Stargate Finance Token Down 8% on Coinbase Delisting

Join the most important conversation in crypto and web3! Secure your seat today

The token (STG) underlying cross-chain bridge protocol Stargate Finance will be delisted by Coinbase (COIN) ahead of the platform's migration to version 2 (v2).

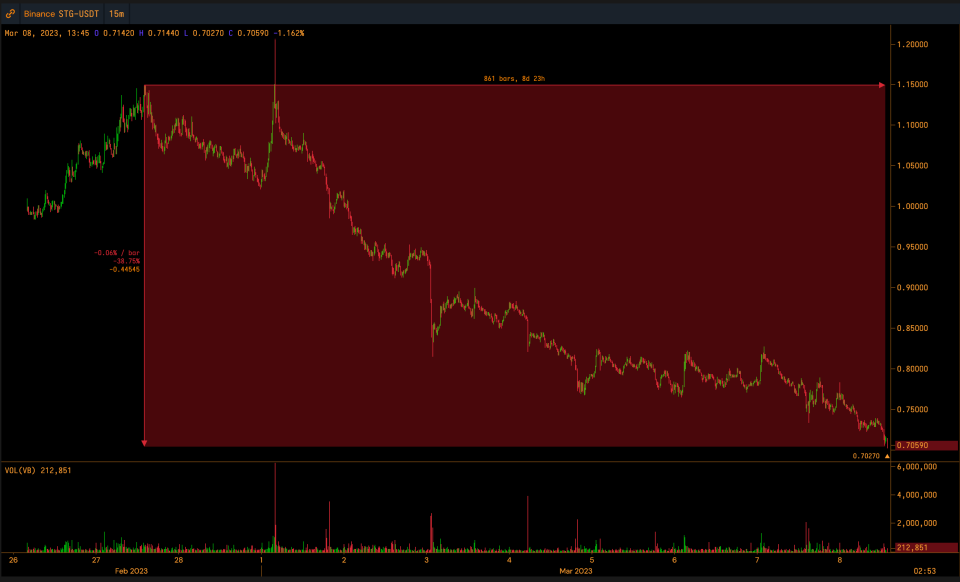

STG is down 7.9% over the past 24 hours, according to Cryptowatch.

In an email to clients, Coinbase said all trading will be suspended on March 14 at 12 p.m. ET. For now, said the email, STG trading has been moved to limit-only mode, which means that users can't market buy or market sell – they can only add orders to the book.

The decision to delist Stargate Finance, which is built by LayerZero Labs, comes one week before the protocol is migrating the token to a new smart contract. Users holding STG in self-custodied wallets will be airdropped an equivalent amount of STG v2 tokens. Coinbase said that it will not airdrop its users the newly-issued token.

Today's decline adds to the trend lower over the past eight days, with STG now off 38.5% over that period to the current 71 cents. Prior to this bearish action, STG had made a sizable move higher in February, in part thanks to a tie-up with Avalanche-based decentralized exchange Trader Joe.

"I am once again looking for STG borrow $5MM+ it's that time of year again," an anonymous trading firm CEO remarked on Twitter during the February bull run when the price was at $1.09.

Yahoo Finance

Yahoo Finance