Steer Clear Of {avoid_company} With {hold_companies_count} Better Dividend Stock Options

In the pursuit of reliable income streams, dividend stocks are a popular choice among investors. However, it's crucial to examine whether a high dividend yield is supported by the company’s financial health. A high payout ratio can be a red flag, indicating that a company might be distributing more money to shareholders than it can afford, which could jeopardize future dividends. This article will explore one such example where caution is advised due to an unsustainable payout ratio and contrast it with other more stable dividend-paying options.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

Yamato Kogyo (TSE:5444) | 3.68% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.59% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.01% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.62% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.15% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

James Latham (AIM:LTHM) | 6.30% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one you may wish to avoid.

Top Pick

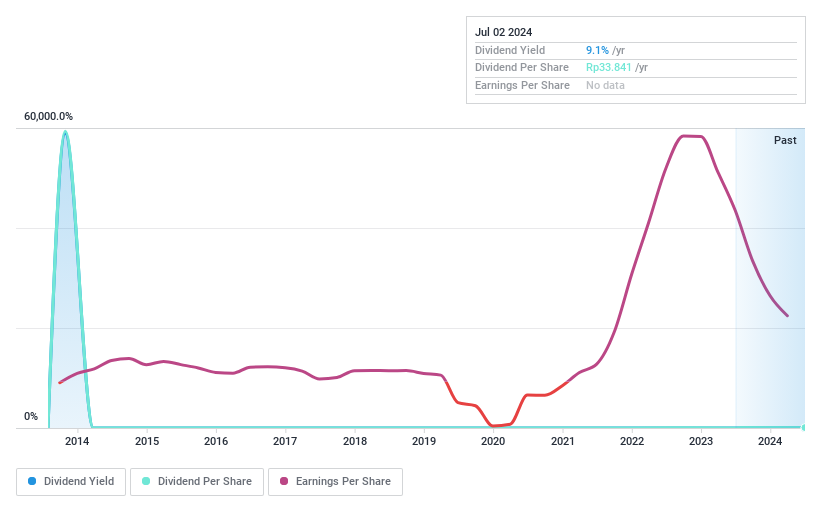

Samudera Indonesia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Samudera Indonesia Tbk operates in cargo transportation and integrated logistics, serving markets in Indonesia, Southeast Asia, the Middle East, and India with a market capitalization of IDR 5.93 trillion.

Operations: The company generates revenue primarily through its Shipping and Agency Services, which contributed $565.13 million, and Logistics and Ports Services, adding $160.92 million.

Dividend Yield: 9.3%

PT Samudera Indonesia Tbk offers a high dividend yield of 9.35%, ranking in the top 25% of Indonesian market payers. However, its dividends have shown volatility and unreliability over the past decade, with significant fluctuations and a lack of consistent growth. Despite this, the payout ratio stands at a low 0.9%, suggesting earnings sufficiently cover dividend payments, contrasting sharply with firms where high payout ratios raise sustainability concerns. Recent financials indicate a drop in net income from US$27.44 million to US$10.16 million year-over-year, reflecting potential pressures on profitability.

One To Reconsider

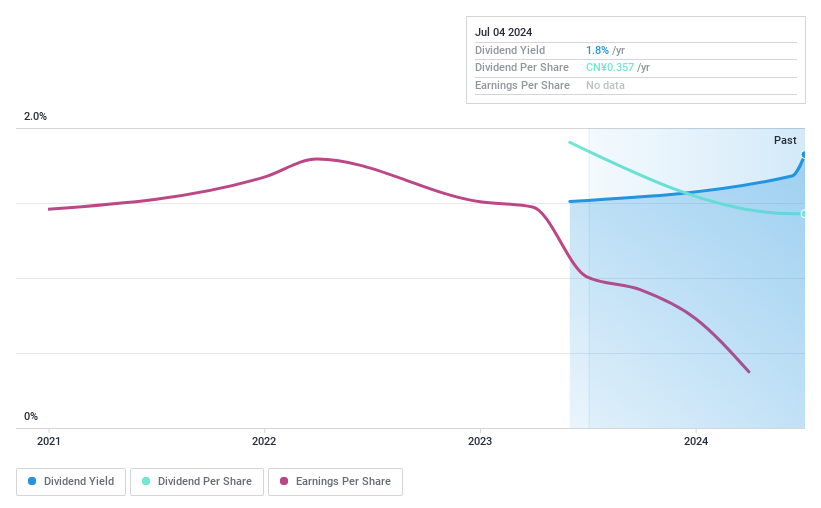

Nanjing TDH TechnologyLtd

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Nanjing TDH Technology Ltd (SZSE: 301378) specializes in the development of judicial information systems and IT services in China, with a market capitalization of approximately CN¥1.98 billion.

Operations: The company generates revenue primarily from its software and programming segment, totaling approximately CN¥548.99 million.

Dividend Yield: 1.8%

Nanjing TDH Technology Ltd faces significant challenges as a dividend stock. With a payout ratio of 119.2%, dividends are poorly covered by earnings, indicating potential sustainability issues. The company's profit margin has dropped from 18.1% to 5.4%, and it lacks free cash flows to support its dividend payments, further exacerbating the risk for investors seeking reliable income streams. Additionally, recent financial reports show a shift from net income to a net loss of CNY 19.3 million, stressing financial instability and raising concerns about future dividend reliability and growth prospects.

Make It Happen

Get an in-depth perspective on all 1969 Top Dividend Stocks by using our screener here.

Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include IDX:SMDRSZSE:301378 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance