Samsung Fire & Marine Insurance Leads 3 Key Dividend Stocks On KRX

The South Korean market has shown robust growth, climbing 1.7% in the last week and achieving a 4.5% increase over the past year, with earnings projected to grow by 29% annually. In such a thriving environment, dividend stocks like Samsung Fire & Marine Insurance stand out for their potential to provide investors with steady income alongside capital appreciation opportunities.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.23% | ★★★★★★ |

NH Investment & Securities (KOSE:A005940) | 6.48% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.53% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.48% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.35% | ★★★★★☆ |

KT (KOSE:A030200) | 5.49% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.88% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.91% | ★★★★★☆ |

Tong Yang Life Insurance (KOSE:A082640) | 6.36% | ★★★★☆☆ |

Korea Cast Iron Pipe Ind (KOSE:A000970) | 5.91% | ★★★★☆☆ |

Click here to see the full list of 72 stocks from our Top KRX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Samsung Fire & Marine Insurance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samsung Fire & Marine Insurance Co., Ltd. offers a range of non-life insurance products and services both domestically in Korea and globally, with a market capitalization of approximately ₩14.41 billion.

Operations: Samsung Fire & Marine Insurance Co., Ltd. generates its revenues primarily through the provision of various non-life insurance products and services across both Korean and international markets.

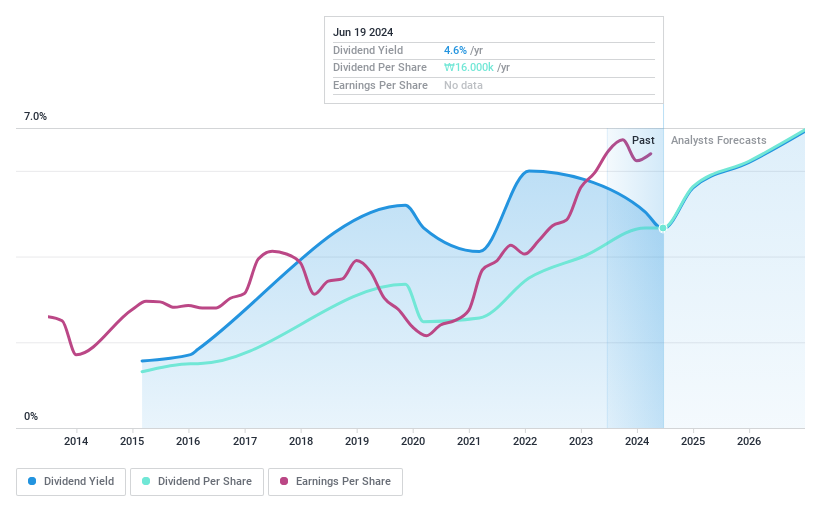

Dividend Yield: 4.6%

Samsung Fire & Marine Insurance offers a dividend yield of 4.64%, ranking in the top 25% in the South Korean market. Despite trading at 66.8% below its estimated fair value, its dividends are well supported with a payout ratio of 38.9% and a cash payout ratio of 50.5%. However, its dividend history is unstable, showing significant volatility over the past nine years despite recent earnings growth of 7.5%. In Q1 2024, Samsung reported a net income increase to KRW 701 billion from KRW 611.8 billion year-over-year.

DB Insurance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. operates in South Korea, offering a diverse range of insurance products and services, with a market capitalization of approximately ₩6.38 trillion.

Operations: DB Insurance Co., Ltd. primarily generates revenue through the provision of various insurance products and services in South Korea.

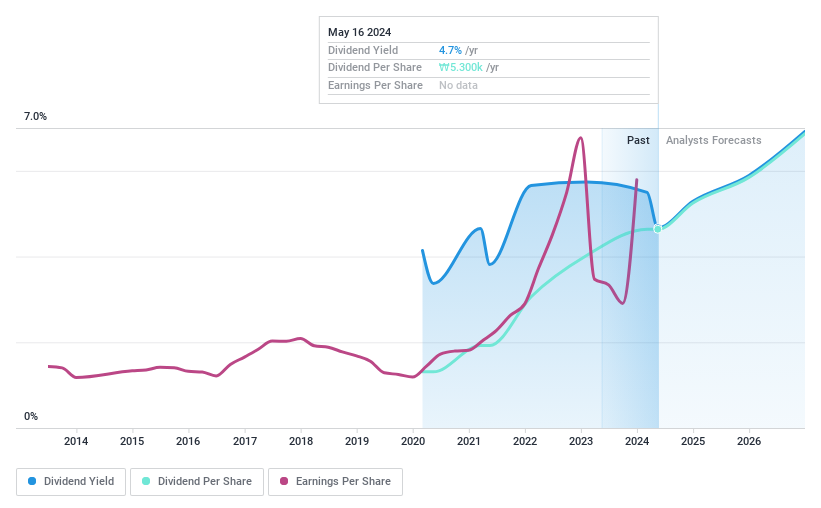

Dividend Yield: 5%

DB Insurance maintains a competitive dividend yield of 4.99%, positioning it well above the South Korean market average. The company's dividends are securely covered by both earnings and cash flows, with payout ratios of 17.7% and 7.9% respectively, indicating strong financial health for continued payouts. Despite this, DB Insurance has a relatively short dividend history of under ten years and lacks consistency in its dividend track record, which may concern some investors seeking long-term stability.

NH Investment & Securities

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NH Investment & Securities Co., Ltd. operates in wealth management, investment banking, trading, and equity sales both domestically and internationally, with a market capitalization of approximately ₩4.24 billion.

Operations: NH Investment & Securities Co., Ltd. generates revenue through wealth management, investment banking, trading, and equity sales across domestic and international markets.

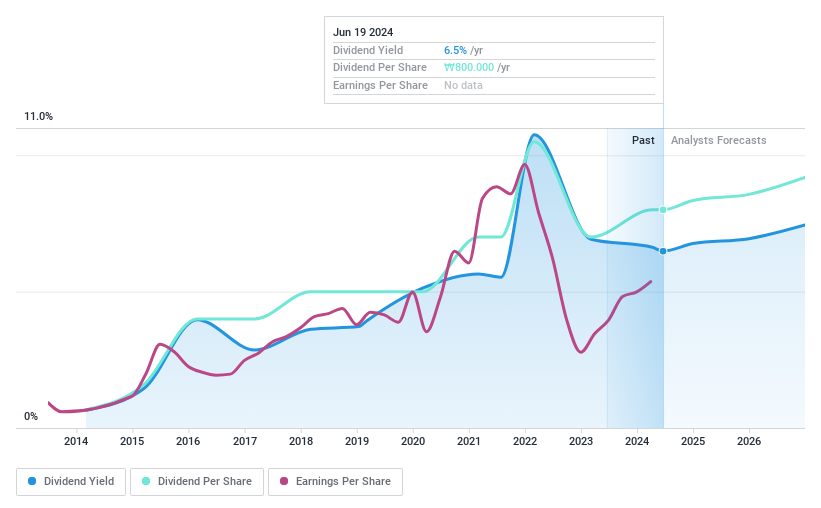

Dividend Yield: 6.5%

NH Investment & Securities reported a net income increase to KRW 225.47 billion in Q1 2024, up from KRW 184.08 billion the previous year, reflecting a solid earnings growth. The company has a high dividend yield of 6.48%, ranking in the top quartile within its market, supported by a low payout ratio of 46.9% and cash payout ratio of 31.1%. Despite these strengths, dividends have shown volatility over the past decade with an unstable track record and significant one-off items impacting financial results, suggesting potential concerns for long-term stability.

Make It Happen

Access the full spectrum of 72 Top KRX Dividend Stocks by clicking on this link.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A000810 KOSE:A005830 and KOSE:A005940.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance