Strategic Moves in Tweedy Browne International Value's Portfolio Highlighted by Major Stake in ...

Insightful Analysis of the Latest N-PORT Filing for Q2 2024

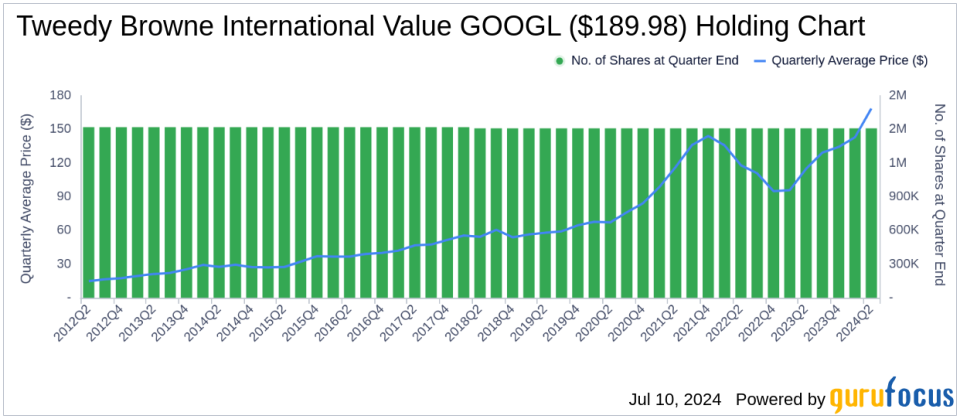

Tweedy Browne International Value (Trades, Portfolio), known for its Ben Graham value-oriented investment approach, recently disclosed its portfolio updates for the second quarter of 2024. The fund, which primarily targets undervalued foreign equity securities, is managed by a seasoned investment committee. This committee's strategy focuses on developed markets while occasionally tapping into emerging markets, aiming to hedge against foreign currency risks effectively.

Summary of New Buys

In a significant portfolio expansion, Tweedy Browne International Value (Trades, Portfolio) added five new stocks. Key additions include:

Dr. Ing. h.c. F. Porsche AG (XTER:P911), purchasing 958,305 shares, making up 1.3% of the portfolio, valued at approximately 71.34 million.

Tencent Holdings Ltd (HKSE:00700), with 1,444,150 shares, representing about 1.25% of the portfolio, valued at HK$68.53 million.

Wuliangye Yibin Co Ltd (SZSE:000858), acquiring 2,768,830 shares, accounting for 0.88% of the portfolio, valued at 48.67 million.

Key Position Increases

The fund also increased its stakes in six stocks, with notable enlargements in:

Roche Holding AG (XSWX:ROG), adding 157,519 shares, bringing the total to 579,564 shares. This adjustment increased the share count by 37.32%, impacting the portfolio by 0.79%, with a total value of CHF160.55 million.

Teleperformance SE (XPAR:TEP), with an additional 408,309 shares, bringing the total to 1,011,618 shares. This represents a 67.68% increase in share count, valued at 106.96 million.

Summary of Sold Out Positions

The fund completely exited two holdings in this quarter:

WH Group Ltd (HKSE:00288), selling all 11,000,000 shares, impacting the portfolio by -0.13%.

Emperor Entertainment Hotel Ltd (HKSE:00296), liquidating all 23,255,073 shares, impacting the portfolio by -0.02%.

Key Position Reductions

Significant reductions were made in 21 stocks, including:

BAE Systems PLC (LSE:BA.), reduced by 2,710,696 shares, resulting in a -17.7% decrease in shares and a -0.84% impact on the portfolio. The stock traded at an average price of 13.5 during the quarter and has returned 0.75% over the past three months and 15.85% year-to-date.

Autoliv Inc (OSTO:ALIV SDB), reduced by 359,589 shares, resulting in a -51.05% reduction in shares and a -0.79% impact on the portfolio. The stock traded at an average price of kr1272.25 during the quarter and has returned -11.80% over the past three months and 2.79% year-to-date.

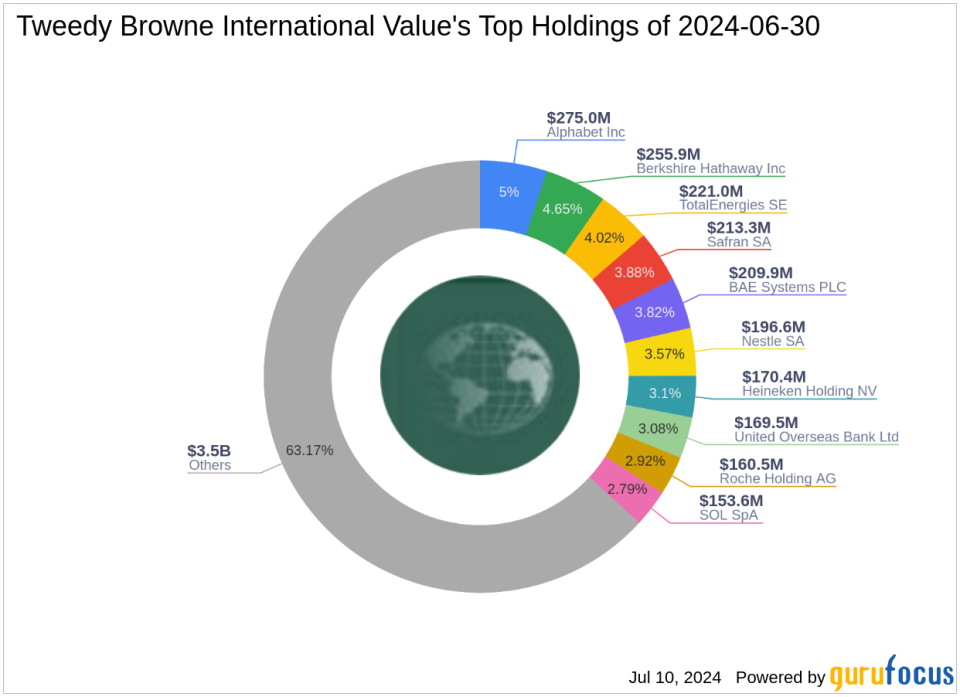

Portfolio Overview

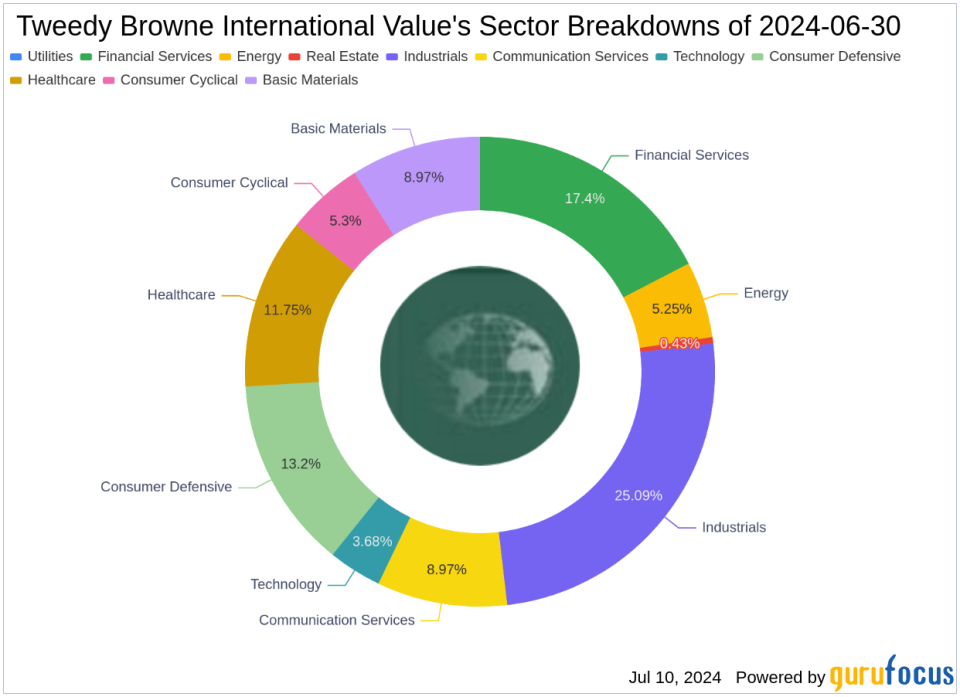

As of the second quarter of 2024, Tweedy Browne International Value (Trades, Portfolio)'s portfolio included 92 stocks. Top holdings were 5% in Alphabet Inc (NASDAQ:GOOGL), 4.65% in Berkshire Hathaway Inc (NYSE:BRK.A), 4.02% in TotalEnergies SE (XPAR:TTE), 3.88% in Safran SA (XPAR:SAF), and 3.82% in BAE Systems PLC (LSE:BA.). The holdings are mainly concentrated across 10 of the 11 industries, including Industrials, Financial Services, Consumer Defensive, Healthcare, Communication Services, Basic Materials, Consumer Cyclical, Energy, Technology, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance