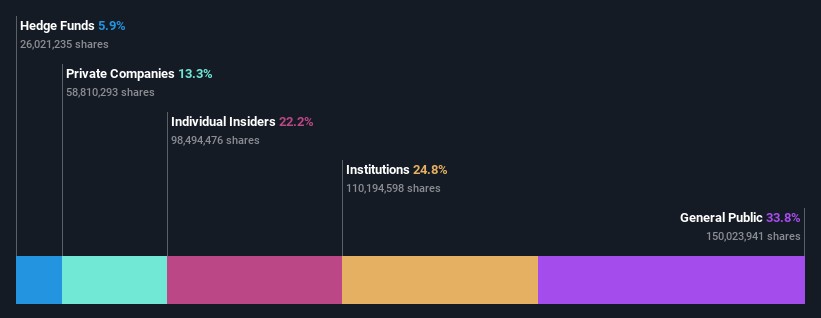

Insider Ownership: 22.2%

Earnings Growth Forecast: 72.8% p.a.

Humble Group, a Swedish growth company with high insider ownership, recently increased its credit facilities by SEK 300 million to SEK 1.95 billion, enhancing financial flexibility. Despite revenue growing at 12% annually—above the Swedish market average—the company's return on equity is expected to remain low at 9.1%. Humble Group is trading at a significant discount to fair value and is forecasted to become profitable within three years, reflecting potential for future growth despite current underperformance in earnings growth compared to industry peers.

MilDef Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MilDef Group AB operates primarily in the security and defense sectors, focusing on the development, manufacture, and sale of rugged IT solutions and special electronics, with a market capitalization of approximately SEK 2.82 billion.

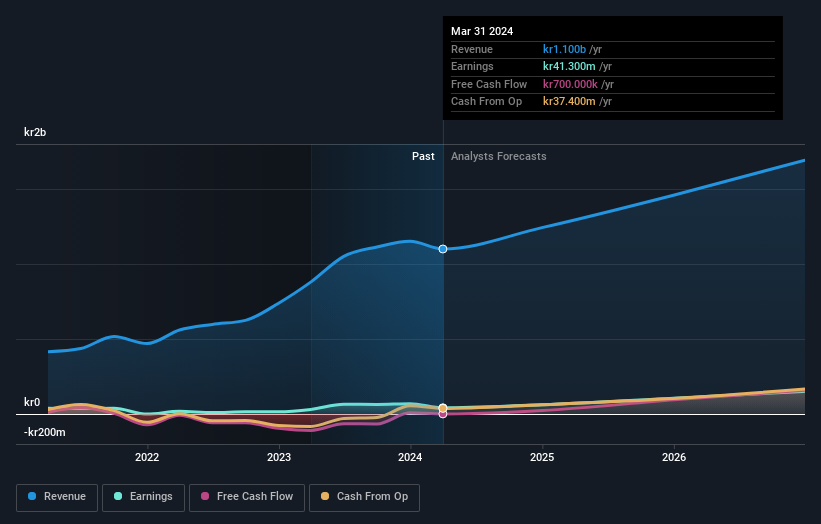

Operations: The company generates its revenue predominantly from the sale of computer hardware, totaling SEK 1.1 billion.

Insider Ownership: 23%

Earnings Growth Forecast: 44.7% p.a.

MilDef Group, a Swedish growth company with significant insider ownership, is poised for substantial earnings growth, forecasted at 44.7% annually, outpacing the Swedish market's 14%. Despite recent challenges like a net loss in Q1 2024 and lower sales compared to the previous year, strategic contracts in Estonia and with BAE Systems signal robust future revenue streams. Currently trading at a considerable discount to its fair value, MilDef offers potential upside amidst its recovery efforts.

Where To Now?

Unlock our comprehensive list of 84 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BETS B OM:HUMBLE and OM:MILDEF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance