SG semicon sector’s trading at a discount to Malaysian counterpart ‘not justified’: CGS-CIMB

Tng's top pick on the SGX is UMS Holdings, but he also includes AEM and GVT in his picks.

CGS-CIMB Research’s William Tng is of the opinion that Singapore’s semiconductor sector is trading at a discount compared to its Malaysian counterpart, which is “not justified”.

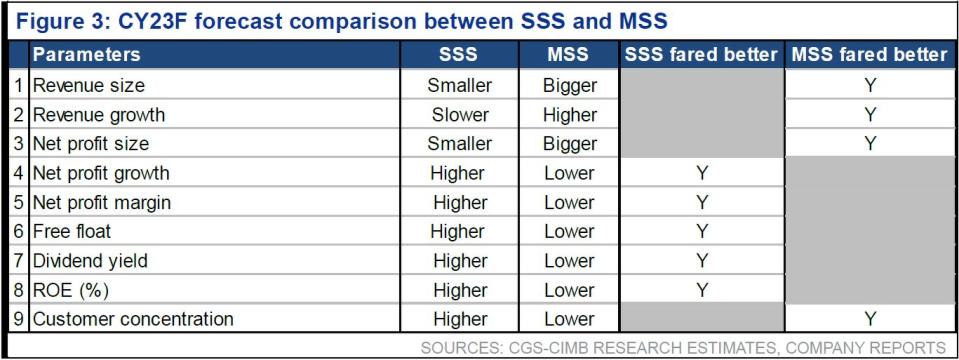

In a sector note, Tng explains that comparing the Singapore semiconductor sector (SSS) with the Malaysian semiconductor sector (MSS), the SSS trades at a 2023 P/E multiple of 10.2x, a 48.5% discount to the MSS average of 19.8x as of Aug 26.

This is despite the SSS’s higher three-year earnings per share (EPS) compounded annual growth rate (CAGR) from 2021 to 2024 of 16.6% vs 15.8% for the MSS.

On 2022 valuations, the SSS trades at 2.53x P/B against a return on equity (ROE) of 22.8%, while the MSS trades at a P/B of 2.70x despite a lower 12.5% ROE.

Tng says that the disparity in valuation between the SSS and MSS could be due to different market dynamics and a larger pool of listed semicon companies in Malaysia.

But in terms of fundamentals, he says this discount “may be unwarranted” as he expects the SSS to show y-o-y net profit growth of 31.2% in 2022, much higher than the 18.3% for the MSS.

Tng also says that for 2023, the SSS’s expected net profit growth rate of 14.4% remains higher than his projected 12.6% for the MSS.

He adds that the SSS’s net profit margins of 17.4% in 2022 and 18.1% in 2023 are higher than his projected net profit margins for the MSS, which are 15.5% and 15.7% for 2022 and 2023 respectively.

The SSS also has a higher free float of 70.9% in August 2022, compared to just 48.9% for the MSS.

Global tailwinds

Tng says that currently, the global economic growth impacts the revenue outlook for the global semicon industry. However, he says that upcycles are long, lasting from two to nine years from 1987-2021, while downcycles are short.

He highlights, “over 1987-2021, we noted seven instances when the global semicon revenue dipped, but these dips only lasted a year each. A key difference we note is the growing trend of

electrification that has led to increased semiconductor usage.”

Tng points to growing application fields, including electric and autonomous vehicles, Internet of Things (IoT) devices and artificial intelligence.

According to McKinsey, global semiconductor revenue could grow to US$1 trillion ($1.4 trillion) by 2030, up from US$556 billion in 2021.

Singapore beneficiaries

As such, he sees beneficiaries of the potential doubling of global semiconductor revenue in Singapore are UMS, AEM and Grand Venture Technology, with UMS as his top pick.

He has also given target prices of $2.03, $6.54 and 85 cents for UMS, AEM and Grand Venture Technology (GVT) respectively.

Tng sees these three companies as the best proxies for the semicon sector, pointing out that in FY2021, they all derived more than 68% of their revenue from the semicon sector, with UMS the highest at 89%.

These companies’ customers include leading industry players, such as Intel for AEM and Applied Materials for UMS that are benefitting from capacity expansion to support the growing demand for chips. UMS, in particular, continues to benefit from strong demand from its key customer, he notes.

“We are positive on the long-term outlook for the SSS,” Tng says, saying that potential rerating catalysts for these companies are stronger-than-expected orders from customers and earlier-than-expected success in securing new customers.

However, downside risks include delivery delays and operational disruptions as the Covid-19 situation continues to pose challenges.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Analysts remain positive on Singtel after 1Q earnings show 'decent start' to FY2023

Analysts keep their 'add' and 'buy' calls for Grab amid push for profitability

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance