Steer Clear Of Lotte Chemical And Explore One Superior Dividend Stock On The KRX

When exploring dividend stocks in South Korea, it's crucial to consider the trajectory of a company’s dividend payments. While some stocks offer the allure of steady income, those with declining dividends could indicate underlying financial challenges. Today, we will examine two contrasting examples from the KRX: one stock that may enhance your portfolio and another, like Lotte Chemical, where declining dividends suggest caution is warranted.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.53% | ★★★★★★ |

LOTTE Fine Chemical (KOSE:A004000) | 4.31% | ★★★★★☆ |

NH Investment & Securities (KOSE:A005940) | 6.31% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.00% | ★★★★★☆ |

KT (KOSE:A030200) | 5.48% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.09% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.63% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.93% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.12% | ★★★★★☆ |

Cheil Worldwide (KOSE:A030000) | 5.99% | ★★★★☆☆ |

Click here to see the full list of 71 stocks from our Top KRX Dividend Stocks screener.

Let's uncover one of the gems from our specialized screener and one you can probably ignore.

Top Pick

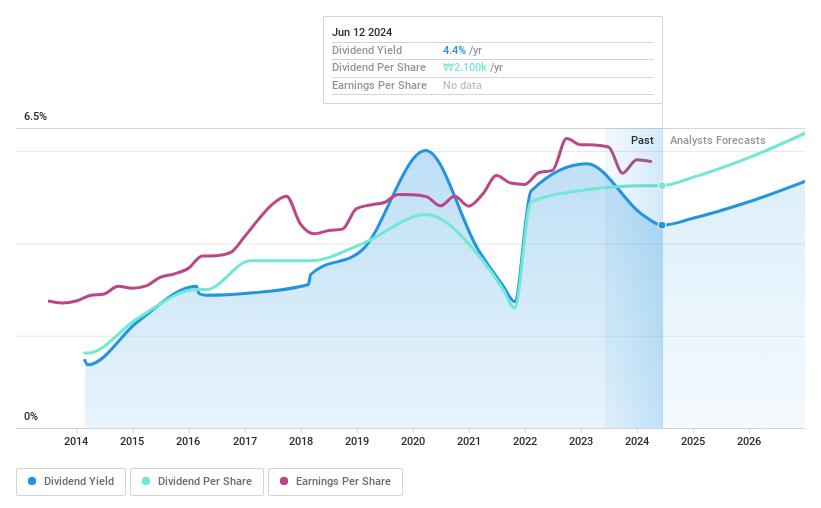

Shinhan Financial Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinhan Financial Group Co., Ltd. operates globally, offering a range of financial products and services, with a market capitalization of approximately ₩25.21 trillion.

Operations: The company's revenue is primarily generated from banking (₩8.67 billion), credit card services (₩2.02 billion), and securities (₩0.76 billion).

Dividend Yield: 4.1%

Shinhan Financial Group maintains a strong dividend profile, with a consistent increase in dividend payments over the past decade and a low payout ratio of 33%, ensuring dividends are well-covered by earnings. Despite its unreliable dividend track record due to volatility, recent activities such as the KRW 300 billion share repurchase program aim to enhance shareholder value. The company's recent quarterly dividend was set at KRW 540, reinforcing its commitment to returning value to shareholders.

One To Reconsider

Lotte Chemical

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Lotte Chemical Corporation operates in the chemical industry, producing and distributing polymers, monomers, basic petrochemical products, and megatrend products with a market capitalization of approximately ₩4.56 trillion.

Operations: The company generates revenue through the production and sale of polymers, monomers, basic petrochemicals, and advanced materials.

Dividend Yield: 3.3%

Lotte Chemical exhibits several red flags for dividend investors. The company has struggled with profitability, reporting a net loss in the most recent quarter, and its dividend yield of 3.28% is below the top quartile of Korean dividend payers. Furthermore, dividends are not well-covered by earnings or free cash flow, indicating potential sustainability issues. Despite trading below fair value estimates and peer comparisons suggesting attractiveness, unreliable and declining dividends coupled with financial losses present significant concerns.

Next Steps

Embark on your investment journey to our 71 Top KRX Dividend Stocks selection here.

Already own any of these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A055550 and KOSE:A011170.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance