Semrush (SEMR) Boosts SEO With AI-Powered Enterprise Platform

Semrush Holdings, Inc. SEMR has launched the Semrush Enterprise SEO platform, designed to transform SEO operations with embedded AI workflows. This innovative platform is poised to significantly enhance digital marketing operations for large businesses by streamlining complex SEO tasks and boosting productivity.

The new platform of this leader in online visibility management leverages AI to automate labor-intensive tasks, conducts thorough technical audits and crafts customized workflows, which dramatically reduces the time required for analysis and issue resolution. With AI-driven capabilities, users can identify and address algorithm update impacts swiftly, minimizing potential downtime.

Semrush Enterprise SEO harnesses an extensive database of more than 25.7 billion keywords and 43 trillion backlinks, providing users with unparalleled insights and competitive advantages. The platform's AI-powered tools offer real-time content optimization, helping marketers enhance content across multiple languages efficiently. Additionally, it includes sophisticated A/B testing, and forecasting features that empower data-driven decision-making, ensuring maximum value and revenue generation.

One of the standout features of Semrush Enterprise SEO is its access to a professional services network, connecting businesses with top industry experts for strategic support. This network enables enterprises to enhance areas, such as mobile SEO, link building and competitive intelligence with expert guidance.

The platform's integrated collaboration suite, including project management and messaging capabilities, facilitates seamless execution and measurement of marketing campaigns, making it a vital tool for enterprise marketers. It allows teams to prioritize high-impact strategies, reducing routine task time and providing clear insights into the ROI of SEO investments.

Early adopters of the platform have reported substantial benefits. AutoScout24 enhanced its strategic SEO view against competitors, while BlueGlass found it to be an essential tool for in-depth analysis and efficient workflow management.

The launch of Semrush Enterprise SEO is expected to drive significant growth for Semrush, positioning it as a critical player in the digital marketing industry and setting a new standard for enterprise-level SEO solutions.

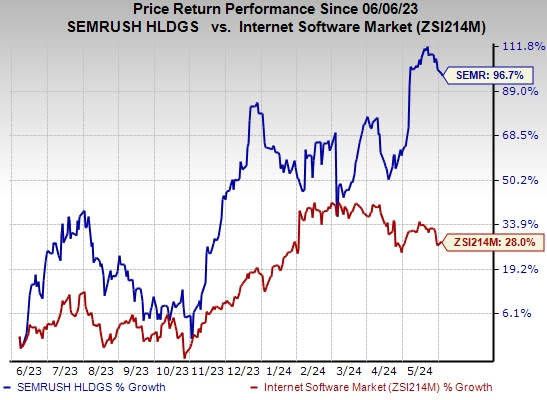

The stock has gained 96.7% in the past year compared with the industry’s growth of 28%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Semrush currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

NVIDIA Corporation NVDA, currently flaunting a Zacks Rank #1, is another key pick in the broader industry. It is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing, gaming and virtual reality platforms.

The company’s GPU platforms are playing major roles in developing multi-billion-dollar end-markets like robotics and self-driving vehicles. NVIDIA has a long-term earnings growth expectation of 30.9% and delivered an earnings surprise of 18.4%, on average, in the trailing four quarters.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 (Buy) at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 9.5%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products, and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

SEMrush Holdings, Inc. (SEMR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance