Roche's (RHHBY) Combo Therapy Misses Lung Cancer Study Goals

Roche RHHBY announced that the late-stage study evaluating the combination therapy of tiragolumab plus Tecentriq (atezolizumab) and chemotherapy for the initial treatment of locally advanced unresectable or metastatic non-squamous non-small cell lung cancer patients failed to achieve its primary goals. Initial or first-line treatment refers to those patients who have previously not been treated for this indication.

The phase II/III SKYSCRAPER-06 study evaluated Roche’s combination therapy compared with Merck’s MRK Keytruda (pembrolizumab) and chemotherapy in 542 patients with the lung cancer indication. The study's primary endpoints comprised progression-free survival (PFS) and overall survival (OS).

Roche’s tiragolumab is an investigational novel immune checkpoint inhibitor with an intact Fc region. The candidate’s unique mechanism of action suppresses the immune response to cancer and acts as an immune amplifier when combined with othercancer immunotherapies, such as Tecentriq.

The study results showed that the combination of tiragolumab plus Tecentriq and chemotherapy was less effective in PFS and OS compared with the control group (Keytruda + chemotherapy). At the time of primary analysis, the PFS had a hazard ratio (HR) of 1.27, while the OS at its first interim analysis had an HR of 1.33, which was immature. Both data indicate reduced efficacy compared to treatment with Merck’s Keytruda and chemotherapy in the treated patient population, which includes the phase II and phase III cohorts.

As a result, Roche intends to halt the phase II/III SKYSCRAPER-06 study and patients and investigators will be unblinded. The findings will be shared with health authorities and presented at a future medical meeting.

The safety profile of the combination therapy of tiragolumab plus Tecentriq and chemotherapy was consistent with previous findings, with no new or unexpected issues.

Roche further clarified that ongoing phase III studies of its combination therapy are exploring treatment settings and indications different than those in the SKYSCRAPER-06 study.

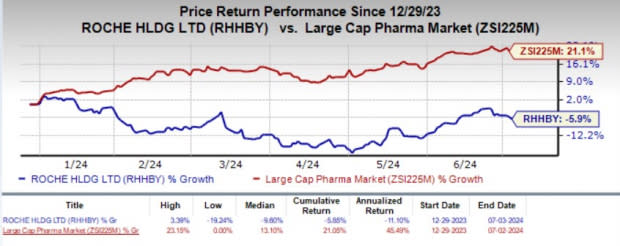

Year to date, shares of RHHBY have lost 5.9% against the industry’s 21.1% growth.

Image Source: Zacks Investment Research

Roche’s blockbuster immuno-oncology drug, Tecentriq, is currently approved in the United States, EU and several other countries to treat some of the most aggressive and difficult-to-treat forms of cancer, including advanced lung cancer, urothelial cancer and breast cancer.

The drug also makes a significant contribution to the company’s top line. In the first quarter of 2024, Tecentriq recorded sales worth CHF 865 million, which represents year-over-year growth of 1%.

Roche’s extensive development program for Tecentriq includes multiple ongoing and planned phase III studies across lung, genitourinary, skin, breast, gastrointestinal, gynecological and head and neck cancers.

Merck’s Keytruda is currently marketed as the standard of care in the frontline treatment of metastatic non-small cell lung cancer patients. Keytruda, an anti-PD-1 therapy, is MRK’s blockbuster oncology drug. It is approved for several types of cancer, accounting alone for 47% of the company’s pharmaceutical sales in 2023.

Keytruda is continuously growing and expanding into new indications and markets globally, bolstering Merck’s position in the oncology market. Merck’s Keytruda is presently approved to treat eight indications in earlier-stage cancers in the United States.

Zacks Rank and Stocks to Consider

Roche currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industryworth mentioning are ALX Oncology Holdings ALXO and Compugen CGEN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has remained constant at $2.89. During the same period, the consensus estimate for 2025 loss per share has remained constant at $2.73. Year to date, shares of ALXO have plunged 62.4%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Compugen’s 2024 earnings per share has remained constant at 5 cents. The consensus estimate for 2025 loss per share is currently pegged at 11 cents. Year to date, shares of CGEN have lost 15.7%.

CGEN’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 5.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Compugen Ltd. (CGEN) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance