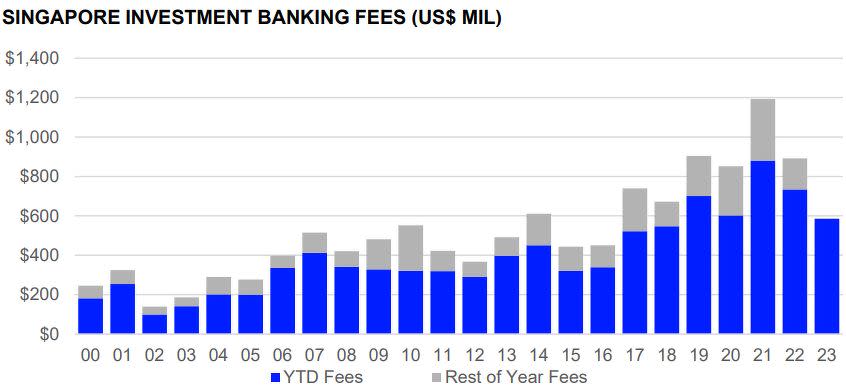

Singapore investment banking fees down 20% y-o-y so far this year, DBS leading: Refinitiv

M&A deals involving a Singapore target total US$10.2 billion so far in 2023, down 70% y-o-y, marking a decade low.

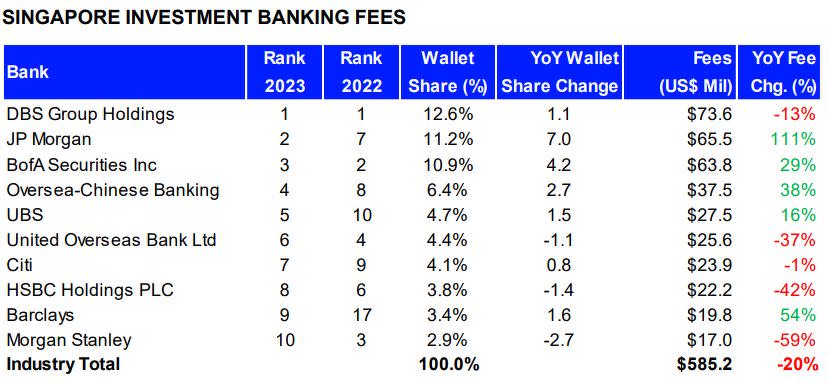

Investment banking fees generated in Singapore so far this year have fallen 20% y-o-y to US$585.2 million ($799.33 million), with DBS Group Holdings D05 currently in the lead with a total of US$73.6 million, taking 13% share of the total fee pool.

Based on preliminary data until Sept 21, banks’ advisory fees earned from completed M&A transactions total US$183.6 million in 9M2023, down 32% y-o-y, reports market data provider Refinitiv.

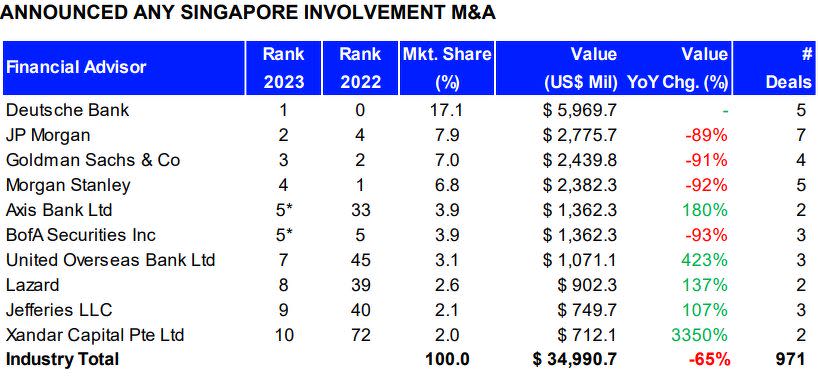

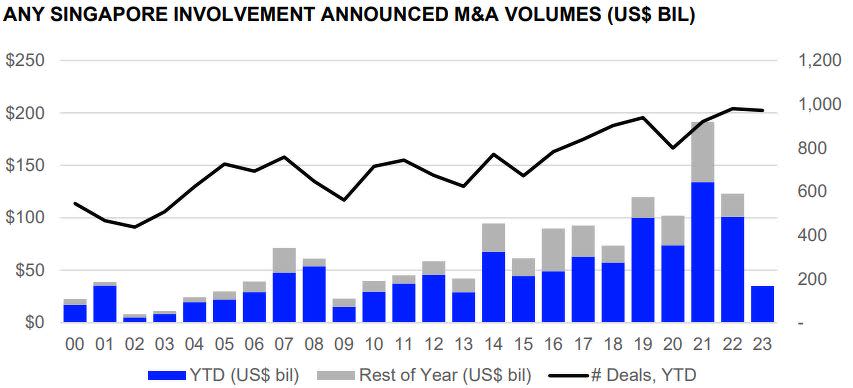

More broadly, the value of announced M&A transactions with any Singapore involvement totals US$35.0 billion so far in 2023, 65% lower y-o-y, forming the lowest first nine-month total since 2013. The number of Singapore deals also declined 1% over the same period.

Deals involving a Singapore target total US$10.2 billion so far in 2023, down 70% y-o-y, marking a decade low, despite a 13% increase in the number of announced deals.

Inbound deals declined 66% y-o-y to US$6.9 billion, while domestic deals fell 75% to US$3.3 billion.

Singapore outbound M&A transactions total US$18.0 billion so far in 2023, down 62% y-o-y, making a six-year low.

Financials is the most targeted sector in Singapore by value, accounting for 35% of M&A transactions involving a Singapore target so far this year. The highest number of deals was recorded in the high technology sector.

Based on preliminary data, Deutsche Bank takes the top spot in the any Singapore involvement M&A financial advisor league table so far in 2023 with a 17% market share.

Underwriting, lending fees also down

In addition, the LSEG (London Stock Exchange Group) business says equity capital markets underwriting fees total US$122.9 million, 7% higher y-o-y, while debt capital markets fees declined 35% y-o-y to US$69.7 million.

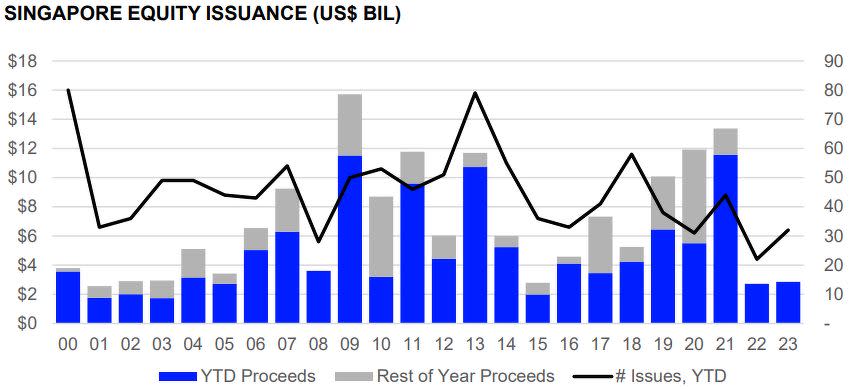

Singapore equity and equity-related issuance total US$2.9 billion so far in 2023, 5% more than the proceeds raised this time last year. The number of issues increased 45% compared to last year.

Follow-on issuance account for 88% of activity so far this year, while convertible issuance and IPOs account for 10% and 2%, respectively.

Proceeds raised from follow-on offerings total US$2.5 billion, a 6% decline y-o-y.

Convertible offerings raised US$281.6 million.

Eight initial public offerings (IPOs) have been recorded so far in 2023. YKGI raised US$12.7 million in its stock market debut in February, the largest Singapore IPO of 2023 so far.

Based on preliminary data, Citi currently takes first place in the Singapore equity capital markets underwriting league table with a 24% market share, followed by DBS.

Meanwhile, syndicated lending fees declined 13% y-o-y to US$209.1 million so far during the first nine months of 2023.

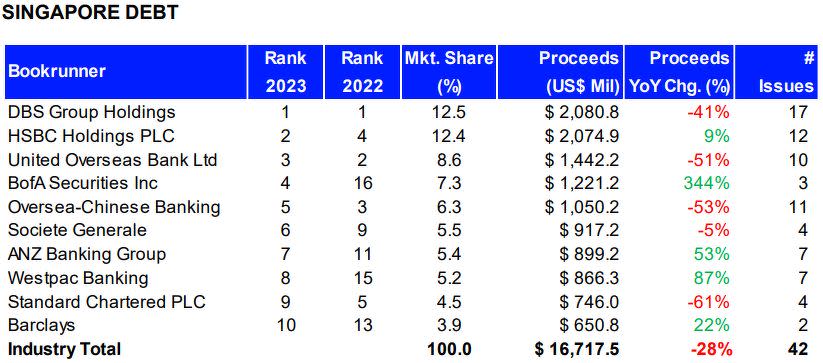

Overall Singapore debt capital markets activity total US$16.7 billion so far in 2023, a 28% decline y-o-y and the lowest nine-month total since 2015.

A total of 42 new offerings were brought to market, compared to 68 during the first nine months of 2022.

Singaporean companies from the financial sector raised US$10.7 billion, accounting for 64% of the market, while government and agencies accounted for a 22% market share and totalled US$3.6 billion.

Based on preliminary data, DBS currently takes the top spot in the Singapore debt capital markets underwriting league table in 9M2023, with US$2.1 billion of related proceeds, or a 12.5% market share.

Infographics: Refinitiv

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

DBS leads in Singapore investment banking fees as industry hits 4-year low: Refinitiv

DBS leads in Singapore investment banking fees, SGX IPO proceeds down 94.5% y-o-y: Refinitiv

Singapore investment banking fees decline 15.6% to US$221.3 mil in 1Q2022: Refinitiv

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance