SentinelOne (S) Q1 Earnings Beat Estimates, Revenues Up Y/Y

SentinelOne S reported break-even earnings per share in first-quarter fiscal 2025, beating the Zacks Consensus Estimate by 100%. The company reported a loss of 15 cents in the year-ago quarter.

Revenues amounted to $186.4 million, up 40% year over year and beating the consensus mark by 3%. The upside can be attributed to the continued adoption of its AI-powered security solutions.

Top-Line Details

At the end of first-quarter fiscal 2025, SentinelOne’s annualized recurring revenues (ARR) increased 35% year over year to $762 million. The upside was driven by a mix of new customer acquisitions and expansion within existing customer accounts.

SentinelOne experienced strong momentum among large enterprises, with customers generating Annual Recurring Revenue (ARR) of more than $100K rose 30% year over year to 1,193.

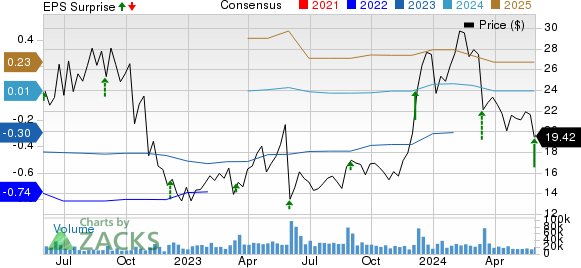

SentinelOne, Inc. Price, Consensus and EPS Surprise

SentinelOne, Inc. price-consensus-eps-surprise-chart | SentinelOne, Inc. Quote

SentinelOne is riding on strong demand for its Cloud Security and Data Lake solutions, with Singularity Cloud emerging as its most rapidly-expanding solution.

Singularity Data Lake saw triple-digit growth, driven by strong demand for advanced security solutions during first-quarter fiscal 2025.

The company continued to innovate its product offerings during the reported quarter, including full cloud-native application protection platform (CNAPP) integration, the introduction of Purple AI and the launch of the Singularity Operations Center to expand its platform capabilities to address evolving cybersecurity challenges.

Operating Details

In first-quarter fiscal 2025, non-GAAP gross margin was 79%, significantly up from the 75% reported in the year-ago quarter.

Research & development expenses, as a percentage of revenues, were 21.3% compared with 29.9% reported in the year-ago quarter.

General & administrative expenses, as a percentage of revenues, were 12.8%, down 730 basis points (bps) year over year.

Sales and marketing expenses, as a percentage of revenues, were 50.8% compared with 63% reported in the year-ago quarter.

Total operating expenses increased 4.8% year over year to $158.1 million.

SentinelOne reported an operating loss of $11.1 million in the reported quarter, narrower than an operating loss of $50.8 million reported in the year-ago quarter.

Balance Sheet & Cash Flow

As of Apr 30, 2024, SentinelOne had cash, cash equivalents and short-term investments of $1.1 billion, in line with the previous quarter's reported figure.

Free cash flow was $33.8 million in the reported quarter compared with cash outflow of $10.6 million reported in the previous quarter. The free cash flow margin was 18%.

Guidance

For second-quarter fiscal 2025, SentinelOne expects revenues to be $197 million, indicating growth of nearly 32% year over year.

Non-GAAP gross margin is expected to be 79%.

For the fiscal 2025, the company expects total revenues between $808-$815 million, suggesting growth of 31% from fiscal 2024 levels.

Non-GAAP gross margin is expected to be 78-79%.

Zacks Rank & Stocks to Consider

Currently, SentinelOne has a Zacks Rank #3 (Hold).

SentinelOne’s shares have declined 29.2% year to date compared Computer & Technology sector’s rise of 10.8%.

Micron Technology MU, Planet Labs PBC PL and SecureWorks SCWX are some better-ranked stocks that investors can consider in the broader sector.

Micron Technology, PL and SecureWorks each carry Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Micron Technology shares have increased 48% year to date. MU is set to report third-quarter fiscal 2024 results on Jun 26.

SecureWorks has declined 19.7% year to date. SCWX is scheduled to release first-quarter fiscal 2025 results on Jun 6.

Planet Labs PBC’s shares have declined 21.9% year to date. PL is scheduled to release first-quarter fiscal 2025 results on Jun 6.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

SentinelOne, Inc. (S) : Free Stock Analysis Report

Planet Labs PBC (PL) : Free Stock Analysis Report

SecureWorks Corp. (SCWX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance