SGX Dividend Stocks Showcase With Yields Ranging From 4.9% To 9%

In recent developments within the Singapore market, the acquisition of Salt Labs by digital banking giant Chime highlights a growing trend towards corporate expansions and strategic partnerships. This dynamic market environment underscores the importance of stability and consistent returns, characteristics often associated with high-yield dividend stocks.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.48% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.07% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.59% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 9.00% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.87% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.26% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.85% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.67% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 6.96% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.70% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

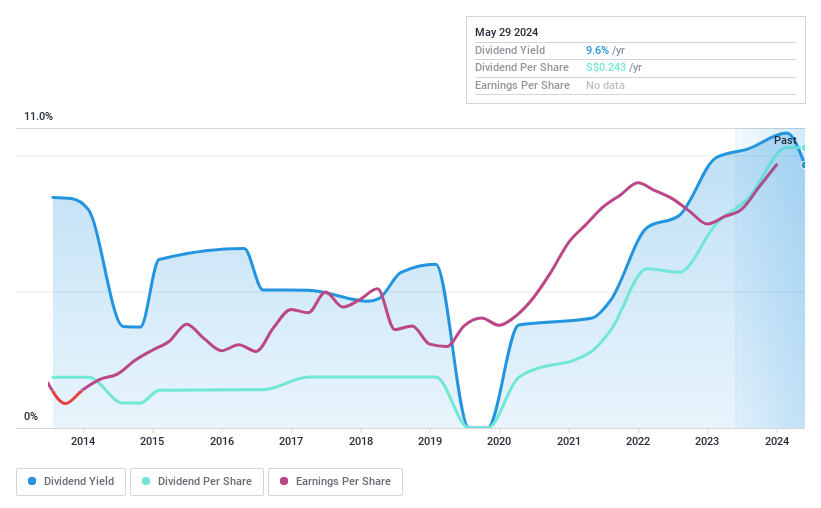

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across Singapore, Greater China, Australia, India, and other international markets, with a market capitalization of SGD 243.26 million.

Operations: Multi-Chem Limited generates revenue primarily through its IT business in Singapore (SGD 372.78 million), other international regions (SGD 153.93 million), Australia (SGD 54.60 million), India (SGD 40.56 million), and Greater China (SGD 34.96 million), alongside a smaller PCB business segment in Singapore contributing SGD 1.79 million.

Dividend Yield: 9%

Multi-Chem Limited, a player in the Singapore market, recently strengthened its governance with significant board changes, including appointing Chong Teck Sin as chairman. While the company's dividend yield stands at 9%, its dividends are covered by earnings and cash flows with payout ratios of 80.7% and 88.1% respectively. However, investors should note that Multi-Chem's dividend track record has been unstable and volatile over the past decade, reflecting potential risks in sustainability despite recent growth in earnings by 35.6%.

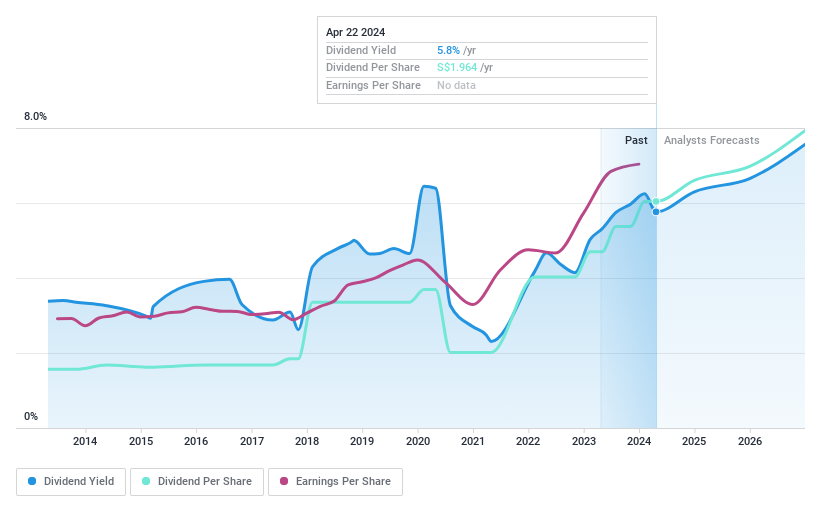

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd operates as a commercial bank offering financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market capitalization of approximately SGD 101.79 billion.

Operations: DBS Group Holdings Ltd generates its revenue primarily through commercial banking and financial services across various regions including Singapore, Hong Kong, Greater China, South and Southeast Asia.

Dividend Yield: 5.5%

DBS Group Holdings, while trading at 49.6% below estimated fair value, shows a mixed dividend profile. Its payout ratio of 50.8% suggests dividends are currently sustainable, supported by earnings growth of 16.7% over the past year. However, dividends have been volatile historically and are low compared to top Singapore dividend payers at only 5.49%. Recent executive changes aim to enhance operational stability following service outages, potentially impacting future performance and investor confidence.

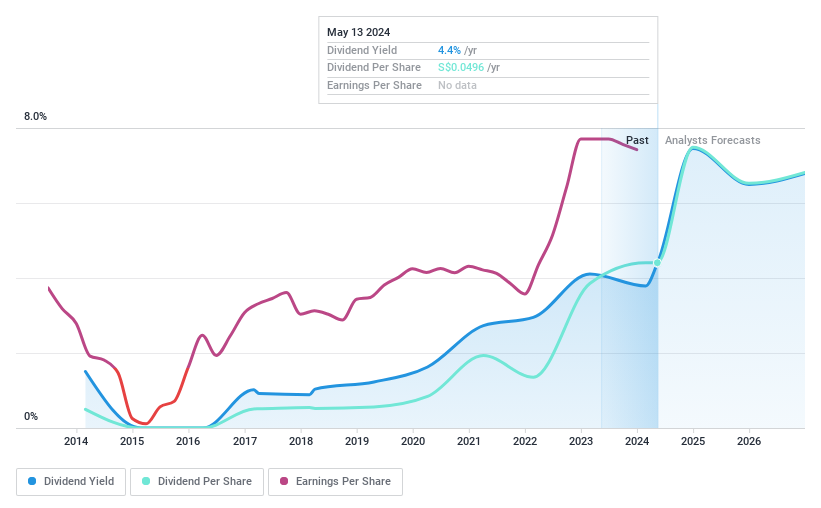

Food Empire Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Food Empire Holdings Limited is an investment holding company that manufactures and distributes food and beverage products in regions including Russia, Ukraine, Kazakhstan, CIS markets, Southeast Asia, South Asia, and other international areas, with a market capitalization of approximately SGD 526.57 million.

Operations: Food Empire Holdings generates revenue primarily from its operations in South-East Asia (SGD 239.74 million), Russia (SGD 152.42 million), South Asia (SGD 68.36 million), and Ukraine, Kazakhstan, and CIS markets (SGD 110.74 million).

Dividend Yield: 5%

Food Empire Holdings, trading 77.4% below estimated fair value, has a dividend yield of 4.97%, lower than the top quartile in Singapore's market at 6.25%. Dividends are supported by a payout ratio of 35.2% and cash flows with a cash payout ratio of 50.7%, indicating sustainability despite historical volatility over the past decade. Recent strategic moves include a $40 million private placement and expansion into Kazakhstan with a $30 million investment in new production facilities, suggesting potential future growth avenues.

Seize The Opportunity

Gain an insight into the universe of 21 Top SGX Dividend Stocks by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AWZ SGX:D05 and SGX:F03

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance