Sika And Two More Stocks Estimated As Undervalued On SIX Swiss Exchange

The Swiss market recently demonstrated resilience, ending on a strong note as the Swiss National Bank implemented another rate cut, aiming to manage inflation and stimulate economic growth. In this context of monetary easing and modest economic projections, investors might find opportunities in undervalued stocks that could benefit from these broader economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

COLTENE Holding (SWX:CLTN) | CHF48.40 | CHF76.05 | 36.4% |

Burckhardt Compression Holding (SWX:BCHN) | CHF589.00 | CHF822.80 | 28.4% |

Sonova Holding (SWX:SOON) | CHF274.20 | CHF448.97 | 38.9% |

Temenos (SWX:TEMN) | CHF61.95 | CHF83.88 | 26.1% |

Julius Bär Gruppe (SWX:BAER) | CHF51.60 | CHF96.08 | 46.3% |

SGS (SWX:SGSN) | CHF83.18 | CHF123.15 | 32.5% |

Comet Holding (SWX:COTN) | CHF376.50 | CHF545.66 | 31% |

Medartis Holding (SWX:MED) | CHF70.70 | CHF120.61 | 41.4% |

Kudelski (SWX:KUD) | CHF1.405 | CHF1.85 | 24.2% |

Galderma Group (SWX:GALD) | CHF75.83 | CHF149.14 | 49.2% |

Let's explore several standout options from the results in the screener

Sika

Overview: Sika AG is a specialty chemicals company that offers products and systems for bonding, sealing, damping, reinforcing, and protecting in the building and automotive industries globally, with a market capitalization of CHF 41.78 billion.

Operations: Sika generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

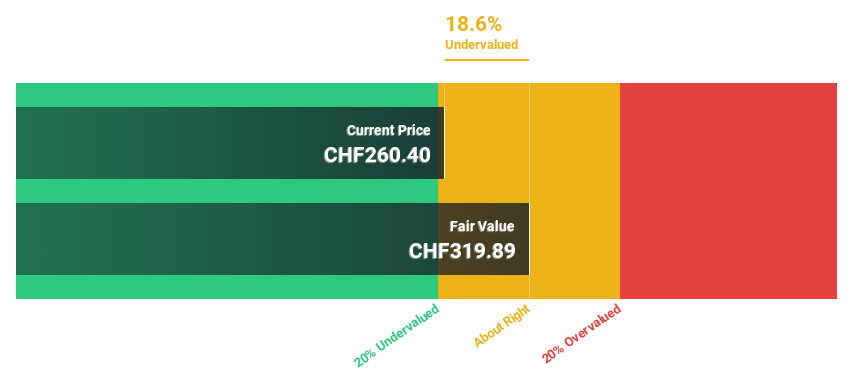

Estimated Discount To Fair Value: 18.6%

Sika, with a trading price of CHF260.4, is currently valued below the estimated fair value of CHF319.89, indicating potential undervaluation based on discounted cash flows. Despite a high level of debt, Sika's robust revenue growth forecast at 6.2% annually outpaces the Swiss market's 4.4%, and its earnings are expected to grow by 12.53% per year—faster than the market average of 8.3%. Recent expansions in China and Peru underscore its strategic initiatives to meet increasing global demands and enhance operational efficiencies.

Our growth report here indicates Sika may be poised for an improving outlook.

Get an in-depth perspective on Sika's balance sheet by reading our health report here.

Sonova Holding

Overview: Sonova Holding AG, with a market cap of CHF 16.35 billion, is a company that manufactures and sells hearing care solutions for adults and children across the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Operations: Sonova's revenue is primarily derived from two segments: Cochlear Implants, generating CHF 282.40 million, and Hearing Instruments, which contributes CHF 3.36 billion.

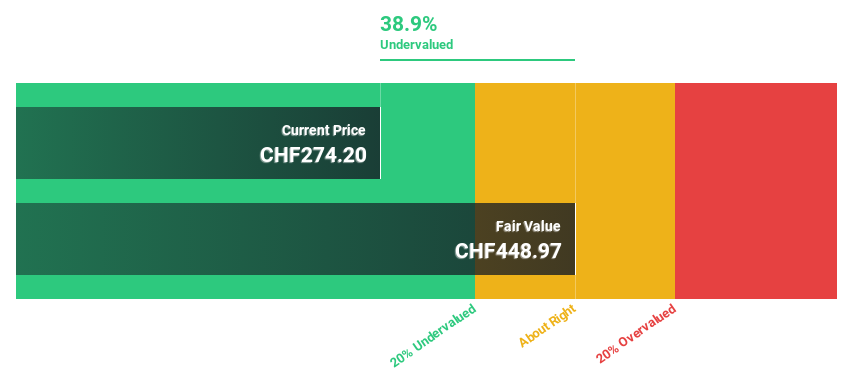

Estimated Discount To Fair Value: 38.9%

Sonova Holding, priced at CHF274.2, appears undervalued by 38.9% relative to our fair value estimate of CHF448.97, based on discounted cash flow analysis. Despite its high debt levels, Sonova's earnings and revenue growth forecasts are optimistic but not exceptional, with earnings expected to grow at 9.91% annually—above the Swiss market average of 8.3%. The company’s recent financial results showed a robust net income of CHF609.5 million from sales of CHF3,626.9 million for FY2024.

Temenos

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software to financial institutions, with a market capitalization of approximately CHF 4.49 billion.

Operations: The firm provides integrated banking software solutions globally, with a market capitalization of around CHF 4.49 billion.

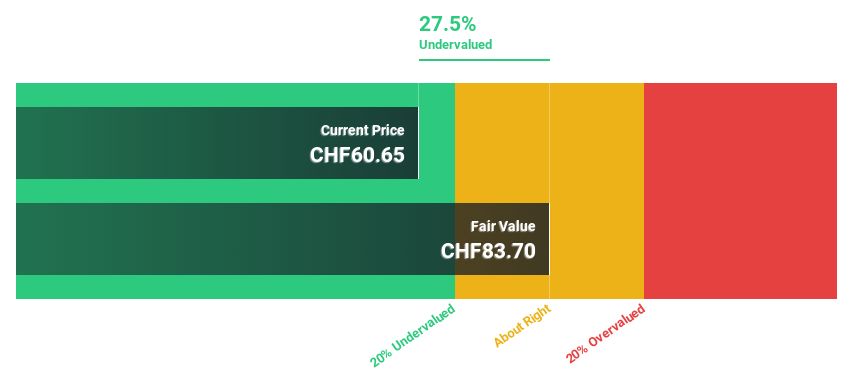

Estimated Discount To Fair Value: 26.1%

Temenos, valued at CHF61.95, is trading 26.1% below our fair value estimate of CHF83.88, highlighting its potential undervaluation based on discounted cash flow (DCF) analysis. Despite a highly volatile share price recently, Temenos has demonstrated strong financial performance with a 16.2% earnings growth over the past year and forecasts suggest an annual profit growth of 14.7%, outpacing the Swiss market's 8.3%. However, its high level of debt and slower revenue growth forecast compared to some peers at 7.6% annually could pose challenges.

The analysis detailed in our Temenos growth report hints at robust future financial performance.

Click to explore a detailed breakdown of our findings in Temenos' balance sheet health report.

Make It Happen

Explore the 13 names from our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:SIKASWX:SOONSWX:TEMN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance