Royce Investment Partners: 4 Long-Term Small-Cap Opportunities

Were you surprised that the Russell 2000 Index did so poorly in the second quarter?

Francis Gannon: We were surprised. The Russell 2000 Index fell -3.3% for the quarter, which seemed pretty odd, especially with large-cap stocks continuing to do wellthe large-cap Russell 1000 Index gained 3.6%. More important, the U.S. economy remained in good shape, and inflation moderated. So we really can't point to an external event that would help us make sense of such a dismal quarter on both an absolute and relative basis.

Chuck Royce (Trades, Portfolio) (Trades, Portfolio) : Some observers have suggested that small-caps floundered because of the absence of rate cuts. I think that's a logical but incomplete explanation. For example, many of our holdings have low or no leverage and are therefore not veryor at allrate sensitive. And while performance for most of our portfolios was better than their respective benchmarks, none was able to outpace large-capsdespite the fact that small-caps continue to be far more attractively valued than their larger peers, based on our preferred index valuation metric of EV/EBIT or enterprise value over earnings before interest & taxes.

Relative Valuations for Small Caps vs. Large Caps Are Near Their Lowest in 25 Years

Russell 2000 vs. Russell 1000 Median LTM EV/EBIT (ex. Negative EBIT Companies)From 6/30/99 through 6/30/24

1Earnings Before Interest and TaxesPast performance is no guarantee of future results. Source: FactSet

What factors do you think account for the ongoing strength of mega-cap stocks?

FG: I think there are a few reasons, the first being the promise of AI (artificial intelligence). It's not surprising that Nvidia has emerged this year as the best performer in the mega-cap Magnificent Seven group, given its edge in making the semiconductors that are powering AI applications. There also seems to be a flight from uncertainty into these behemoth namesAlphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. So, while the U.S. economy is still in good shape, there's also a lot of anxiety over the pace of economic growth, inflation, interest rates, the elections, geopolitics, etc. These stocks appear to be impervious to these issuesat least in the minds of their investors. At some point, that will change, but I admit that this run of mega-cap leadership has continued for a longer time than any of us here at Royce anticipated.

What catalysts can you point to that would allow small-caps to recapture market leadership?

CR: There's a lot of attention being devoted to whenor ifthe Fed will cut rates this year. However, I don't see a rate cut being the necessary catalyst. And though I'm sure small-caps would see an uptick in the event of a reduction, I think it would likely be a short-term bump. We see earnings acceleration as being far more likely to spark a lasting small-cap leadership cycle. So, while we sympathize with investors who may be frustrated with the current extended period of small-cap underperformance, we are even more steadfast in our conviction that small-cap will recapture its historical role of outperformance. During this kind of extended leadership period, it's easy to forget that market cycles are finite, but we have been small-cap specialists with a long-term investment horizon for long enough to know that patience is a critical investment virtueand that finding attractively valued opportunities during periods of relative underperformance creates the foundation for rewarding long-term results.

With that in mind, can you talk about two high-confidence holdings that have been underwater so far in 2024?

CR: One interesting name is EnPro (NYSE:NPO), which is an industrial technology company that provides proprietary, value-added products and services for critical sealing and advanced semiconductor applications. It has strong brand names on time-tested products that are typically a low percentage of its customers cost of goods but at the same time have a high cost of failure. Customers often spec in EnPro's products, which results high switching costs and therefore considerable pricing power. Incumbency in this large base of products and services drives EnPro's razor and razor blade' business model, with 53% of sales coming from aftermarket. A series of divestitures and acquisitions over the last several years have enabled management to refocus on faster growth and higher margin businesswhich we think will be reflected in improving returns on invested capital going forward. After a very strong five years, its shares have come down so far in 2024 due to an ongoing pushout in the recovery of its semiconductor-related products and services business, as well as deceleration in certain Sealing Tech end markets, such as heavy duty trucks. We see these as cyclical issues that have only temporarily depressed EnPro's normalized earnings power.

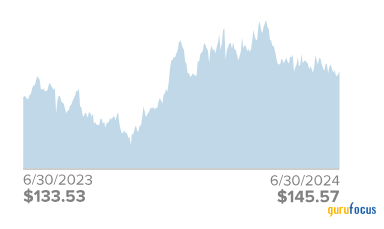

EnPro (NYSE: NPO)6/30/23-6/30/24

Past performance is no guarantee of future results

Another is John Bean Technologies (NYSE:JBT)a global manufacturer of food and beverage processing equipment that holds a leading market position in its niche. JBT tends to compete and win on its innovative technology, not price. It's been a facilitator of increasing automation, and its customers have reaped the resulting benefits of lower labor costs, improved processing efficiency, and food safety. Roughly half of its revenue is recurring in the form of parts and services sold into its large installed base of equipment. The company also has a proven track record of reinvesting free cash flow into acquisitions that provide new processing capabilities or expanded geographic reach. Early in 2024, JBT announced its intention to acquire Iceland-based global peer Marel in a deal that would double the size of company. The long shareholder and regulatory approval process, particularly in the uncertain interest rate and economic environment, has weighed on the stock so far this year. However, we believe there are meaningful cost and revenue synergies, along with scale advantages, that would accrue to the combined company over the long term.

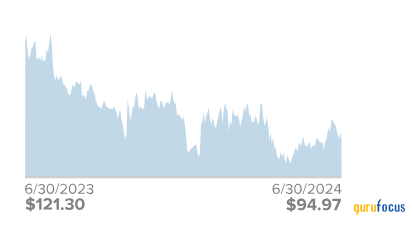

John Bean Technologies (NYSE: JBT)6/30/23-6/30/24

Past performance is no guarantee of future results

Can you tell us about a company that's done well so far this year?

CR: I like the rebound we've seen so far this year for Valmont Industries (NYSE:VMI). Valmont manufactures products for the infrastructure and agricultural markets, including those used in utility grid resilience, solar energy, upgrades to lighting and transportation infrastructure, and the 5G rollout. Demand remains fairly strong across Valmont's Infrastructure segment, with ongoing investments in utility grid resilience, clean energy solutions (solar) and the upgrading of lighting and transportation infrastructure. However, this growth has admittedly been tempered by reduced demand for irrigation equipment and 5G wireless equipmentboth driven by reductions in U.S. farm income from record highs. We continue to be attracted to Valmont's transformation to a more streamlined, higher return oriented company under new leadership. We also see the near-term pressures, on irrigation in particular, as transitory.

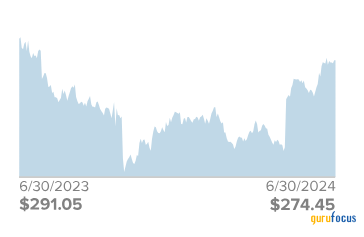

Valmont Industries (NYSE: VMI)6/30/23-6/30/24

Past performance is no guarantee of future results

Can you discuss one that's performed well over the last 12 months?

CR: One company that's done well and looks positioned for continues success is Innospec (NASDAQ:IOSP). It's a specialty chemicals manufacturer with three segmentsPerformance Chemicals, Fuel Specialties, and Oilfield Service Chemicalsthat each account for about one-third of revenue. Chemistry expertise and R&D focused on technology-based solutions underpin IOSP's new product development engine that enables it to target faster-growing niches and benefit from secular tailwinds. Within Performance Chemicals, 75% of sales come from personal and home care product manufacturers that rely on Innospec as they reformulate their products with more environmentally friendly and natural ingredients without compromising performance. Similarly, additive produced by its Fuel Specialties segment are giving transportation providers better engine performance with lower emissions. In addition, Innospec's Oilfield Services products are helping reduce production costs and optimize pipeline throughput. Its stock has rebounded as customer destocking in the personal/household products markets has abated. With no debt and strong cash flows, Innospec remains on a disciplined hunt for acquisitions, primarily in the Performance Chemicals area, that complement its existing offerings, facilitate expansion into adjacent markets, or broaden its geographic reach. Last December, for example, Innospec announced the acquisition of a small Brazil-based performance chemicals manufacturer, which gives it a manufacturing foothold from which to serve existing and potentially new Latin American customers.

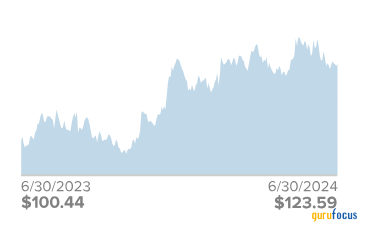

Innospec (Nasdaq: IOSP)6/30/23-6/30/24

Past performance is no guarantee of future results

What would you say to investors who may be doubtful about small-cap's long-term prospects?

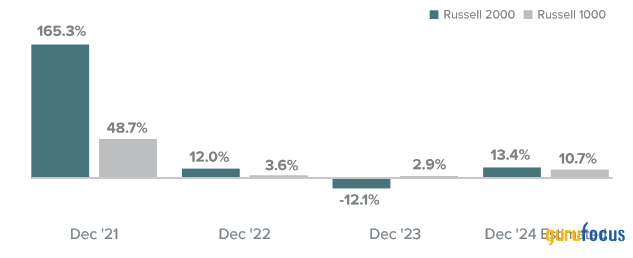

FG: I think we'd start with the fact that active management within small-cap has done wellmarkedly so in some casesover the last several years, and this includes our major domestic Strategies. Based on this, we think that active managers who focus on earnings growth remain best positioned for strong performance going forward. The Russell 2000 finished June with a near-record number of companies with no earnings, but earnings acceleration is expected to be higher for small-cap companies than for large-cap businesses through the end of 2024.

Small-Cap's Estimated Earnings Growth Is Expected to Be Higher in 2024 than Large-Cap's1-Year EPS Growth as of 6/30/24

Earnings per share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock. The EPS Growth Estimates are the pre-calculated mean long-term EPS growth rate estimates by brokerage analysts. Long Term Growth (LTG) is the annual EPS growth that the company can sustain over the next 3 or 5 years. Both estimates are the average of those provided by analysts working for brokerage firms who provide research coverage on each individual security as reported by FactSet. All non-equity securities, investment companies, companies without brokerage analyst coverage are excluded.

This encouraging earnings picture is buttressed by a growing U.S. economy that in the coming months will see more and more tangible benefits from reshoring, the CHIPS Act, and infrastructure improvements. Along with increasing recognition for the small-cap companies that are providing the picks and shovels' for AI applications, these activities should foster advantages for active small-cap managers who focus on profitable companies and other fundamental measures of financial and operational strength. Needless to say, we think our Strategies are well positioned to outperform the overall small-cap market in this kind of environment.

Mr. Royce's and Mr. Gannon's thoughts and opinions concerning the stock market are solely their own and, of course, there can be no assurance with regard to future market movements. No assurance can be given that the past performance trends as outlined above will continue in the future.

The performance data and trends outlined in this presentation are presented for illustrative purposes only. Past performance is no guarantee of future results. Historical market trends are not necessarily indicative of future market movements.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance