Steer Clear Of Pandox With One Better Dividend Stock Option

Dividend stocks often attract investors looking for regular income streams. However, caution is essential, especially with companies like Pandox where high payout ratios may raise concerns about the sustainability of dividends. In this article, we will explore both a promising dividend stock option and why Pandox might be a choice to reconsider in Sweden's market.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.45% | ★★★★★★ |

Betsson (OM:BETS B) | 5.61% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.54% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.39% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.04% | ★★★★★☆ |

Duni (OM:DUNI) | 4.96% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.13% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.45% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.39% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.52% | ★★★★☆☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

Let's explore one of the standout options from the results in the screener and examine one not meeting the grade.

Top Pick

Bilia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership, operating in Sweden, Norway, Luxembourg, and Belgium with a market capitalization of SEK 13.42 billion.

Operations: Bilia generates revenue from various segments including SEK 19.28 billion from car sales in Sweden, SEK 7.16 billion from car sales in Norway, SEK 3.61 billion from car sales in Western Europe, SEK 6.16 billion from service operations in Sweden, SEK 2.16 billion from service operations in Norway, and SEK 654 million from service operations in Western Europe, along with SEK 1.08 billion from fuel sales.

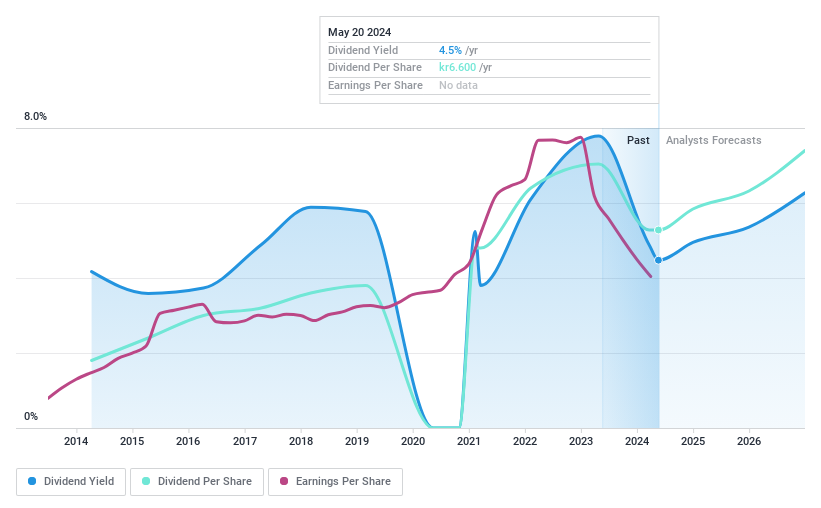

Dividend Yield: 4.5%

Bilia, a Swedish company, offers a dividend yield of 4.66%, ranking in the top 25% for dividend payers in Sweden. However, this dividend is challenged by coverage issues, with a cash payout ratio at 518.9%, indicating dividends are not well supported by cash flows. Despite these concerns, Bilia has maintained its payouts with a reasonable earnings payout ratio of 72.6%. Recent strategic moves include a new partnership with Volvo Car Sweden aimed at enhancing customer experiences from September 2024 onwards.

One To Reconsider

Pandox

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Pandox AB, a global hotel property company, owns, develops, and leases hotel properties with a market capitalization of approximately SEK 35.30 billion.

Operations: The firm generates its revenue primarily through two segments: own operation (SEK 3.24 billion) and rental agreements (SEK 3.76 billion).

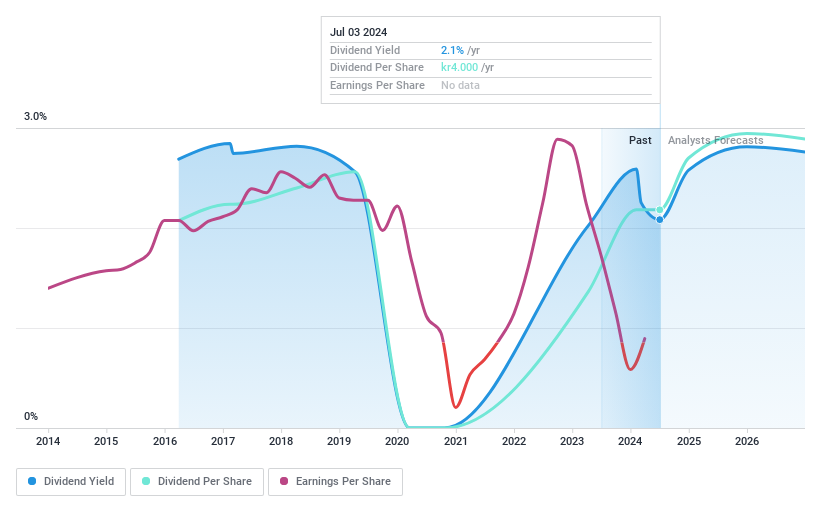

Dividend Yield: 2.1%

Pandox, a Swedish hotel operator, has increased its dividend to SEK 4.00 per share despite a high payout ratio of 942.8%, signaling potential risk in sustainability. The company's recent earnings show improvement with a net income of SEK 447 million up from last year's loss; however, its dividend yield remains low at 2.11%, below the top quartile average of 4.16%. Additionally, Pandox's dividends have been volatile over the past eight years, further questioning reliability amidst financial pressures such as inadequate interest coverage by earnings.

Where To Now?

Explore the 25 names from our Top Dividend Stocks screener here.

Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BILI A and OM:PNDX B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance