Royal Bank of Canada (RY) Stock Gains 5.3% as Q2 Earnings Rise

Shares of Royal Bank of Canada RY have gained 5.3% since the release of its fiscal second-quarter 2024 (ended Apr 30) results late last week. Quarterly adjusted net income of C$4.2 billion ($3.09 billion) grew 11% from the prior-year quarter.

During the reported quarter, RY completed the previously announced deal to acquire HSBC Bank Canada for C$13.5 billion. Results were driven by higher revenues and loans and deposit balances. However, an increase in expenses and provisions acted as a headwind.

Revenues Improve, Expenses Rise

Total revenues were C$14.15 billion ($10.43 billion), up 14% year over year.

Net interest income (NII) was C$6.62 billion ($4.88 billion), growing 9% from the prior-year quarter. Non-interest income was C$7.53 billion ($5.55 billion), surging 19%.

Non-interest expenses were C$8.31 billion ($6.12 billion), up 12%.

The company’s provision for credit losses was C$920 million ($677.9 million), jumping 58%.

Balance Sheet Solid

As of Apr 30, 2024, Royal Bank of Canada’s total loans were C$966.25 billion ($704.3 billion), up 12% from the prior quarter. Deposits totaled C$1.33 trillion ($1 trillion), rising 7%. Total assets were C$2.03 trillion ($1.5 trillion), up 3%.

Capital Ratios Deteriorate

As of Apr 30, 2024, Royal Bank of Canada’s Tier 1 capital ratio was 14.1%, down from the prior-year quarter’s 14.9%. Total capital ratio was 16.1%, falling from 16.8%.

The company’s Common Equity Tier 1 ratio was 12.8%, down from 13.7% in the prior-year quarter.

Our View

Solid loan balances, higher rates and a diversified product mix will likely keep driving Royal Bank of Canada’s financials. However, higher provisions on the uncertain economic outlook are major near-term concerns.

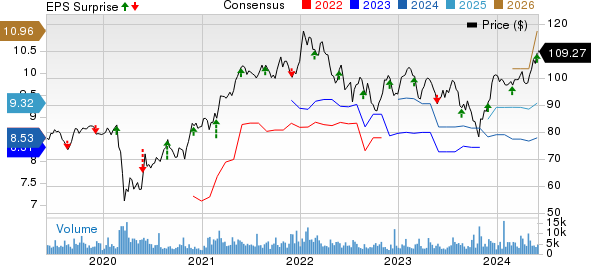

Royal Bank Of Canada Price, Consensus and EPS Surprise

Royal Bank Of Canada price-consensus-eps-surprise-chart | Royal Bank Of Canada Quote

Royal Bank of Canada currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Canadian Banks

The Bank of Nova Scotia's BNS second-quarter fiscal 2024 (ended Apr 30) adjusted net income was C$2.11 billion ($1.55 billion), which declined 2.6% year over year.

A rise in expenses and a surge in provisions for credit losses hurt the results. However, higher revenues, an increase in loan balance and solid capital ratios were tailwinds for BNS.

Toronto-Dominion Bank TD reported second-quarter fiscal 2024 (ended Apr 30) adjusted net income of C$3.79 billion ($2.79 billion), which increased 2.2% from the prior-year quarter.

Results benefited from higher non-interest income and growth in loans and deposit balance. However, an increase in expenses and provision for credit losses were the undermining factors for TD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toronto Dominion Bank (The) (TD) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

Bank of Nova Scotia (The) (BNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance