A Soriano Leads Three Key Dividend Stocks For Investors

As global markets exhibit mixed signals with the Dow Jones experiencing a significant drop and the Nasdaq hitting new highs, investors are navigating through a landscape marked by divergent performances across major indices. In such a fluctuating environment, dividend stocks like A. Soriano can offer a measure of stability and predictable returns, making them an appealing option for those looking to balance their portfolios amidst ongoing economic uncertainties.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Mitsubishi Shokuhin (TSE:7451) | 3.55% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 8.04% | ★★★★★★ |

Allianz (XTRA:ALV) | 5.19% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.66% | ★★★★★★ |

Sonae SGPS (ENXTLS:SON) | 5.90% | ★★★★★★ |

Globeride (TSE:7990) | 3.85% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.98% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.53% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.17% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.46% | ★★★★★★ |

Click here to see the full list of 1925 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

A. Soriano

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: A. Soriano Corporation operates in the Philippines, focusing on resort management, cable and wire manufacturing, among other ventures, with a market capitalization of approximately ₱15.96 billion.

Operations: A. Soriano Corporation generates revenue primarily from cable and wire manufacturing (₱10.45 billion), followed by its holding company operations (₱4.81 billion), with additional contributions from resort operations and villa development (₱1.50 billion).

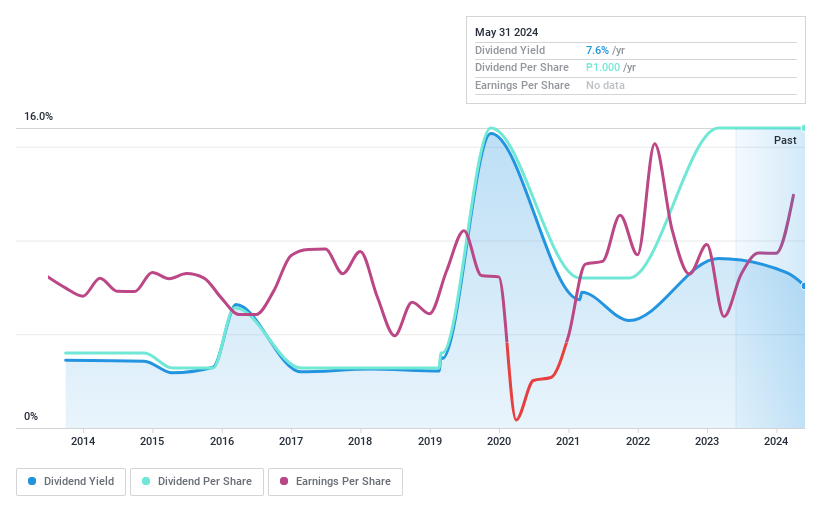

Dividend Yield: 7.6%

A. Soriano Corporation offers a dividend yield of 7.58%, ranking in the top 25% of Philippine dividend payers, with a notably low price-to-earnings ratio of 3.8x compared to the market average of 9.2x. However, the sustainability of its dividends is questionable as they are poorly covered by cash flows, with a high cash payout ratio of 96.4%. Additionally, the company's dividends have shown volatility and unreliability over the past decade, despite recent substantial earnings growth reported in Q1 2024 with net income rising to PHP 2.29 billion from PHP 638 million year-over-year.

DMCI Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DMCI Holdings, Inc. operates in various sectors including general construction, mining, power generation, real estate development, water concession, and manufacturing in the Philippines and abroad with a market capitalization of approximately ₱147.11 billion.

Operations: DMCI Holdings, Inc.'s revenue is primarily generated from DMCI Homes and DMCI Mining, contributing ₱15.33 billion and ₱2.66 billion respectively.

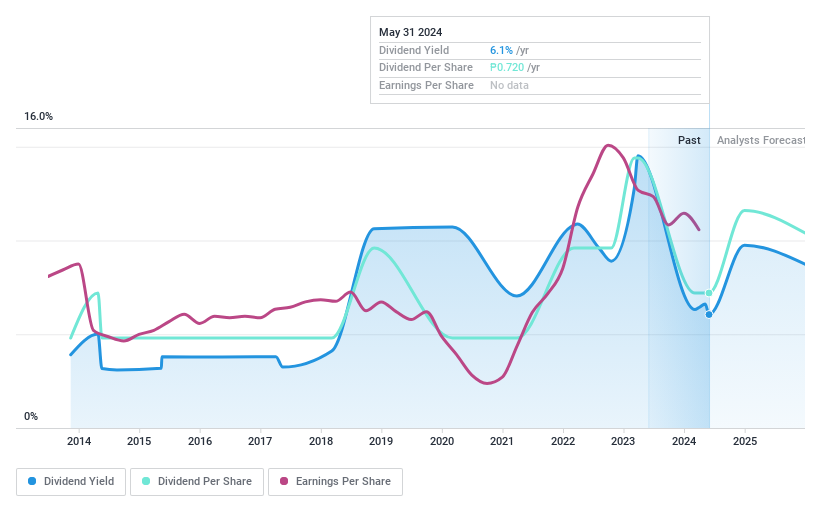

Dividend Yield: 6.1%

DMCI Holdings has demonstrated a mixed track record in dividend reliability, with volatile payments over the past decade. Recent financials show a decline in quarterly revenues and net income as of March 2024, yet dividends are well-supported by earnings and cash flows, indicated by low payout ratios of 26.8% and 23.3%, respectively. The company is actively exploring expansion in mining assets which may influence future profitability and sustainability of dividends.

Delve into the full analysis dividend report here for a deeper understanding of DMCI Holdings.

Our valuation report here indicates DMCI Holdings may be undervalued.

Mitsuuroko Group HoldingsLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsuuroko Group Holdings Co., Ltd. operates in various sectors including energy, power and electricity, food, living and wellness, with a market capitalization of approximately ¥73.90 billion.

Operations: Mitsuuroko Group Holdings Co., Ltd. generates revenue primarily through its Energy Solutions Business (¥146.89 billion), Electric Power Business (¥134.08 billion), and Foods Business (¥21.30 billion), along with contributions from its Overseas Business (¥2.68 billion) and Living & Wellness Business (¥2.68 billion).

Dividend Yield: 3%

Mitsuuroko Group Holdings recently raised its dividend to JPY 41.00 from JPY 37.00 last year, maintaining this rate for the upcoming fiscal year. Despite a stable history in dividend payments over the past decade, sustainability is questionable; dividends are not well covered by earnings or cash flows, with a high cash payout ratio of 108.4%. Nevertheless, earnings have shown growth, increasing by 16.9% last year, and its price-to-earnings ratio at 8.8x remains below the market average of 13.9x.

Seize The Opportunity

Navigate through the entire inventory of 1925 Top Dividend Stocks here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include PSE:ANS PSE:DMC and TSE:8131.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance