Sim Lian Group is top bidder for Dairy Farm Walk GLS site at $980 psf ppr

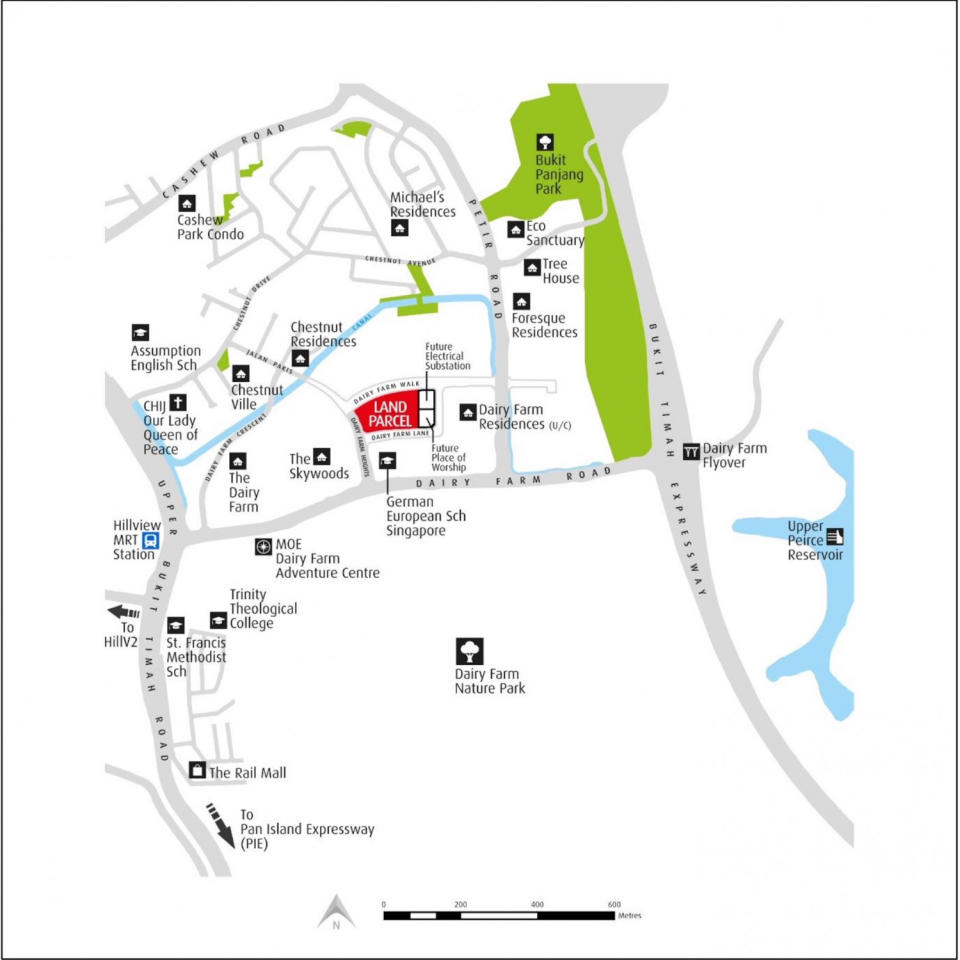

Location map of Dairy Farm Walk GLS site (Credit: URA)

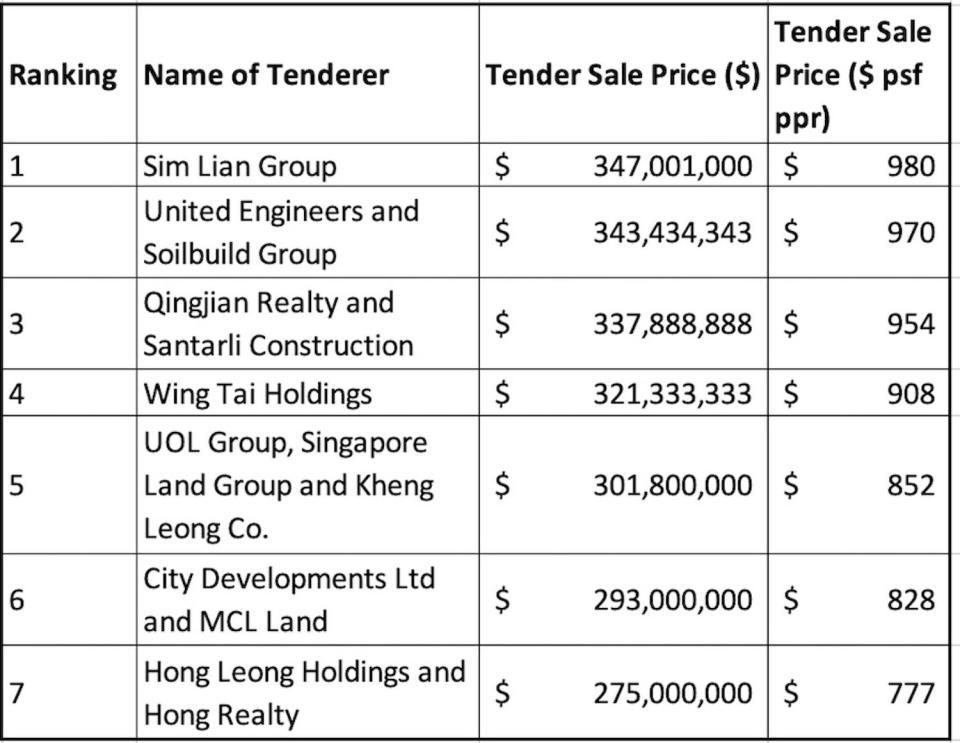

SINGAPORE (EDGEPROP) - At the close of the tender for two government land sale (GLS) sites this evening, there were seven bids for the residential site at Dairy Farm Walk and nine bids for the executive condo (EC) site at Bukit Batok West Avenue 8.

Read more: Qingjian-Santarli JV bids a record $662 psf ppr for EC site at Bukit Batok West

For the Dairy Farm Walk GLS site, at the top of the heap is Sim Lian Group’s entities, Sim Lian Land and Sim Lian Development. The group submitted a bid of $347 million, which works out to $980 psf per plot ratio (psf ppr).

Bids at the close of the tender for Dairy Farm Walk Government Land Sale (GLS) residential site

Source: URA, developers, consultants

The second highest bid of $970 psf ppr came from a joint venture between United Engineers and Soilbuild Group, which is just 1% below the top bid, points out Nicholas Mak, head of research at ERA Realty.

With the land rate of $980 psf ppr, the new condo project at the Dairy Farm Walk residential site could be launched at $1,880 to $1,980 psf, Mak estimates. (Discover insightful data of any Singapore condominium with our condo directory)

The 168,597 sq ft, 99-year leasehold site, has the potential to yield about 350 to 400 residential units.

The 2,203-unit Treasure at Tampines was fully sold as at Feb 13, 2022 -- three years after it was launched (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Sim Lian Group has been an active participant in the last few government land sale (GLS) tenders, but was unsuccessful until now. The group’s 2,203-unit Treasure at Tampines private condo (a redevelopment of the former Tampines Court collective sale site) was fully sold as of February 13, 2022. With that, SIm Lian’s development pipeline was completely depleted. Notably, Treasure at Tampines was considered the biggest private condominium project launched in Singapore to date, and it was fully sold within three years of its launch in February 2019.

Second highest bidder, United Engineers Ltd, is the developer of the 460-unit Dairy Farm Residences, located just one street away from the Dairy Farm Walk GLS site. Launched in late 2018, the 99-year leasehold condo is over 95% sold with average price at $1,612 psf psf, based on caveats lodged to date.

“It is not surprising that the tenders for the two plots [at Dairy Farm Walk and Bukit Batok West] - both located in the Outside Central Region (OCR) - have witnessed keen bidding among developers,” says Wong Siew Ying, PropNex head of research and content. “Following the robust new home sales last year, many developers are eager to top up their land inventory, especially for OCR sites.”

The 460-unit Dairy Farm Residences by United Engineers Ltd is over 95% sold to date (Photo: Albert Chua/EdgeProp Singapore)

According to PropNex, as at the end of 2021, the unsold stock of new private homes (excluding ECs) in the OCR was at a record low of 3,972 units, based on data from URA. “At that level, the balance inventory of unsold mass market homes could potentially be snapped up in less than a year – going by the annual average sales of about 4,900 new OCR units (ex. ECs) between 2017 and 2021,” adds Wong.

Another factor contributing to the enthusiastic tender for the site is its medium size and palatable price of $347 million, which poses lower risks compared to larger land parcels, observes Ong Teck Hui, JLL senior director of research and consultancy. “Developers are also keen to acquire residential sites to replenish their land banks as the inventory of unsold private residential units is at a record low of 14,333 units as at 4Q2021.”

Check out the latest listings near Treasure at Tampines, Dairy Farm Residences

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

New home sales fell substantially in February, preliminary numbers show

Hong Leong-led joint venture submits highest bid of $1,060 psr ppr for Lentor Hills Road Parcel A

Government releases 13 sites under 1H2022 Government Land Sales Programme

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance