Singapore to produce a steady pipeline of emerging tech start-ups

The Agrifood sector accounted for the largest proportion of emerging tech companies incorporated in 2022, reports SGInnovate.

Despite growing economic uncertainty, Singapore is expected to produce a steady pipeline of emerging tech start-ups, according to the Singapore Early-Stage Emerging Tech Startups 2022 landscape report by SGInnovate.

Thirty-five emerging tech start-up incorporations were noted in 2022. However, the final number is expected to be approximately 60, taking into account new emerging tech start-ups that have yet to exit stealth mode.

This echoes a similar pattern that was observed in the 2021 edition of the report, which initially noted that there were 36 emerging tech start-ups incorporated last year. Based on new information available as more start-ups exit stealth mode, the tally for 2021 has since been updated to 63 this year.

Private sector organisations are also driving a greater proportion of the start-up incorporation pipeline in Singapore through specialised venture programmes, collaboration with local and overseas universities, as well as vertical-focused accelerator and incubator programmes.

The report also reveals that the Agrifood sector accounted for the largest proportion of emerging tech companies incorporated in 2022 (14 of 35 tracked in total).

Notably, the number of start-ups spun off from the National University of Singapore (NUS) has been growing in recent years as the university continues to support research in areas of food technology. Building on this momentum, six out of 14 of all Agrifood emerging tech start-ups incorporated in 2022 were spun off from NUS.

Greater investor interest in this vertical may also be linked to government initiatives and priorities, such as Singapore’s ‘30 by 30’ food security goals, announced as part of the Singapore Green Plan 2030. In a sign of investor confidence and shifting consumer trends, Next Gen Foods, a plant-based alternative proteins start-up, raised a US$100 million ($133 million) Series A round in 2022, making up close to 40% of all funds raised by early-stage emerging tech start-ups last year.

“Companies leveraging emerging technology to solve difficult problems – in fields such as clean energy production and diversifying our food sources – are likely to continue seeing strong investor interest in 2023. As Singapore’s emerging tech start-up ecosystem continues to mature, we look forward to supporting our homegrown start-ups in making a difference on a global scale,” says Hsien-Hui Tong, executive director – Investments at SGInnovate.

Fundraising strategies need to change

More start-ups are focusing on raising immediate funding rounds to extend development runways and minimise the impact of uncertain valuations, with the early-stage fundraising environment expected to continue to be challenging as public market volatility introduces greater uncertainty to private markets. In 2022, 20 early-stage emerging tech start-ups raised Seed+/Pre-A or A+ funding rounds, more than double the number that did so in 2021.

At the same time, the total number of funding deals completed by emerging tech start-ups fell by 17% between 2021 and 2022. Fundraising amounts have also decreased by 28% on average across all verticals and funding stages.

“While the venture capital scene in Singapore continues to be very active, early-stage emerging tech start-ups here should also tap on other strengths of the local ecosystem, such as the availability of alternative funding mechanisms and openness to corporate innovation for co-development. Besides extending their runway to focus on product development, this also allows start-ups to minimise the impact on their valuations until the macroeconomic environment improves,” says Tong.

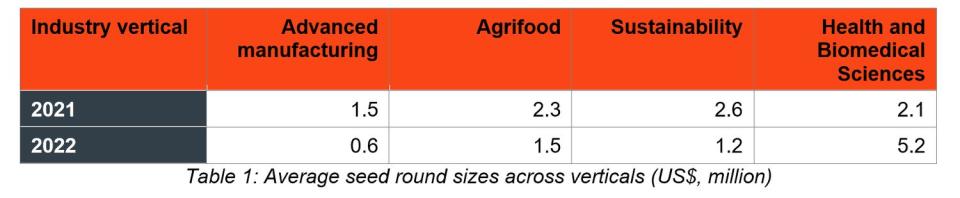

Interestingly, investor activity across the verticals examined in 2022 varied considerably. Within the advanced manufacturing vertical, average seed round sizes decreased from US$1.5 million in 2021 to US$0.6 million in 2022, even as the number of funding events in the sector declined. This may reflect a shift in investors’ interests to other verticals, and a general slowdown in the manufacturing industry.

In contrast, average seed round sizes in the health and biomedical sector more than doubled, even though fewer start-ups in this vertical were incorporated. This could indicate that start-ups in this sector are facing challenges beyond fundraising, including perennial talent gaps. These factors may result in a ‘winner-raise-all’ scenario where a small number of start-ups raise larger rounds to capture limited resources.

Table: SGInnovate

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Why Tim Draper is betting on Sri Lanka’s unlikely start-up scene

SGInnovate to catalyse deep tech talent development in Singapore

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance