Swedish Exchange Growth Companies With At Least 16% Insider Ownership

As global markets exhibit mixed signals with some regions showing signs of cooling while others capitalize on growth opportunities, the Swedish market presents a unique landscape for investors focusing on growth companies with substantial insider ownership. Understanding the interplay between insider stakes and company performance could be increasingly relevant in navigating current market conditions.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Sileon (OM:SILEON) | 14.1% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

BioArctic (OM:BIOA B) | 34% | 50.9% |

Calliditas Therapeutics (OM:CALTX) | 11.7% | 52.9% |

SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

We're going to check out a few of the best picks from our screener tool.

CTT Systems

Simply Wall St Growth Rating: ★★★★★★

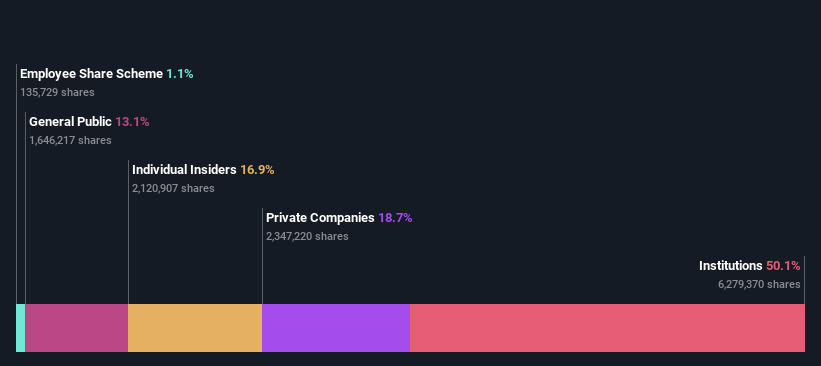

Overview: CTT Systems AB, based in Sweden, specializes in designing and manufacturing humidity control systems for aircraft globally, with a market capitalization of approximately SEK 3.85 billion.

Operations: The company generates its revenue primarily from the aerospace and defense sector, amounting to SEK 314.20 million.

Insider Ownership: 16.9%

CTT Systems, a Swedish company specializing in aircraft cabin humidification systems, is poised for robust growth with forecasted annual earnings and revenue increases of 21.58% and 20.3%, respectively, outpacing the Swedish market significantly. Insider transactions over the past three months show more buying than selling, indicating strong insider confidence. However, its dividend track record remains unstable. Recent successes include securing deals at the Aircraft Interiors Show for their humidifiers in A350s and Boeing 777Xs from multiple airlines, underscoring their market dominance and innovative edge in this niche sector.

Click here to discover the nuances of CTT Systems with our detailed analytical future growth report.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

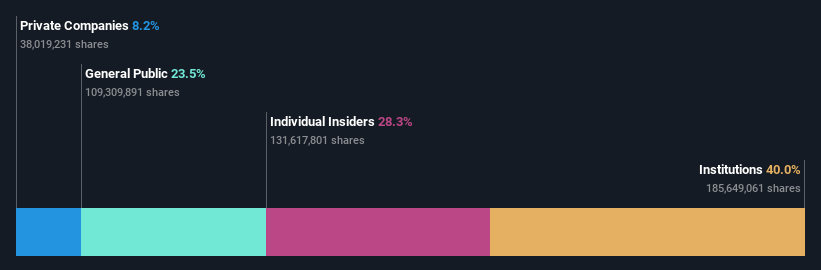

Overview: AB Sagax (publ) is a property company active in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market capitalization of approximately SEK 101.31 billion.

Operations: The company generates revenue primarily through real estate rentals, amounting to SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish real estate company, exhibits strong growth potential with insider ownership aligning interests with shareholders. Recent financial activities include issuing €500 million in green bonds to fund sustainable projects, highlighting commitment to green initiatives. Although its debt is not well covered by operating cash flow, earnings growth outpaces the market significantly at 33.5% annually. However, revenue growth projections are modest at 9.3% yearly, slightly above the Swedish market average of 1.7%.

Click here and access our complete growth analysis report to understand the dynamics of AB Sagax.

Our valuation report here indicates AB Sagax may be overvalued.

Yubico

Simply Wall St Growth Rating: ★★★★★★

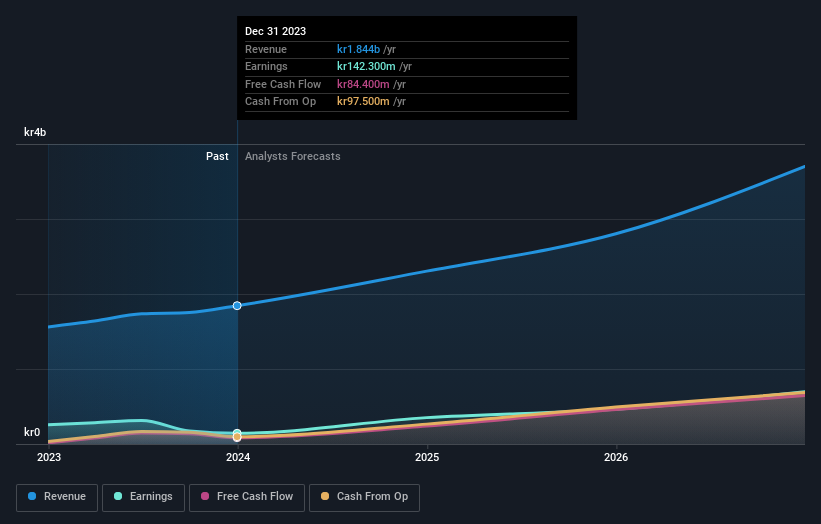

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 21.27 billion.

Operations: The company generates SEK 1.93 billion in revenue from its security software and services segment.

Insider Ownership: 37.5%

Yubico AB, a Swedish growth company with high insider ownership, is trading below its fair value by 16.3%. Despite no substantial insider purchases recently, forecasts predict robust annual earnings growth of 43.8% and revenue increases of 22.9%, both well above market averages. However, shareholder dilution occurred last year and profit margins have declined from 16.9% to 8.6%. The firm continues to innovate in cybersecurity with the upcoming release of YubiKey firmware updates aimed at enhancing enterprise security solutions.

Taking Advantage

Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 83 more companies for you to explore.Click here to unveil our expertly curated list of 86 Fast Growing Swedish Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:CTT OM:SAGA A and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance