RTX's Business Unit Secures $400M Contract for StormBreaker

RTX Corporation’s RTX business unit, Raytheon, recently announced that it has secured a $400 million contract from the U.S. Airforce to produce and deliver more than 1,500 StormBreaker smart weapons.

About StormBreaker

RTX’s StormBreaker is a precision-guided winged munition. It is a smart weapon that can autonomously detect and classify moving targets in poor visibility situations caused by darkness, bad weather, smoke, or dust kicked up by helicopters. The small size enables the use of fewer aircraft to take out the same number of targets as larger weapons that require multiple jets.

StormBreaker is being integrated by the U.S. Air Force and U.S. Navy on the F-15E Strike Eagle and F/A-18E/F SuperHornet, with testing going on across all variants of the F-35. It completed 28 test drops in 2023.

Growth Opportunities for RTX

The turbulence between Russia and Ukraine in the recent past, along with other geopolitical tensions, has led nations to strengthen their defense systems manifold. In this context, the demand for missiles may increase manifold as these have immense destructive power to support military operations efficiently.

Going forward, per the report from the Mordor Intelligence firm, the global missiles and missile defense system market is poised to witness a CAGR of 4.8% over the 2023-2028 period. This should benefit RTX, which enjoys an extensive missile portfolio containing AIM-9X Sidewinder, SM-6, SM-3 interceptor and TOW missiles, along with a few more, thereby boasting strong demand in the missile market.

Peer Moves

Apart from RTX, defense contractors that are likely to benefit from the growth opportunities offered by the missiles and missile defense system market are as follows:

Northrop Grumman NOC: The company’s missile defense program includes AGM-88E advanced anti-radiation guided missiles, the Ground Based Strategic Deterrent weapon system and rocket propulsion systems. On Oct 24, 2023, NOC received a contract from the U.S. Navy to develop the new 57mm guided high explosive ammunition.

Northrop has a long-term (three-to five-years) earnings growth rate of 2.3%. The Zacks Consensus Estimate for 2024 sales suggests a growth rate of 5.2% from the prior-year estimated figure.

Lockheed Martin LMT: The company’s Missiles and Fire Control business unit includes the PAC-3 family of missiles, M270, RRPR, THAAD, etc. On Dec 7, 2023, Lockheed announced the 800th delivery of Terminal High Altitude Area Defense interceptor to the Missile Defense Agency.

Lockheed has a long-term earnings growth rate of 8.6%. The Zacks Consensus Estimate for 2024 sales suggests a growth rate of 2.9% from the prior-year estimated figure.

General Dynamics GD: The company’s Ordnance and Tactical Systems (OTS) designs, develops and produces a comprehensive range of sophisticated weapon systems for ground forces. The unit also produces next-generation weapon systems for shipboard and aircraft applications. OTS holds a leading position in providing missile subsystems for U.S. tactical and strategic missiles.

General Dynamics’ long-term earnings growth rate is pegged at 9%. The Zacks Consensus Estimate for 2024 sales suggests a growth rate of 6.2% from the prior-year estimated figure.

Price Performance

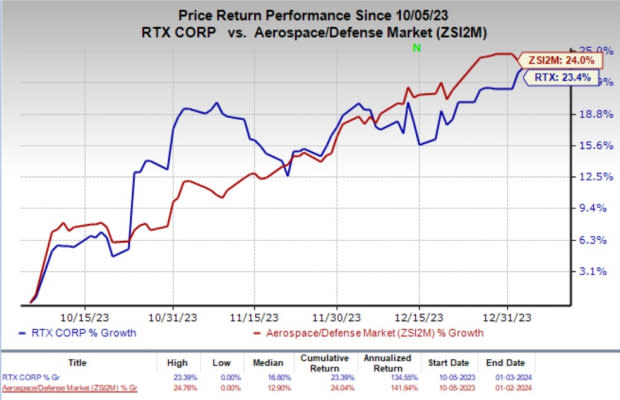

In the past three months, shares of RTX have gained 23.4% compared with the industry’s 24% increase.

Image Source: Zacks Investment Research

Zacks Rank

RTX currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance