'Serving sweeteners': These local large-caps offered the highest FY2022 dividends

OCBC’s Carmen Lee estimates that the overall average dividend yield for FY2023 will come in at an attractive level of 5.0%.

Large-cap companies on the Singapore Exchange (SGX) are serving up sweeteners in the form of attractive dividends, says OCBC Investment Research’s Singapore strategist Carmen Lee.

“As the results season for companies came to an end, it is interesting to note that several companies have either increased their final dividend payouts and/or thrown in sweeteners in the form of unexpected special dividends,” writes Lee. “In an environment that is challenging, especially in view of rising costs and the heightened possibility of slower revenues and profits, this unexpected sweetener, especially from some of the bigger capitalisation companies, is a welcome move for long-term investors.”

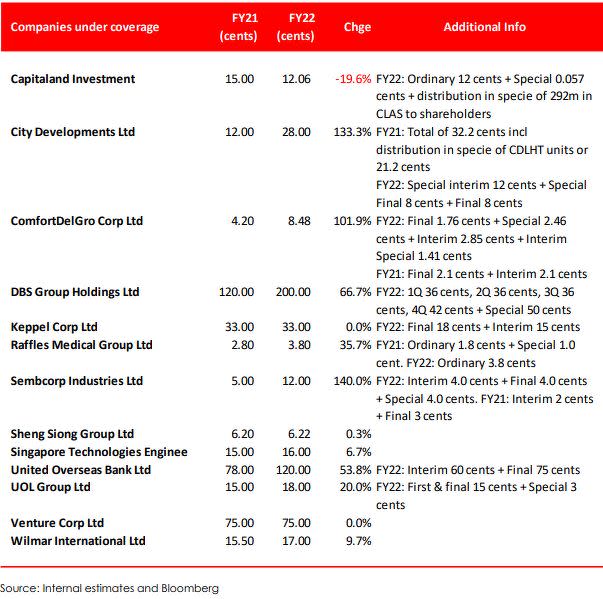

Of note is DBS’s D05 “mammoth” $2 total dividend per share (DPS) for FY2022 ended December, giving an “attractive” dividend yield of 6.0% based on the closing share price on March 10, says Lee.

DBS’s payout included a special dividend of 50 cents and lifted FY2022 DPS y-o-y growth to a “staggering” 67%, adds Lee in a March 13 note.

While most Straits Times Index (STI) companies were not able to match DBS’s “eye-catching” FY2022 payouts, dividend yields for these companies are also commendable, says Lee. “For example, based on the payout of 33 cents, Keppel Corporation’s BN4 current dividend yield is 6.0%. As for ComfortDelGro, C52 with a total DPS of 8 cents in FY2022, the dividend yield works out to be 7.1%.”

“While dividend distribution is highly unpredictable and dependent on economic outlook and specific company’s performance, big-cap companies tend to offer a steady stream of annual dividends or clearly articulated annual dividend payout policies,” notes Lee.

With the current weak market sentiment, this presents buying opportunities to accumulate at lower price levels for longer term holdings, Lee adds.

To Lee, companies with attractive FY2022 dividend yields include City Developments (3.8%) C09, ComfortDelGro (7.1%), DBS (6.0%), Keppel Corp (6.0%), ST Engineering (4.7%) S63, United Overseas Bank (4.7%) U11, Venture Corp (4.4%) V03 and Wilmar International (4.3%) F34.

Results were fairly mixed

In the banking sector, DBS exceeded market estimates, while UOB was slightly below consensus expectations.

In the property sector, City Developments exceeded expectations as its performance was boosted by asset divestments and growth for its hotel operation, while Capitaland Investment missed estimates as its operations were hampered by lockdowns in China.

City Developments posted net income of $1.29 billion, $30 million higher than market estimates. Capitaland Investment posted net income of $861 million, compared to consensus expectation of $1.03 billion.

Hard to predict

That said, Lee warns of low predictability to DPS trends. “While dividend trends are highly unpredictable and can fluctuate widely depending on market conditions and companies’ performance, dividend payouts by bigger capitalised companies tend to be more stable and at times on an upwards sloping trajectory.”

While corporate earnings growth globally could come under some pressure due to the softer outlook in 2023, this situation is slightly different in Singapore, she adds.

Earnings per share (EPS) is projected to grow from 248.34 in FY2022 to 300.14 in FY2023, up 20.9%, based on the latest consensus estimates from Bloomberg.

This is largely explained by the composition of the Singapore market, which has a larger component of listed companies with stable earnings streams.

In addition, the tailwind is likely to come from the opening up of the Chinese economy, says Lee, which will benefit Singapore, especially in the 2HFY2023.

Also, most Singapore companies are not highly geared, especially after the experiences from the Asian Financial Crisis and the Global Financial Crisis, notes Lee. “We believe that the bigger capitalised or more matured companies are in a much stronger position than small-cap companies in FY2023.”

Look at other growth factors

While high interest rates and elevated inflation will remain in focus in 2023, investors should adopt a longer-term investment horizon and look at other growth factors beyond 2023, says Lee.

The current weak market sentiment is an opportune time to accumulate quality names with consistent good dividend yields, especially on price weaknesses, she adds.

For the STI, valuations are not expensive in terms of both price-to-earnings or price-to-book ratios based on current level, notes Lee. “In addition, with the recent sweetener of higher dividend payouts by several blue-chip companies, the overall average dividend yield for FY2023, is estimated at an attractive level of 5.0%.”

As at 4.09pm, the STI is down 37.44 points, or 1.18% down, at 3,139.99 points.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Analysts divided on impact of stabilising net interest margin on DBS going forward

'Hold' HPHT as throughput volume growth expected to be flat: OCBC

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance