Robert Olstein's Strategic Exits and Additions in Q2 2024, Highlighting Cracker Barrel's Impact

Insight into Olstein's Latest 13F Filings and Portfolio Adjustments

Robert A. Olstein, the Chairman and Chief Investment Officer of the Olstein Financial Alert Fund (OFALX), is renowned for his expertise in corporate financial disclosure and reporting practices. Since co-founding the "Quality of Earnings Report" service in 1971, Olstein has been a pioneer in using inferential financial screening techniques to analyze financial statements, aiming to uncover factors that could affect a company's future earnings and stock value. His investment philosophy focuses on a "defense first" approach, prioritizing financial strength and potential downside risks over mere appreciation potential. Olstein's strategy involves selecting stocks that generate substantial cash flow, exhibit strong balance sheet fundamentals, avoid aggressive accounting, and are undervalued relative to their private market value. He adjusts his holdings based on a stock reaching its appraised value.

Summary of New Buys

During the second quarter of 2024, Robert Olstein (Trades, Portfolio) expanded his portfolio by adding three new stocks:

Henry Schein Inc (NASDAQ:HSIC) was the most significant new addition with 86,000 shares, representing 0.98% of the portfolio and valued at $5.51 million.

Fiserv Inc (NYSE:FI) followed, with 13,000 shares making up about 0.35% of the portfolio, totaling $1.94 million.

AGCO Corp (NYSE:AGCO) was also added with 6,000 shares, accounting for 0.1% of the portfolio and valued at $590,000.

Key Position Increases

Olstein also made notable increases to several existing positions:

The Middleby Corp (NASDAQ:MIDD) saw a significant boost with an additional 28,500 shares, bringing the total to 66,500 shares. This adjustment increased the portfolio impact by 0.62% and the total value to $8.15 million.

Aptiv PLC (NYSE:APTV) had an impressive 95.24% increase in share count with an additional 40,000 shares, bringing the total to 82,000 shares valued at $5.77 million.

Summary of Sold Out Positions

Olstein completely exited positions in two companies:

Cracker Barrel Old Country Store Inc (NASDAQ:CBRL), where he sold all 85,000 shares, impacting the portfolio by -1.01%.

Hormel Foods Corp (NYSE:HRL), with all 84,000 shares liquidated, causing a -0.48% impact on the portfolio.

Key Position Reductions

Significant reductions were made in several holdings:

Warner Bros. Discovery Inc (NASDAQ:WBD) saw a reduction of 659,200 shares, a 64.36% decrease, impacting the portfolio by -0.94%. The stock traded at an average price of $8.01 during the quarter and has seen a -11.96% return over the past three months and -35.63% year-to-date.

WESCO International Inc (NYSE:WCC) was reduced by 17,000 shares, a 26.15% decrease, impacting the portfolio by -0.48%. The stock traded at an average price of $170.23 during the quarter and has returned -4.74% over the past three months and -8.26% year-to-date.

Portfolio Overview

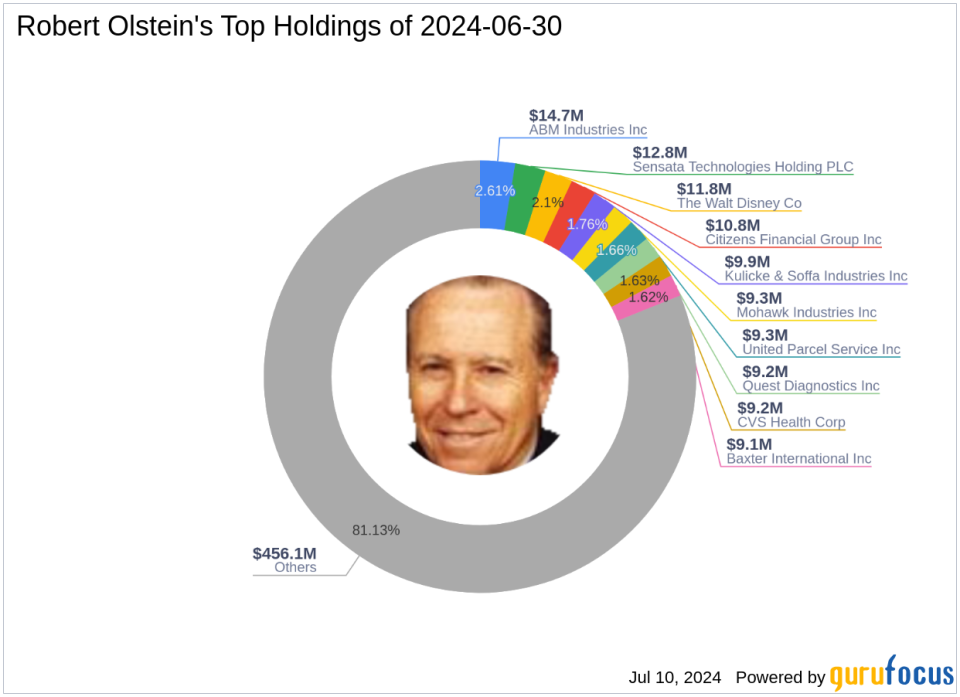

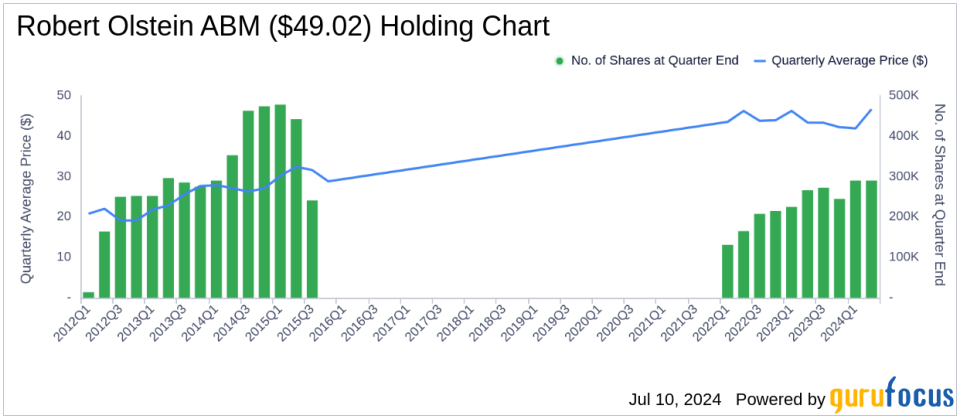

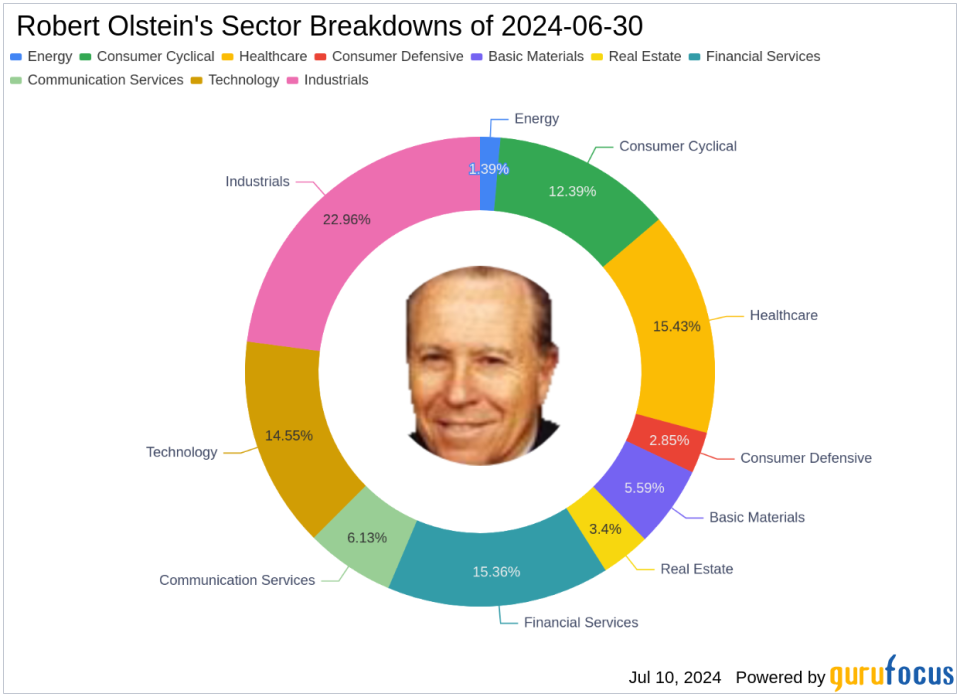

As of the second quarter of 2024, Robert Olstein (Trades, Portfolio)'s portfolio included 99 stocks. The top holdings were 2.61% in ABM Industries Inc (NYSE:ABM), 2.28% in Sensata Technologies Holding PLC (NYSE:ST), 2.1% in The Walt Disney Co (NYSE:DIS), 1.92% in Citizens Financial Group Inc (NYSE:CFG), and 1.76% in Kulicke & Soffa Industries Inc (NASDAQ:KLIC). The holdings are predominantly concentrated in 10 of the 11 industries, including Industrials, Healthcare, Financial Services, Technology, Consumer Cyclical, Communication Services, Basic Materials, Real Estate, Consumer Defensive, and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance