Southern Company (SO) Q1 Earnings on Deck: What to Expect

The Southern Company SO is set to release first-quarter results on Apr 27. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 75 cents per share on revenues of $6.7 billion.

Let’s delve into the factors that might have influenced the power supplier’s performance in the December quarter. But it’s worth taking a look at Southern Company’s previous-quarter results first.

Highlights of Q4 Earnings & Surprise History

In the last reported quarter, the Atlanta, GA-based service provider beat the consensus mark due to the positive effects of rates, usage and pricing changes, plus a demand boost from favorable weather. Southern Company had reported adjusted earnings per share of 26 cents, ahead of the Zacks Consensus Estimate of 24 cents. Moreover, revenues of $7 billion came in 15.6% above the consensus mark.

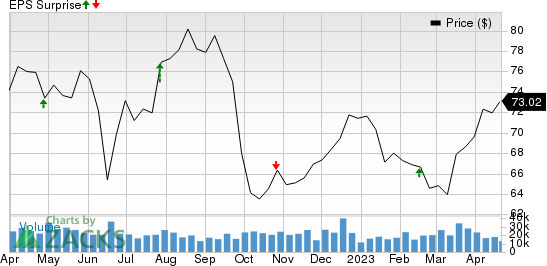

SO topped the Zacks Consensus Estimate for earnings in three of the last four quarters and missed in the other. The utility has a trailing four-quarter earnings surprise of 10.2%, on average. This is depicted in the graph below:

Southern Company (The) Price and EPS Surprise

Southern Company (The) price-eps-surprise | Southern Company (The) Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the first-quarter bottom line has been revised 1.3% downward in the past seven days. The estimated figure indicates a 22.7% decline year over year. However, the Zacks Consensus Estimate for revenues suggests a slight (0.9%) increase from the year-ago period.

Factors to Consider

Southern Company's seven major regulated utilities serve approximately nine million electric and natural gas customers. Leveraging the demographics of its operating territories, the firm has been successfully expanding its regulated business customer base. As proof of that effort, Southern Company added more than 49,000 new residential electric customers and in excess of 31,000 residential natural gas customers in 2022. This trend most likely continued in the January-March period of 2023 because of healthy economic development across its service territories.

In particular, the firm is expected to have benefited from higher retail electricity sales, reflecting economic strength in the Southeast in the form of demand from industrial buyers. Finally, investment in state-regulated electric/gas franchises and continued trends in hybrid working have most likely buoyed Southern Company’s revenues and cash flows.

On a somewhat bearish note, the power supplier’s total operating cost in the fourth quarter increased 13.3% year over year to $6.9 billion. The upward cost trajectory is likely to have continued in the to-be-reported quarter due to inflationary pressures.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Southern Company is likely to beat estimates in the first quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company is -5.8%.

Zacks Rank: Southern Company currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for Southern Company, here are some firms from the utilities space that you may want to consider on the basis of our model:

Portland General Electric Company POR has an Earnings ESP of +5.33% and a Zacks Rank #2. The firm is scheduled to release earnings on Apr 28.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Portland General Electric Company delivered a four-quarter average earnings surprise of 4.7%. Valued at around $4.6 billion, POR has lost 5.6% in a year.

New Jersey Resources NJR has an Earnings ESP of +1.67% and a Zacks Rank #2. The firm is scheduled to release earnings on May 4.

For fiscal 2023, New Jersey Resources has a projected earnings growth rate of 5.2%. Valued at around $5.2 billion, NJR has gained 16.2% in a year.

Edison International EIX has an Earnings ESP of +0.24% and a Zacks Rank #3. The firm is scheduled to release earnings on May 2.

For 2023, Edison International has a projected earnings growth rate of 2.6%. Valued at around $27.9 billion, EIX has gained 2.4% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southern Company (The) (SO) : Free Stock Analysis Report

Edison International (EIX) : Free Stock Analysis Report

Portland General Electric Company (POR) : Free Stock Analysis Report

NewJersey Resources Corporation (NJR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance