Sika Leads Three Stocks Estimated To Be Undervalued On SIX Swiss Exchange

After a somewhat slow start, the Swiss market demonstrated resilience and growth on Monday, buoyed by optimism surrounding potential interest rate cuts from major central banks. The benchmark SMI index notably increased, reflecting a robust appetite for equities among investors. In such an environment, identifying stocks that appear undervalued could be particularly compelling for those looking to potentially capitalize on market movements and underlying economic strengths.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

COLTENE Holding (SWX:CLTN) | CHF48.30 | CHF76.14 | 36.6% |

Burckhardt Compression Holding (SWX:BCHN) | CHF581.00 | CHF823.07 | 29.4% |

Julius Bär Gruppe (SWX:BAER) | CHF50.74 | CHF96.33 | 47.3% |

Sonova Holding (SWX:SOON) | CHF271.20 | CHF449.27 | 39.6% |

Temenos (SWX:TEMN) | CHF61.00 | CHF84.02 | 27.4% |

SGS (SWX:SGSN) | CHF81.20 | CHF122.47 | 33.7% |

Comet Holding (SWX:COTN) | CHF364.50 | CHF546.28 | 33.3% |

Medartis Holding (SWX:MED) | CHF71.00 | CHF120.79 | 41.2% |

Kudelski (SWX:KUD) | CHF1.42 | CHF1.86 | 23.6% |

Galderma Group (SWX:GALD) | CHF74.86 | CHF149.48 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen

Sika

Overview: Sika AG is a specialty chemicals company that offers solutions for bonding, sealing, damping, reinforcing, and protecting in the building and automotive industries globally, with a market capitalization of CHF 40.97 billion.

Operations: Sika's revenue is generated primarily from two segments: CHF 9.45 billion from construction industry products and CHF 1.78 billion from industrial manufacturing products.

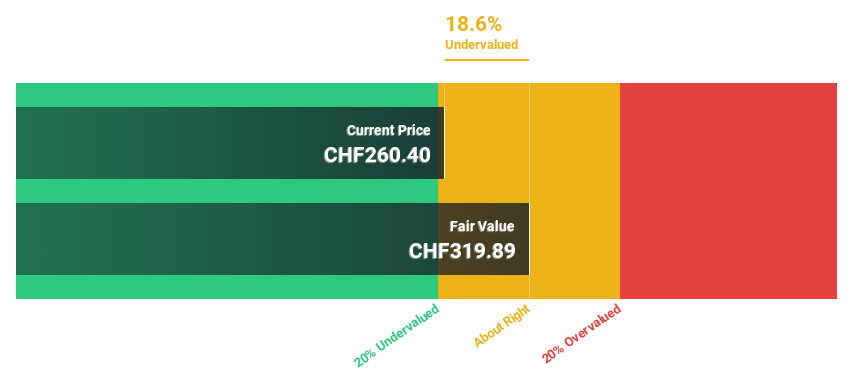

Estimated Discount To Fair Value: 20.2%

Sika, a Swiss company, is currently trading at CHF 255.4, which is 20.2% below the estimated fair value of CHF 319.89, indicating it may be undervalued based on discounted cash flow analysis. Despite high levels of debt and past shareholder dilution, Sika's Return on Equity is expected to remain robust at 20.2% in three years. The company's earnings are projected to grow by 12.5% annually, outpacing the Swiss market forecast of 8.3%. Recent expansions in China and Peru underscore its strategic growth initiatives in emerging markets.

Swissquote Group Holding

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and professional institutional clients with a market capitalization of CHF 4.22 billion.

Operations: The company generates revenue primarily through leveraged Forex and securities trading, amounting to CHF 101.09 million and CHF 429.78 million respectively.

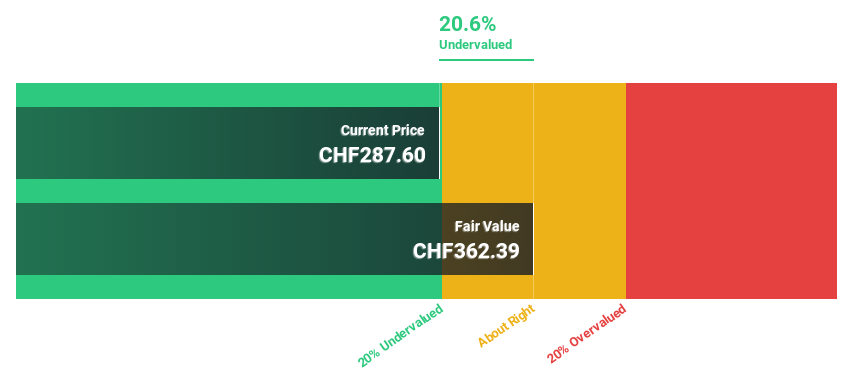

Estimated Discount To Fair Value: 21.8%

Swissquote Group Holding, priced at CHF 284, appears undervalued by cash flow metrics, trading 21.8% below its estimated fair value of CHF 363.38. The company has experienced a substantial earnings growth of 38.3% over the past year and is projected to grow earnings by approximately 14% annually, surpassing the Swiss market's average of 8.3%. Despite slower revenue growth forecasts at around 10.3% per year compared to higher industry standards, Swissquote's forecasted high Return on Equity of about 23.1% in three years highlights its potential efficiency gains.

Temenos

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.42 billion.

Operations: The company generates its revenue by providing integrated banking software solutions to financial institutions globally.

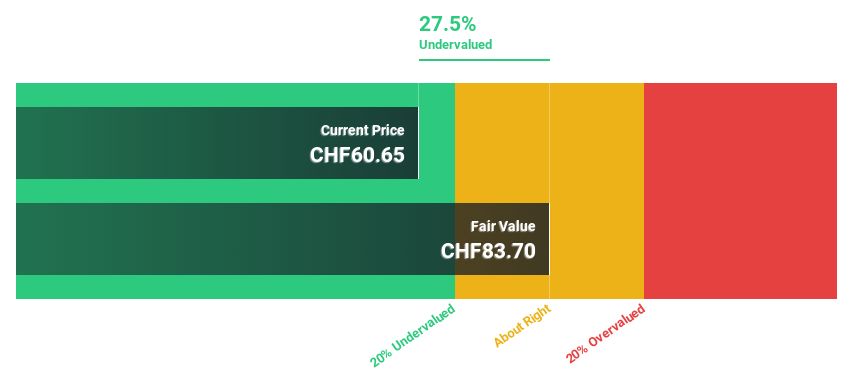

Estimated Discount To Fair Value: 27.4%

Temenos, trading below its estimated fair value by 27.4%, shows promise as an undervalued stock based on cash flow metrics. Recent share buyback announcements indicate a proactive approach to capital management, potentially enhancing shareholder value. The company's earnings have grown by 16.2% over the past year and are projected to increase by 14.66% annually, outpacing the Swiss market's growth rate of 8.3%. Additionally, Temenos' revenue is expected to grow at 7.6% per year, surpassing the Swiss market average of 4.4%. Despite these positive indicators, the highly volatile share price and high level of debt pose risks that warrant caution.

The analysis detailed in our Temenos growth report hints at robust future financial performance.

Get an in-depth perspective on Temenos' balance sheet by reading our health report here.

Where To Now?

Click here to access our complete index of 13 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:SIKA SWX:SQN and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance