Swedish Exchange Highlights: Three Growth Companies With High Insider Ownership

As global markets exhibit varied responses to economic signals, Sweden's market remains a focal point for investors seeking stability and growth potential. In this context, companies with high insider ownership can be particularly appealing as they often demonstrate a deep commitment from those who know the business best. In light of the current market conditions, where investor sentiment is cautiously optimistic amid economic adjustments, stocks with substantial insider stakes might offer a sense of security; insiders are likely to act in ways that protect long-term value when they have significant skin in the game.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Biovica International (OM:BIOVIC B) | 12.7% | 73.8% |

InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Let's explore several standout options from the results in the screener.

BioArctic

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) focuses on developing biological drugs for central nervous system disorders in Sweden, with a market capitalization of SEK 19.52 billion.

Operations: The company generates SEK 252.21 million in revenue from its biotechnology segment.

Insider Ownership: 35.1%

BioArctic AB, a Swedish biopharmaceutical company, is experiencing significant growth with a forecasted revenue increase of 40.8% per year. The firm is expected to become profitable within the next three years, outpacing average market growth. Notably, its Return on Equity is predicted to be high at 31.7%. Recent strategic moves include a partnership with Eisai Co., Ltd., focusing on Alzheimer’s treatment innovations and the approval of Leqembi® in South Korea for early-stage Alzheimer's disease management. However, recent financial results show a substantial net loss compared to the previous year's net income, indicating potential volatility in its financial performance.

Fortnox

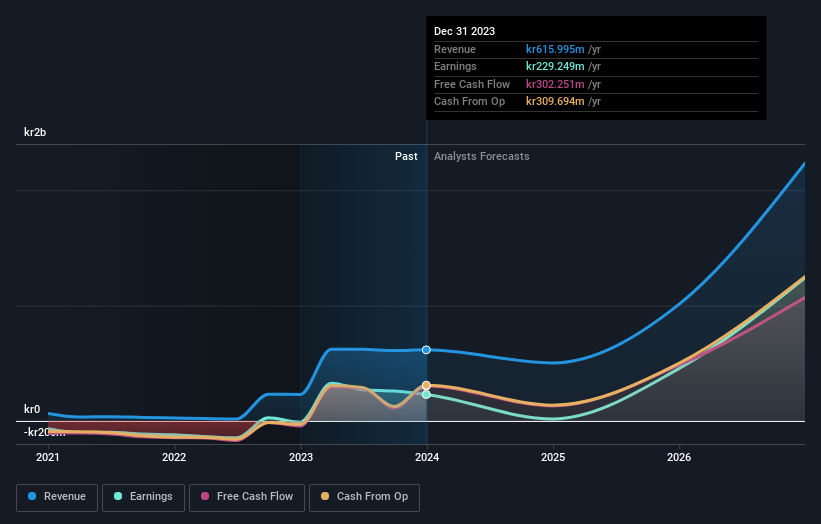

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB operates in providing financial and administrative software solutions to small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 38.72 billion.

Operations: The revenue for the company is segmented into Core Products generating SEK 698 million, Entrepreneurship at SEK 356 million, The Agency contributing SEK 327 million, Money at SEK 232 million, and Marketplaces with SEF 150 million.

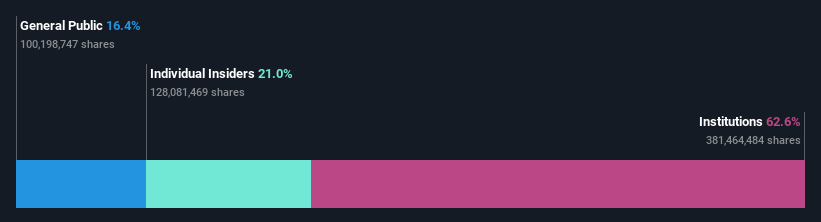

Insider Ownership: 21%

Fortnox AB, a Swedish software company, has shown robust growth with earnings increasing by 58.8% over the past year and forecasted to grow at 21.1% annually. Despite this, insider transactions have not been substantial in recent months. The firm's revenue is also expected to outpace the market with an annual increase of 19.7%. Additionally, its Return on Equity is projected to be strong at 33.2% in three years' time, underscoring efficient capital management despite less aggressive insider buying recently.

AB Sagax

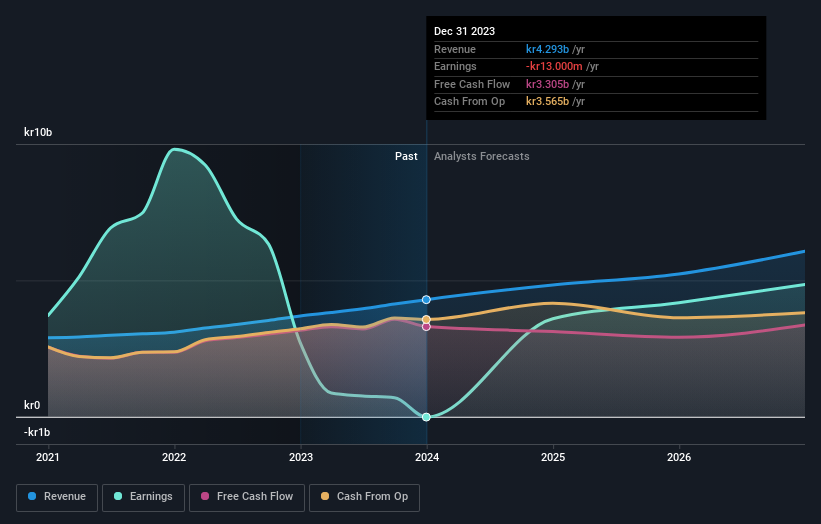

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European regions, boasting a market cap of SEK 94.29 billion.

Operations: The company generates its revenue primarily from real estate rentals, amounting to SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish real estate company, has demonstrated strong financial performance with a significant 53.3% earnings growth over the past year and is projected to grow earnings by 33.49% annually. Despite slower revenue growth at 9.3% per year, it outpaces the broader Swedish market's 1.7%. Recent capital-raising activities through green bond issuances totaling €499.56 million underscore its commitment to sustainable development but also reflect some level of increased debt not well-covered by operating cash flow, posing potential concerns about financial leverage.

Dive into the specifics of AB Sagax here with our thorough growth forecast report.

Our valuation report here indicates AB Sagax may be overvalued.

Taking Advantage

Take a closer look at our Fast Growing Swedish Companies With High Insider Ownership list of 86 companies by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BIOA BOM:FNOXOM:SAGA A and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance