Stiff price resistance contributes to muted 1% q-o-q HDB resale price growth in 1Q2023

SINGAPORE (EDGEPROP) - The latest resale data published by the Housing and Development Board (HDB) shows the price of public housing flats increase 1% q-o-q in 1Q2023. This is a relatively moderate increase compared to 4Q2022 which saw resale prices increase 2.3% q-o-q.

The latest statistics on resale HDB prices are slightly higher compared to the flash estimates published at the start of this month – which had projected resale prices inching up by 0.9% q-o-q.

According to Eugene Lim, key executive officer of ERA Realty Network, a reason behind the relative slowdown in HDB resale price is attributed to growing price resistance from buyers. “Over the last three years, HDB resale prices have increased by 32%, (which is) an average of 10.7% per year”. (Find HDB flats for rent or sale with our Singapore HDB directory)

He adds: “We see a widening disparity between the expectations of sellers and buyers. Homebuyers are reluctant to match the high asking prices of sellers because this could well mean paying higher cash-over-valuation”.

However, while first-time homebuyers are increasingly price sensitive and entering the market with a smaller home-buying budget, sellers are holding fast to their asking prices since the cost of their replacement properties remains high, says Lim.

The increase in resale flat prices last quarter marks the 12th consecutive quarterly increase in the public housing market so far. However, Wong Siew Ying, head of research and content at PropNex Realty, notes that it is the slowest quarterly pace of growth since 2Q2020 when prices moved up 0.3% q-o-q. Resale prices moderated during that period as a result of the lockdown effect during the pandemic.

The first three months of this year also saw a total of 6,979 resale flats transacting, and this transaction volume is 5.8% more than the 6,597 flats sold in 4Q2022. On a yearly basis, the resale volume in 1Q2023 is 0.6% more than the 6,934 flats sold in 1Q2022.

“Some buyers have taken a step back to reassess their options and review their price offers. A combination of skyrocketing home prices, inflationary pressures and rising mortgage rates have lowered buyers’ housing affordability,” says Christine Sun, senior vice president of research and analytics at OrangeTee & Tie.

This prompted some buyers to pick up smaller, more affordable flats, she says. “As buyers’ affordability was affected by the cooling measures and rising interest rates, buyers bought more small flats last quarter”.

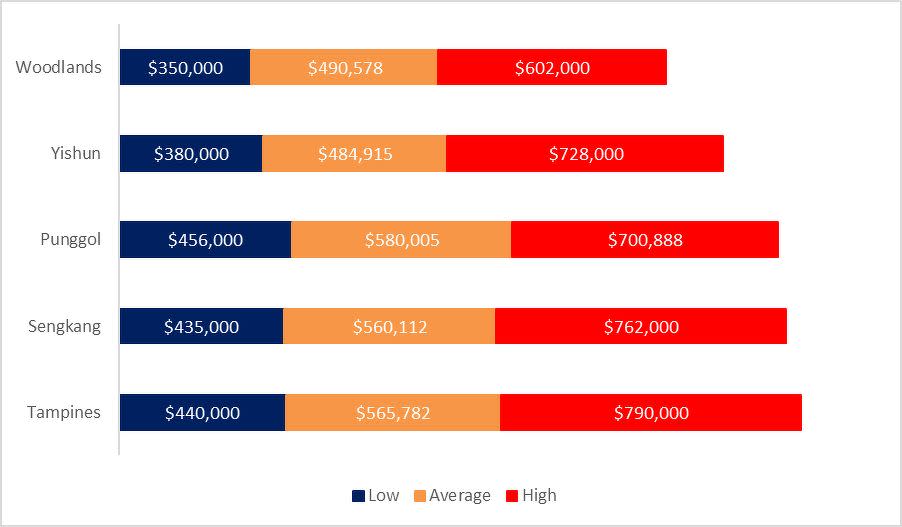

Based on a breakdown of resale prices in 1Q2023, Lee Sze Teck, senior director of research at Huttons Asia, says that the top five most popular HDB towns by transaction volume were Woodlands, Punggol, Yishun, Tampines, and Sengkang. Resale transactions in these five estates accounted for 38% of total transactions last quarter.

Research by Huttons also shows that the average price of a four-room flat in Woodlands was about $490,000, while the average price of a four-room flat in Punggol was about $580,000.

On the other hand, 14 HDB towns saw a decline in their quarterly prices. Bukit Panjang and Kalang/Whampoa were the only two towns to suffer two consecutive quarterly resale price decreases, the data from Huttons shows.

In light of the price expectation disparity between buyers and sellers, Lim of ERA says that HDB resale prices could increase between 5-7% this year, a more moderate growth compared to the 10.4% price increase recorded in 2022.

Moreover, market intelligence from ERA reports that approximately 15,000 flats will reach the end of their minimum occupation period (MOP) in 2023. This is 49.1% less than the 30,197 flats that reached MOP last year.

“Due to the limited supply in the resale market, the likelihood of a significant price correction is unlikely even though some price resistance is evident. We continue to see strong demand from homebuyers with more immediate housing needs,” says Lim. “Realistic pricing remains the key and sellers are more open to genuine offers”.

HDB will launch up to 11,600 Build-To-Order flats for sale in the next two BTO launches in May and August. The May sales exercise will include projects in Bedok and Serangoon – areas which have not seen new public housing flats for about seven and nine years, respectively, says Lee.

More BTO projects in Tengah are also expected to be included in upcoming sales exercises. According to Lee of Huttons, this could redirect demand from the resale market as the projects in Tengah could have relatively shorter construction times compared to BTO projects in other areas.

“Nevertheless, the HDB resale market is likely to trend towards stabilisation and see not more than a 5% increase (in resale price) in 2023. HDB flat transactions are forecast to range from 24,000 to 26,000 for the entire year,” he says.

Check out the latest listings near Woodlands, Punggol, Yishun, Tampines, Sengkang, Bukit Panjang, Bedok, Serangoon

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

HDB flash estimates show resale prices up 0.9 % q-o-q in 1Q2023; slowest increase since 2Q2020

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance