SAS Dragon Holdings Leads Three Key Dividend Stocks In Hong Kong

Amidst a backdrop of fluctuating global markets and economic uncertainties, Hong Kong's financial landscape continues to present intriguing opportunities for investors focused on stability and consistent returns. Dividend stocks, such as SAS Dragon Holdings, offer potential havens due to their regular income streams and historical resilience in various market conditions.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.79% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.90% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.96% | ★★★★★★ |

China Electronics Huada Technology (SEHK:85) | 7.84% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.82% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.58% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.73% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.59% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.28% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

Click here to see the full list of 92 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

S.A.S. Dragon Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S.A.S. Dragon Holdings Limited operates as an investment holding company, specializing in the distribution of electronic components and semiconductor products across various regions including Hong Kong, Mainland China, Taiwan, the USA, Vietnam, Singapore, and Macao with a market capitalization of approximately HK$2.55 billion.

Operations: S.A.S. Dragon Holdings Limited generates HK$22.37 billion in revenue primarily through the distribution of electronic components and semiconductor products.

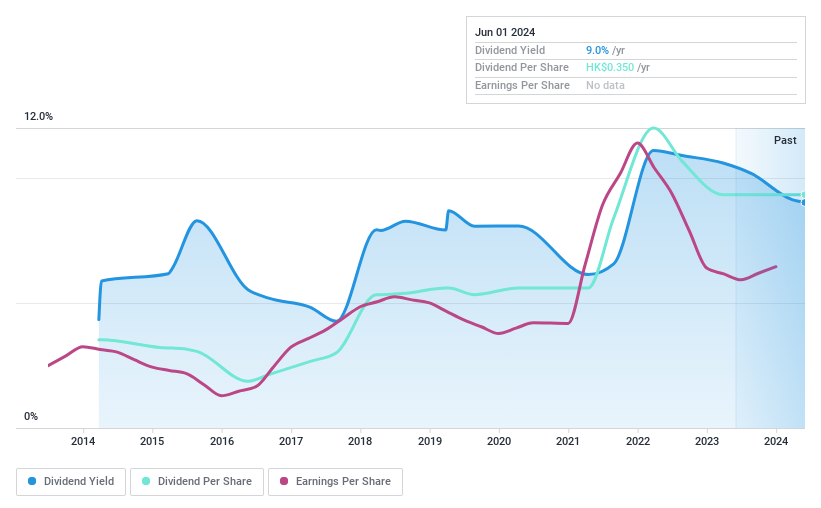

Dividend Yield: 8.6%

S.A.S. Dragon Holdings recently affirmed a final dividend of HK$0.25 per share for 2023, reflecting a commitment to shareholder returns despite an unstable dividend history marked by volatility over the past decade. With earnings of HK$403.8 million and sales decreasing to HK$22.37 billion from HK$24.97 billion, financial performance shows mild resilience. The dividends are supported by a reasonable payout ratio of 54.2% and a low cash payout ratio of 21.2%, suggesting coverage by both earnings and cash flow despite broader financial inconsistencies.

Huishang Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huishang Bank Corporation Limited offers a range of commercial banking products and services across the People’s Republic of China, with a market capitalization of approximately HK$34.03 billion.

Operations: Huishang Bank Corporation Limited generates revenue primarily through three segments: Corporate Banking (CN¥13.23 billion), Treasury (CN¥8.84 billion), and Retail Banking (CN¥5.67 billion).

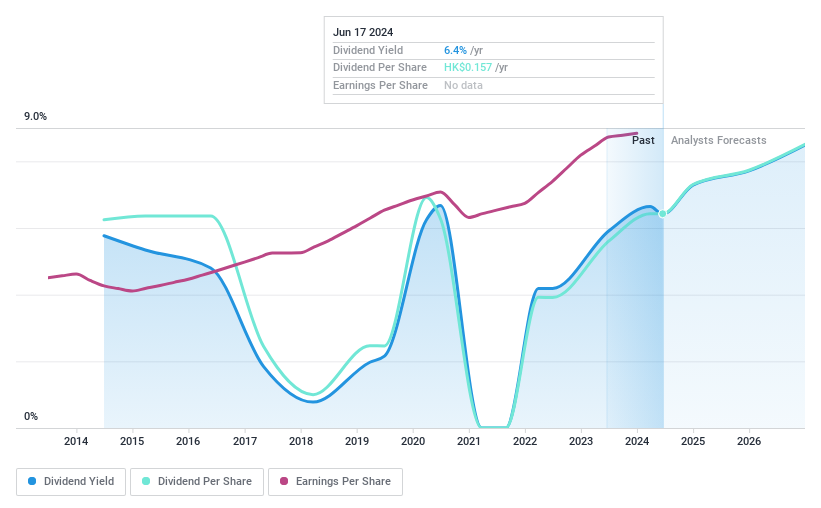

Dividend Yield: 6.4%

Huishang Bank reported a slight increase in net interest income and net income for 2023, with earnings per share rising from CNY 0.93 to CNY 1. The bank proposed a final dividend of RMB 0.146 per share for the year, indicating a commitment to returning value to shareholders despite its unstable dividend track record over the past decade. Trading at 78.9% below estimated fair value and with dividends well-covered by earnings (payout ratio of 14.5%), the stock offers good relative value in its market segment, although its dividend yield remains low compared to top Hong Kong dividend payers.

Carpenter Tan Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carpenter Tan Holdings Limited operates as an investment holding company that designs, manufactures, and distributes wooden handicrafts and accessories under the Carpenter Tan brand, with a market capitalization of approximately HK$1.37 billion.

Operations: Carpenter Tan Holdings Limited generates revenue primarily through the manufacture and sales of wooden handicrafts and accessories, totaling CN¥499.69 million.

Dividend Yield: 6.8%

Carpenter Tan Holdings recently announced a final dividend of HK$0.3864 per share, reflecting its commitment to shareholder returns despite a historically unstable dividend track record. With earnings surging by 62% last year and sales increasing significantly, the company's financial health appears robust. Both earnings and cash flows adequately cover the dividends, with payout ratios of 50.1% and 51.6% respectively, suggesting sustainability in its distribution policy amid volatile past payments.

Next Steps

Take a closer look at our Top Dividend Stocks list of 92 companies by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1184 SEHK:3698 and SEHK:837.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance