Schott Pharma IPO's investor demand exceeds deal size -bookrunners

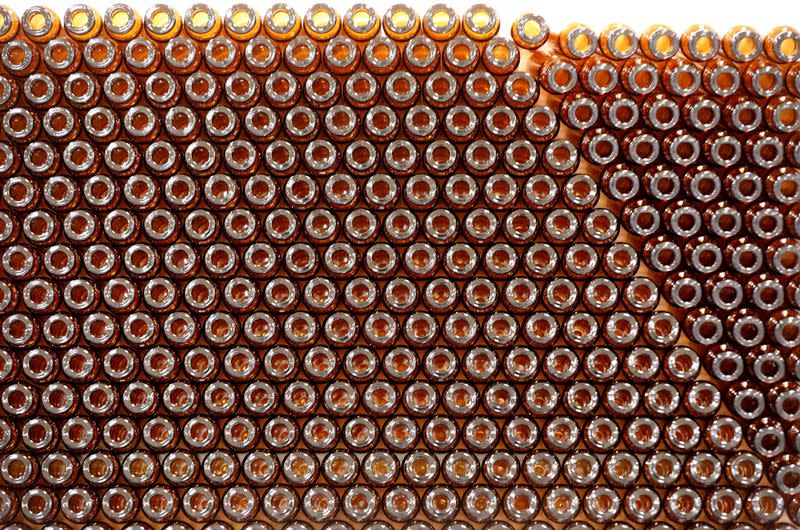

BERLIN (Reuters) -Investor demand for shares in the medical vials division of Schott AG exceeds the deal size in its initial public offering, including the greenshoe option, banks told investors on Tuesday, an hour after the start of the subscription period.

The IPO values Schott Pharma at up to 4.3 billion euros ($4.59 billion).

The German glassmaker is offering a 23% stake in the business at a price of 24.50 euros to 28.50 euros per share. It hopes to raise 849 million to 987 million euros from the share sale.

Reuters reported in early September that Schott was targeting proceeds of at least 800 million euros in the deal, making it Germany's largest IPO so far this year.

(Reporting by Alexander Huebner and Pablo Mayo Cerqueiro, Writing by Rachel More, Editing by Friederike Heine)

Yahoo Finance

Yahoo Finance