Shenzhen Megmeet Electrical Leads Trio Of Chinese Growth Companies With High Insider Ownership

As China's stock market shows signs of recovery, buoyed by strong holiday spending and positive trade data, investors are keenly observing trends that could indicate sustained growth. In this context, companies like Shenzhen Megmeet Electrical are gaining attention not only for their growth potential but also for the high insider ownership which often aligns management’s interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.8% |

UTour Group (SZSE:002707) | 24% | 27.3% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

Anhui Huaheng Biotechnology (SHSE:688639) | 28.3% | 28.5% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen Megmeet Electrical

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Megmeet Electrical Co., LTD is a company based in China that specializes in the research, development, production, sales, and services of hardware, software, and system solutions for electrical automation with a market capitalization of approximately CN¥12.83 billion.

Operations: The company generates its revenue primarily from the development, production, and sale of electrical automation solutions.

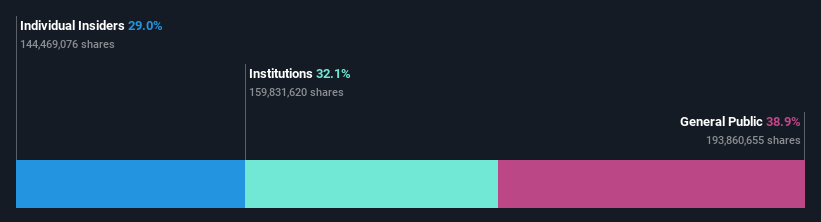

Insider Ownership: 29.0%

Shenzhen Megmeet Electrical, a company with high insider ownership, shows promising growth prospects in China. Its earnings are expected to grow by 24.4% annually, outpacing the Chinese market average of 23.3%. Despite a low return on equity forecast at 16.8%, its price-to-earnings ratio stands favorably at 21.1x compared to the market's 31.9x, indicating potential undervaluation. Recent financials reveal a year-over-year sales increase to CNY 6.75 billion and net income rise to CNY 629.32 million, affirming its growth trajectory despite a slight dividend coverage concern from cash flows.

SG Micro

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SG Micro Corp, based in China, specializes in designing, marketing, and selling analog integrated circuits with a market capitalization of approximately CN¥37.05 billion.

Operations: The company primarily generates its revenue from the integrated circuit industry, totaling CN¥2.83 billion.

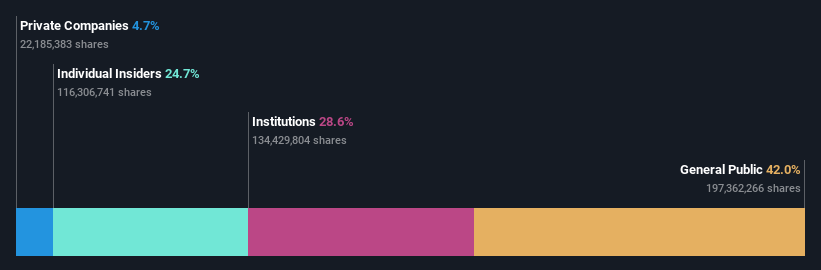

Insider Ownership: 24.7%

SG Micro, despite a dip in profit margins from 22% to 10.8%, has shown robust earnings growth, with forecasts indicating a substantial annual increase of 39.44%. This growth rate surpasses the broader Chinese market's expectations. Recent financials underscore this trend, with Q1 revenue jumping to CNY 729.04 million from CNY 513.29 million year-over-year, alongside a net income rise to CNY 54.38 million from CNY 30.21 million, highlighting strong operational performance despite market challenges.

Get an in-depth perspective on SG Micro's performance by reading our analyst estimates report here.

Our valuation report here indicates SG Micro may be overvalued.

Qingdao Huicheng Environmental Technology Group

Simply Wall St Growth Rating: ★★★★★★

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. is a company focused on environmental protection technologies and services, with a market capitalization of approximately CN¥9.39 billion.

Operations: The company generates its revenue primarily from environmental protection technologies and services.

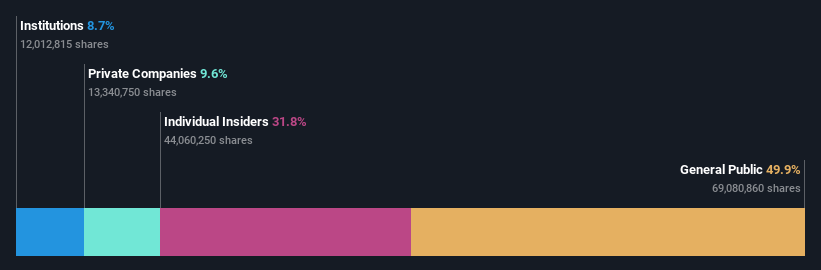

Insider Ownership: 31.8%

Qingdao Huicheng Environmental Technology Group has shown significant growth, with a recent surge in annual sales to CNY 1.07 billion from CNY 363.23 million and net income increasing to CNY 138.51 million from CNY 2.47 million. Despite a recent quarterly dip in net income to CNY 20.54 million from CNY 36.14 million, the company's revenue growth is projected at a robust rate of 38.6% per year, outpacing the Chinese market forecast of 14.1%. However, shareholder dilution has occurred over the past year, reflecting some financial maneuvers that could concern investors focused on equity value retention.

Key Takeaways

Take a closer look at our Fast Growing Chinese Companies With High Insider Ownership list of 408 companies by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:002851SZSE:300661 and SZSE:300779.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance