Singaporean investor were net buyers in December, diverging from overall investor population: TD Ameritrade

Despite reducing their exposure for the month, TD Ameritrade's Singapore clients were net buyers of equities in December.

In December 2022, TD Ameritrade found that despite reducing their exposure for the month, its clients in Singapore were net buyers of equities.

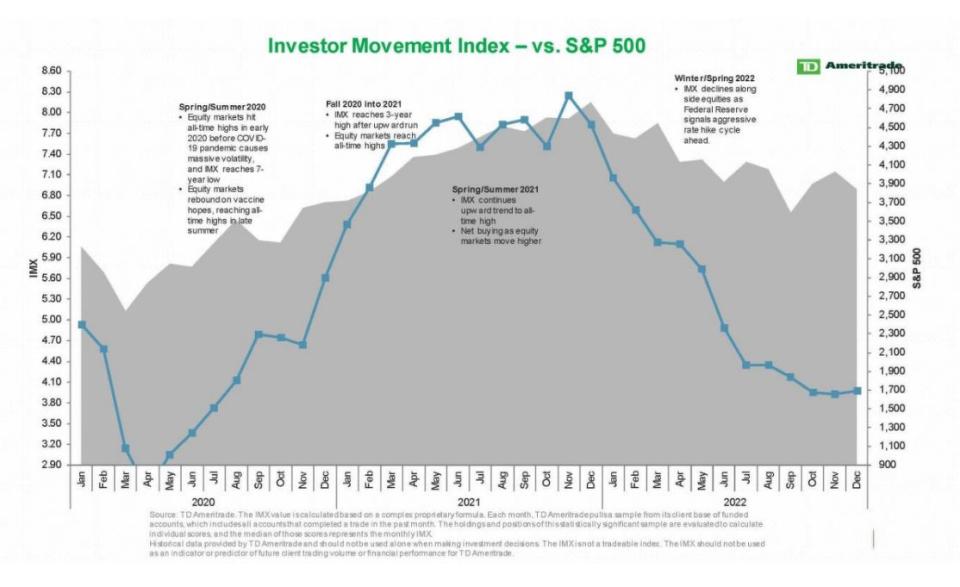

The brokerage found that this was in contrast to the overall TD Ameritrade client population, with the Singapore population’s Investor Movement Index (IMX) score measuring 3.97 in December, a slight increase from the previous score of 3.93 in November.

In comparison, the total IMX score for all TD Ameritrade clients measured 4.17 in December, unchanged from its November score.

The IMX is TD Ameritrade’s proprietary, behaviour-based index that aggregates Main Street investor positions and activities to see what investors were actually doing and how they were positioned in the market.

In the same month, both TD Ameritrade Singapore clients and the overall TD Ameritrade client population were net buyers of Tesla as the electric vehicle (EV) maker cratered over 30% while reports of production cuts due to slow demand and CEO Elon Musk’s Twitter activities dominated headlines.

Another EV company, Lucid Group, was net bought by both client populations after also sinking over 30% during the “tumultuous” period for EV makers, says TD Ameritrade.

Singapore clients of the brokerage were net buyers of Salesforce despite a sharp selloff early in the period, following surprise news that co-CEO Bret Taylor would be leaving the company, seeing the dip as an opportunity to buy into weakness.

Meanwhile, both client populations saw Meta Platforms’ bounce back period, where it finished up over 8%, as an opportunity to reduce exposure into some recent strength.

TD Ameritrade Singapore clients were also net sellers of application software company Unity Software as well as Visa, as the companies plunged nearly 20% and just under 3% respectively during the period, amid uncertainty around the economic picture heading into 2023.

Despite being net buyers of equities overall, TD Ameritrade Singapore clients were net sellers of three of the S&P sectors: energy, healthcare, and materials.

“TD Ameritrade clients in Singapore diverged from the overall client population in net buying equities in December. As a year that exposed some significant and sustained macroeconomic challenges came to a close, clients in Singapore increased exposure to the markets, perhaps showing a glimmer of optimism as we head into 2023,” says Greg Baker, CEO of TD Ameritrade Singapore.

“For the overall population, though, the whiplash caused by the up-down nature of the news cycle held market exposure in place,” he adds.

The beginning of the December IMX period was marked by a strong bounce in equities after comments from US Federal Reserve chairman Jerome Powell shifted marginally from the more hawkish tone of the central bank throughout the year of 2022.

However, as the month rolled on, volatility returned to the US financial markets. Equity markets were particularly volatile on Dec 13 as the monthly US Consumer Price Index (CPI) showed a rate of inflation that indicated signs of moderation, causing equity futures to initially

surge over 3% but ultimately losing almost all of the reactionary gains over the next few hours of trading.

The very next day, the US Federal Open Market Committee released updated interest rate projections which were perceived as more hawkish than expected, leading to a sharp, immediate decline in equity markets. The equity markets were interrupted by holiday seasonality for much of the rest of the month, but the tone never recovered.

The S&P 500 finished down 4.64% during the December IMX period, but interestingly the CBOE Market Volatility Index (VIX) was relatively muted, ending the period at a moderate 21.67. US Treasury markets were choppy again during the December period, with the 10 year yield finishing up near 3.9%.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Economists see Powell’s message as 'hawkish'; 50 bps increase 'consistent' with forecasts

Singapore investors take a ‘risk-off approach’ to investing in November: TD Ameritrade

Singapore IMX sees 4.14% drop to 4.17 amid rocky September season

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance