SONY Raises Price of PS5 Amid Global Economic Challenges

Sony Corporation SONY has announced that it is raising the price of its PS5 console in select markets across Europe, Middle East, and Africa (EMEA), Asia-Pacific (APAC), Latin America (LATAM) and Canada. Per the company blog, it will not increase the price of the console in the United States.

The current increase in price is due to a steep rise in inflation and depreciation of the yen against the dollar. Further rising global costs and semiconductor shortages have hampered production.

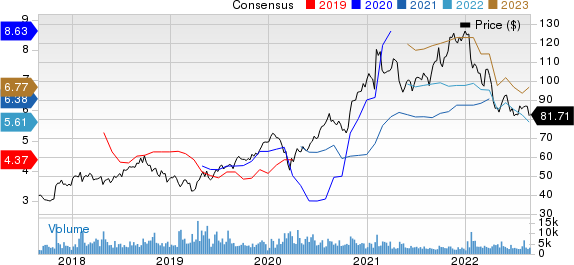

Sony Corporation Price and Consensus

Sony Corporation price-consensus-chart | Sony Corporation Quote

Increasing supply and logistics are major constraints on distribution, which creates a huge imbalance in supply and demand.

Per a Financial Times report, when PS5 was launched (in November 2020), the yen was trading at about ¥105 against the U.S. dollar. Since June 2022, the yen has depreciated immensely to levels of ¥130 per dollar, therefore increasing the production cost in yen terms.

Further citing Sony’s long-term analyst Pelham Smithers, the Financial Times report added that per the analyst the company was losing approximately ¥15,000 on each PS5 sold in Japan, whereas globally, the average loss per machine is roughly $50, owing to higher material and crude costs and yen’s devaluation.

Recently, Sony was reportedly slapped with a lawsuit for allegedly “overcharging” millions of its PlayStation customers in the U.K. by exploiting its market dominance. Per the report, Sony allegedly imposed “unfair” terms and conditions on gaming developers/publishers that led to unfair pricing, which was eventually passed on to PlayStation end customers.

The company designs, manufactures and sells several consumer and industrial electronic equipment. The company invests heavily in research and development to launch new products and enhance the existing product line.

The company reported first-quarter fiscal 2022 net income per share (on a GAAP basis) of ¥175.21 per share, increasing from ¥169.22 reported in the year-ago quarter.

Quarterly total revenues inched up 2.4% year over year to ¥2,311.5 billion ($17842.4 million). However, due to weak macro-economic conditions, the company trimmed its operating income guidance. Operating income is now projected to be ¥1,110 billion, suggesting a decline of 8% year over year. Earlier, operating income was projected to be ¥1,160 billion.

The unfavorable foreign exchange movement coupled with the ongoing lawsuit is a major headwind for Sony.

It currently has a Zacks Rank #3 (Hold). The stock has lost 20.3% in the past year compared with the industry’s fall of 23.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Cadence Design Systems CDNS, Badger Meter BMI and Arista Networks ANET. Cadence Design Systems and Arista Networks each sport a Zacks Rank #1 (Strong Buy), whereas Badger Meter carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CDNS 2022 earnings is pegged at $4.11 per share, rising 5.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.7%.

Cadence’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 9.8%. Shares of CDNS have jumped 8.5% in the past year.

The Zacks Consensus Estimate for BMI’s 2022 earnings is pegged at $2.30 per share, up 6% in the past 60 days.

Badger Meter’s earnings beat the Zacks Consensus Estimate in three of the preceding four quarters, with the average being 12.6%. Shares of BMI have lost 9.3% of their value in the past year.

The Zacks Consensus Estimate for Arista Network’s 2022 earnings is pegged at $4.04 per share, increasing 9.8% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.6%.

Arista Network’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.1%. Shares of ANET have increased 32.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Sony Corporation (SONY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance