Schott Pharma IPO targets market cap of up to 4.3 billion euros

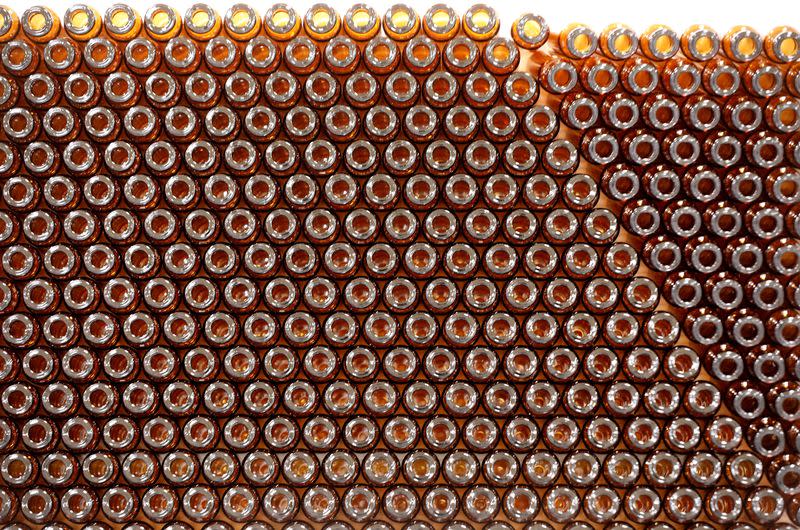

BERLIN/LONDON (Reuters) -The medical vials division of Schott AG launched its initial public offering on Monday, aiming for a valuation of up to 4.3 billion euros ($4.59 billion), it said in a statement.

The German glassmaker is offering a 23% stake in its Schott Pharma business at a price of 24.50 euros to 28.50 euros per share. It hopes to raise 849 million to 987 million euros from the share sale.

Reuters reported in early September that Schott was targeting proceeds of at least 800 million euros in the deal, making it Germany's largest IPO so far this year.

Banks plan to formally start taking stock orders from Tuesday, with a view to completing the transaction by the end of the month.

The investor roadshow includes meetings in Frankfurt, London and New York, according to a tentative schedule seen by Reuters.

"We have received very positive feedback on our outstanding business model, track record, and growth ambitions," said Andreas Reisse, chief executive of Schott Pharma, in the statement.

Mainz-headquartered Schott Pharma focuses on the market for injectable drugs, which is estimated to grow at 9% annually until 2026, according to the company.

Qatar Holding LLC, a vehicle for Qatar's sovereign wealth fund QIA, will purchase up to 200 million euros worth of shares through the IPO as a cornerstone investor, or up to 4.99% of Schott Pharma.

German hydrogen firm ThyssenKrupp Nucera similarly enlisted Saudi Arabia's Public Investment Fund (PIF) as a cornerstone investor in its July listing.

Schott Pharma is going public as the IPO market shows signs of improvement, following an early wave of stock listings in Europe and the United States this summer.

SoftBank-backed chipmaker Arm Holdings successfully priced its blockbuster IPO last week at the top of its indicative price range.

German defence contractor Renk is also preparing to list on the Frankfurt Stock Exchange in the coming weeks.

($1 = 0.9377 euros)

(Reporting by Rachel More, Pablo Mayo Cerqueiro and Emma-Victoria Farr; Editing by Jacqueline Wong, Kirsten Donovan)

Yahoo Finance

Yahoo Finance