Roche (RHHBY) NSCLC Drug Alecensa Gets EC Nod for Label Expansion

Roche RHHBY obtains the European Commission’s (EC) approval for Alecensa (alectinib) monotherapy, as adjuvant treatment following tumor resection for adult patients with anaplastic lymphoma kinase (ALK)-positive non-small cell lung cancer (NSCLC) at high risk of recurrence.

Approximately half of all patients with early-stage NSCLC experience disease recurrence following surgery, despite adjuvant chemotherapy. Hence, Alecensa can now address this patient population.

Please note that Alecensa is already approved in several countries as an initial (first-line) and second-line treatment for ALK-positive, metastatic NSCLC, including the United States, Europe, Japan and China.

The latest EC approval was supported by data from the late-stage ALINA study, where Alecensa demonstrated an unprecedented 76% reduction in the risk of disease recurrence or death in patients with resected ALK-positive NSCLC.

An exploratory analysis of data from the study also showed an improvement in central nervous system disease-free survival. Patients with ALK-positive NSCLC are at a greater risk of developing brain metastases than those with other types of NSCLC.

In April 2024, the FDA also approved Alecensa as adjuvant treatment following tumour resection for patients with ALK-positive NSCLC (tumours ≥ 4 cm or node positive), as detected by an FDA-approved test.

Sales of the Alecensa came in at CHF 355 million in the first quarter of 2024. Approval in the adjuvant treatment setting should boost demand for Alecensa for treating ALK-positive resectable NSCLC where there is a significant need for treatments.

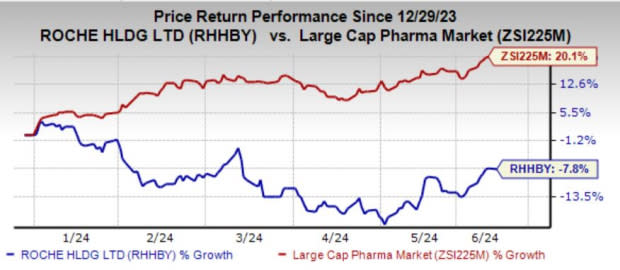

Roche’s shares have lost 7.8% year to date against the industry’s growth of 20.1%.

Image Source: Zacks Investment Research

Roche currently has six approved drugs to treat certain kinds of lung cancer, which is one of the leading causes of cancer death globally.

Drugs like Vabysmo, Ocrevus, Hemlibra and Polivy fuel Roche’s top line as the company looks to fill up the dent in sales caused by a decline in COVID-19-related sales. Competition from biosimilars for established drugs like Avastin, MabThera/Rituxan and Herceptin continues to hurt sales.

Approval of new drugs and label expansion of the existing ones should bode well for Roche in this scenario.

Concurrently, Roche announced that the FDA has granted Emergency Use Authorization for its cobas liat SARS-CoV-2, Influenza A/B & RSV nucleic acid test, an automated multiplex real-time polymerase chain reaction assay on the cobas liat system. The approval further expands and complements Roche’s broad portfolio of single and multiplex tests, intended to help diagnose and address the needs of patients presenting with symptoms of respiratory illness.

Zacks Rank & Stocks to Consider

Roche currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the healthcare sector are Krystal Biotech, Inc. KRYS, ALX Oncology Holdings ALXO and Minerva Neurosciences, Inc. NERV, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for KRYS’ earnings per share has increased 45 cents to $2.06. KRYS beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 21.46%. Shares of Krystal Biotech have surged 44.1% year to date.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

In the past 60 days, estimates for Minerva Neurosciences’ 2024 loss per share have narrowed from $3.57 to $1.89. Loss per share estimate for 2025 has narrowed from $4.54 to $3.60.

NERV’s earnings beat estimates in one of the trailing four quarters and missed the same in the other three, the average negative surprise being 54.43%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Minerva Neurosciences, Inc (NERV) : Free Stock Analysis Report

Krystal Biotech, Inc. (KRYS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance