Steering Clear Of Foshan Golden Milky Way Intelligent Equipment With One Better Dividend Stock Option

Investors often turn to dividend stocks for a reliable source of income. However, the stability of these dividends can vary significantly among companies, making some investments riskier than others. For example, Foshan Golden Milky Way Intelligent Equipment has experienced significant fluctuations in its dividend payouts, which could be a red flag for those seeking dependable returns.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Lao Feng Xiang (SHSE:600612) | 3.20% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.68% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.88% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.64% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.62% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.95% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.66% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.20% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.52% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.57% | ★★★★★★ |

Click here to see the full list of 232 stocks from our Top Dividend Stocks screener.

Let's explore one of the standout options from the results in the screener and examine one not meeting the grade.

Top Pick

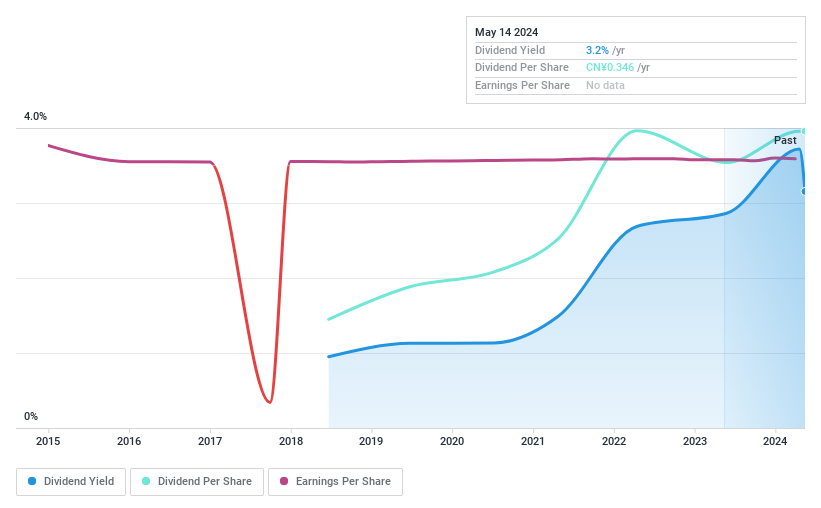

Nacity Property Service GroupLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nacity Property Service Group Ltd (ticker: SHSE:603506) is a company based in China that provides real estate property management services, with a market capitalization of approximately CN¥1.64 billion.

Operations: The firm generates its revenue primarily from real estate property management services in China.

Dividend Yield: 4%

Nacity Property Service Group has demonstrated a consistent dividend payout, with a recent declaration of CNY 0.35057 per share. Despite a dip in quarterly net income from CNY 40.33 million to CNY 20.83 million, annual figures show growth, with net income rising from CNY 145.48 million to CNY 185.77 million year-over-year. The company's dividends are sustainably covered by earnings and cash flows, showcasing stability not seen in some peers who have reduced dividends significantly.

One To Reconsider

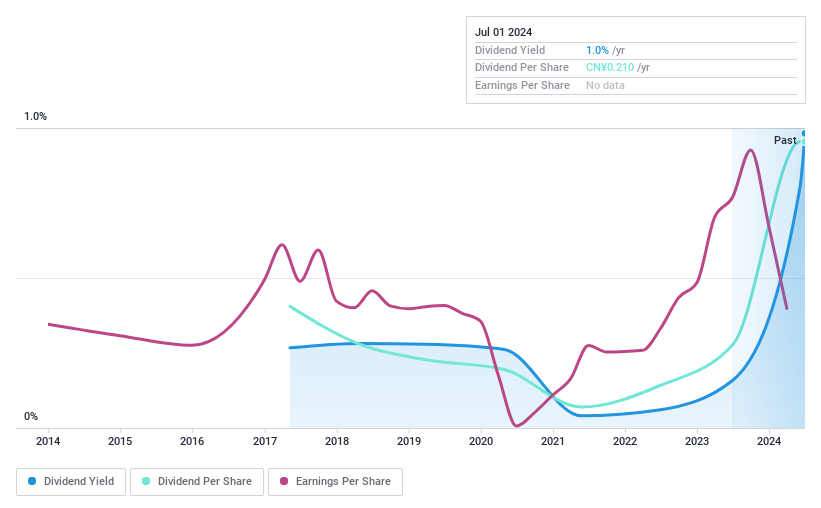

Foshan Golden Milky Way Intelligent Equipment

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Foshan Golden Milky Way Intelligent Equipment Co., Ltd. is a company that specializes in the production and sale of automated equipment, with a market capitalization of approximately CN¥2.86 billion.

Operations: The company generates revenue from the production and sale of automated equipment.

Dividend Yield: 1%

Foshan Golden Milky Way Intelligent Equipment's dividend history reveals instability, with a recent yield of only 0.98%, significantly lower than the top quartile of Chinese dividend stocks at 2.54%. Despite a low payout ratio of 43.9%, dividends are not supported by free cash flow, indicating potential sustainability issues. Shareholder dilution over the past year and volatile share prices further undermine confidence in its dividend reliability, compounded by a substantial annual drop in payments previously.

Seize The Opportunity

Click through to start exploring the rest of the 230 Top Dividend Stocks now.

Have a stake in one of these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:603506SZSE:300619.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance