Sensirion Holding Plus Two More Growth Companies With High Insider Ownership On SIX Swiss Exchange

The Switzerland market recently experienced a slight downturn, reflecting a cautious stance from investors as they awaited key economic data from the U.S. Amidst this backdrop of modest shifts in major indices and varied performances across sectors, understanding the intrinsic value and potential resilience of growth companies with high insider ownership becomes particularly relevant. These firms often demonstrate alignment between management’s interests and those of shareholders, which can be crucial during uncertain market phases.

Top 10 Growth Companies With High Insider Ownership In Switzerland

Name | Insider Ownership | Earnings Growth |

Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

VAT Group (SWX:VACN) | 10.2% | 21.2% |

Straumann Holding (SWX:STMN) | 32.7% | 20.9% |

Swissquote Group Holding (SWX:SQN) | 11.4% | 14.0% |

COLTENE Holding (SWX:CLTN) | 22.2% | 20.9% |

Temenos (SWX:TEMN) | 17.4% | 14.7% |

Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Let's take a closer look at a couple of our picks from the screened companies.

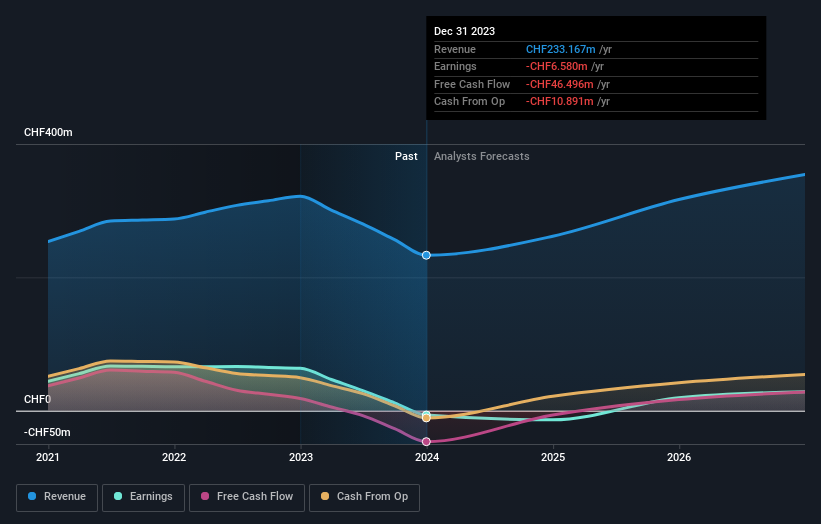

Sensirion Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG operates globally, focusing on the development, production, sale, and servicing of sensor systems, modules, and components with a market capitalization of CHF 1.22 billion.

Operations: The company generates CHF 233.17 million from its sensor systems, modules, and components segment.

Insider Ownership: 20.7%

Sensirion Holding AG, a Swiss company known for its high insider ownership, is poised for significant growth. The firm's revenue is expected to grow at 13.2% annually, outpacing the Swiss market average of 4.4%. Although Sensirion's return on equity is anticipated to be modest at 10.3% in three years, it stands out with its strategic shift towards profitable sectors, including methane emission monitoring services highlighted in recent events. However, investors should note the stock's high volatility over the past three months.

Unlock comprehensive insights into our analysis of Sensirion Holding stock in this growth report.

Upon reviewing our latest valuation report, Sensirion Holding's share price might be too optimistic.

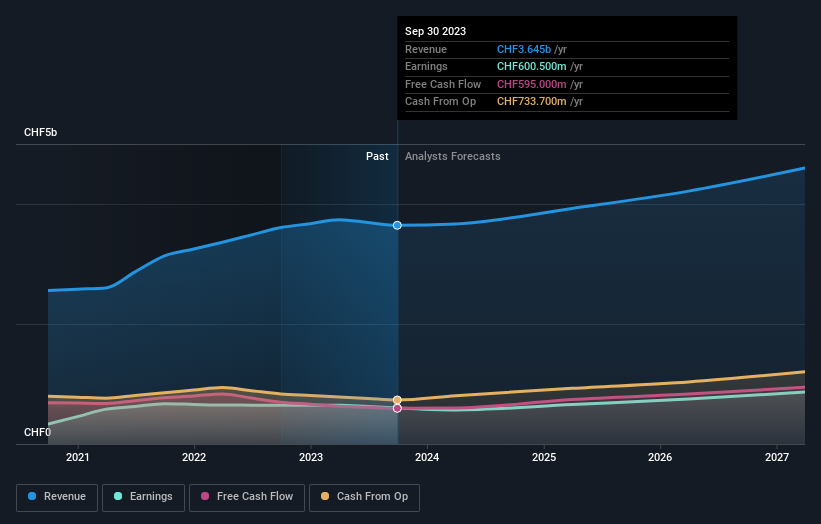

Sonova Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sonova Holding AG, with a market cap of CHF 16.45 billion, is a company that manufactures and sells hearing care solutions for adults and children across the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Operations: Sonova's revenue is generated primarily from two segments: Cochlear Implants which brought in CHF 282.40 million, and Hearing Instruments, contributing CHF 3.36 billion.

Insider Ownership: 17.7%

Sonova Holding AG, a Swiss company with substantial insider ownership, reported robust full-year earnings with sales reaching CHF 3.63 billion and net income at CHF 609.5 million as of March 2024. Despite its strong financial performance, forecasted annual earnings growth is modest at approximately 9.91%, slightly outpacing the broader Swiss market's growth rate. Sonova trades at a significant discount to its estimated fair value and is expected to maintain a high return on equity of around 26.2% in three years, although it carries a high level of debt which could be a concern for potential investors.

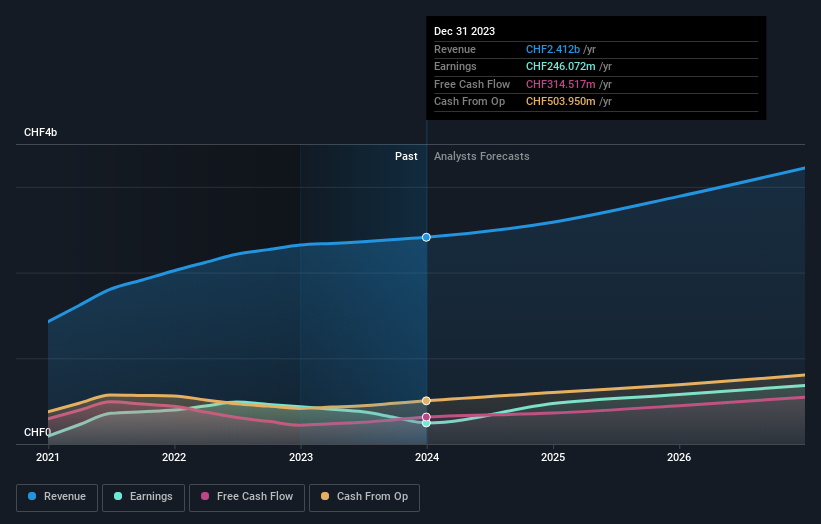

Straumann Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Straumann Holding AG specializes in providing tooth replacement and orthodontic solutions globally, with a market capitalization of approximately CHF 18.12 billion.

Operations: Straumann's revenue is primarily generated from sales in Europe, Middle East, and Africa (CHF 1.17 billion), followed by North America (CHF 793.05 million), Asia Pacific (CHF 451.27 million), and Latin America (CHF 265.82 million).

Insider Ownership: 32.7%

Straumann Holding AG, a key player in the Swiss market, is poised for notable growth with its revenue expected to increase by 9.8% annually, outpacing the national average of 4.4%. While its profit margins have dipped from last year's 18.7% to 10.2%, earnings are projected to surge by 20.9% per year over the next three years, significantly above Switzerland's market growth rate of 8.4%. Despite this promising outlook and a high forecasted return on equity at 24%, Straumann's share price has experienced considerable volatility recently. The company has been active in industry conferences across Europe, underscoring its strategic engagement within the sector.

Seize The Opportunity

Reveal the 16 hidden gems among our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership screener with a single click here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SWX:SENS SWX:SOON and SWX:STMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance