Steering Clear Of {avoid_company} And Highlighting {hold_companies_count} Superior Dividend Stock Options

Investing in dividend stocks is a popular strategy for those seeking regular income from their investments. However, caution is warranted when a company's dividend payout ratio appears excessively high, as this can indicate that the dividends are not sustainable over the long term. Companies with such financial metrics might initially seem appealing due to their high yields, but they could pose risks to investors if their earnings do not adequately cover dividend payments.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.62% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.01% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.21% | ★★★★★★ |

Allianz (XTRA:ALV) | 5.28% | ★★★★★★ |

Globeride (TSE:7990) | 3.89% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.39% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.25% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.54% | ★★★★★★ |

Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 1989 stocks from our Top Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one you may wish to avoid.

Top Pick

IVD Medical Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVD Medical Holding Limited, an investment holding company, specializes in distributing in vitro diagnostic products across Mainland China and internationally, with a market capitalization of approximately HK$1.26 billion.

Operations: The company generates revenue primarily through its distribution business, which brought in CN¥2.90 billion, supplemented by after-sales services and a self-branded products business contributing CN¥179.37 million and CN¥10.62 million respectively.

Dividend Yield: 9.8%

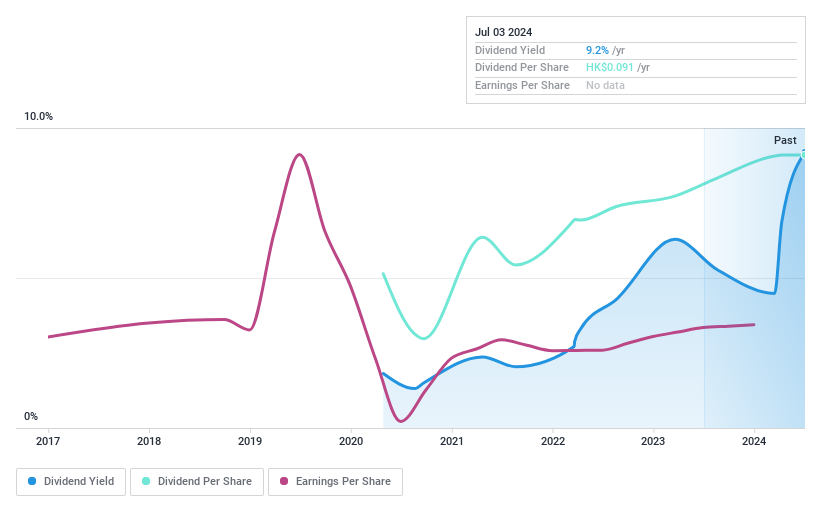

IVD Medical Holding maintains a sustainable dividend with a payout ratio of 47.3% and a cash payout ratio of 45.5%, ensuring dividends are well-covered by both earnings and cash flows. Despite its high yield of 9.79%, which ranks in the top tier for the Hong Kong market, the company's dividend history is marked by volatility and an unreliable track record over its short four-year dividend-paying period. Recent executive changes have occurred smoothly, indicating stable governance amidst operational shifts.

One To Reconsider

Alarko Carrier Sanayi ve Ticaret

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Alarko Carrier Sanayi ve Ticaret A.S. specializes in manufacturing and selling heating, cooling, air-conditioning, and water pressurization products and services, with a market capitalization of TRY 13.34 billion.

Operations: The company generates revenue primarily from the HVAC equipment segment, totaling TRY 5.23 billion.

Dividend Yield: 1%

Alarko Carrier Sanayi ve Ticaret presents several red flags for dividend investors. Despite a recent increase in dividend payments, the company's 0.97% yield remains uncompetitive within the Turkish market, where top payers offer around 2.47%. More critically, Alarko is distributing dividends without generating free cash flow and while being unprofitable, evidenced by a net loss of TRY 108.1 million in Q1 2024 and TRY 411.42 million for the full year of 2023. This unsustainable financial strategy highlights significant risks associated with its dividend reliability and stability.

Seize The Opportunity

Investigate our full lineup of 1989 Top Dividend Stocks right here.

Hold shares in some of these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1931 and IBSE:ALCAR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance