Rising Debt, Gradual De-dollarisation Are Growing Risks for US Sovereign Rating

Growing fiscal and institutional risks represent core challenges for the sovereign credit ratings of the United States, underpinning Scope Ratings’ long-held view of why it is no longer the benchmark AAA-rated, risk-free borrower. Scope has publicly rated the US at AA, two levels below AAA, since 2017.

US general government debt will continue to rise having resumed an upward trajectory last year after improving in 2021-22 due principally to the economy’s quick post-pandemic recovery and elevated inflation. The increase in debt will still be gradual given Scope’s expectation of a soft landing for the economy, with 2.8% real growth forecast this year and 2.5% in 2025, and continued robust nominal growth medium run.

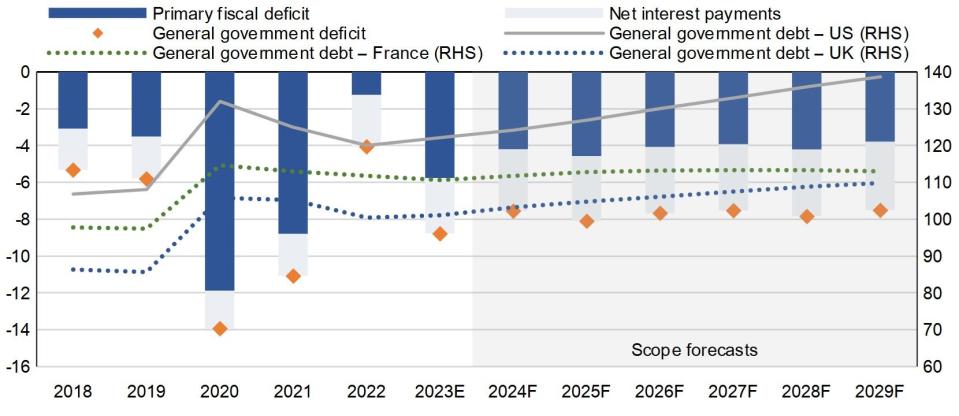

Nevertheless, the reversal of recent declines in debt-to-GDP is a rating risk. The ratio is forecast to reach 138.6% of GDP by 2029 (Figure 1), up from 122.1% at end-2023 and 108.1% at end-2019, hence our Negative Outlook assigned to the sovereign in June 2023. Among G-7 sovereigns, the US is forecast to sustain the third highest debt-to-GDP ratio, below Japan (258% by 2029) and Italy (144%), but well above similarly rated France (113%) and the United Kingdom (110%).

Figure 1. Structural rise in debt represents a rating risk for US

% of GDP

US Set for Persistently Wide Primary Fiscal Deficits in 2024-29

Scope projections follow persistent and significant primary fiscal deficits averaging 4.1% over 2024-29 and a continued rise in net interest payments, forecast at 3.7% of GDP by 2029 (or 11.9% of revenue), nearly double the recent low of 2.1% of GDP (6.7% of revenue) in 2020.

Interest payments are on the rise as we expect the Federal Reserve to hold rates higher for longer and maintain them above pre-2022 levels even after rate cuts start. Investors have recently scaled back their bets on the extent of future rate cuts, a shift which is visible in the recent rise of 10-year Treasury yields to around 4.5% from 3.8% last December.

The headline annual US fiscal deficit is seen averaging 7.7% of GDP over 2024-29, after rising to 8.8% of GDP last year from a recent low of 4.1% in 2022. Risks to our fiscal deficit projections are skewed to the upside given the possibility of an adverse shock to the economy, partly due to the more volatile geopolitical and macro-economic context.

The Outcome of 2024 Elections to Determine US Fiscal Trajectory

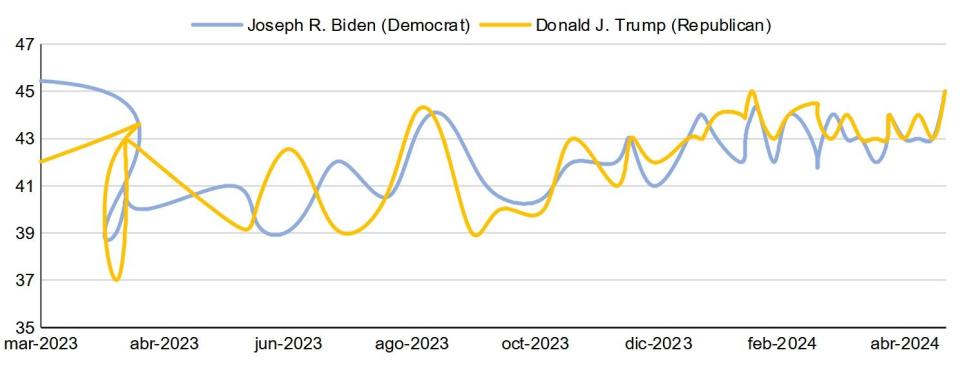

Much of future political uncertainty regarding the US budget deficit relates to the outcome of the presidential and congressional elections in November. In recent months, Donald Trump has held a slight advantage over President Joe Biden (Figure 2) in national polling, but this margin is more meaningful than it appears as the Republican challenger could win a majority of votes in the Electoral College even if he loses the popular vote by around 2pps or slightly more.

Figure 2. US national opinion polling

% of voting intentions

A Divided Future Government Might Be One Key for Tighter Fiscal Controls

What matters for policy making is the make-up of the next government and Congress. Further budgetary loosening after 2025 is likely if the same party wins the presidency and controls Congress. This assumes a greater propensity to spend by any second Trump government than the historical preferences of previous Republican administrations. A second Biden presidency, together with a Democrat-held Congress, would also likely result in additional government expenditure. In contrast, a divided government would likely ensure that there would be comparatively tighter fiscal controls.

Regardless of the policies, the question of fiscal sustainability will remain politically charged with the question of resolving the debt ceiling returning shortly after elections.

US Treasuries’ Status as Global Safe Asset Could Be Tested by Election Outcome

To be sure, the US continues to enjoy by some distance the most-significant debt tolerance of any borrower globally – sovereign or non-sovereign – a by-product of the dollar-based world order, with US Treasuries representing the global safe asset and the Federal Reserve the leading global central bank.

As a result, the US benefits from enhanced economic and financial resilience and safe-haven inflows during shocks, resulting in declining rather than rising US Treasury yields during crises, supporting US funding through the cycle. The reputation of US Treasuries cuts the federal government’s borrowing rate by around 25bp, according to some estimates.

While the status of Treasuries as the global risk-free asset curbs any risk concerning debt sustainability in the near to medium term, in an increasingly multi-polar world, the greater supply needed to finance the US deficit might coincide with softening global demand for Treasuries and increase the risk premium that the government pays. Some foreign investors, particularly from the ‘Global South’, are diversifying their risk exposure as large economies such as China and Russia promote their own currencies. Sanctions against Russia after the escalation of its war in Ukraine have also accelerated this de-dollarisation, even if it remains gradual.

In the longer run, the status of Treasuries as the benchmark global risk-free asset is also likely to be affected by the outcome of this year’s elections. The scenario of a second Trump presidency might lead to a more-adversarial US approach to trading relations and accelerate de-dollarisation. Global reserves held in dollars declined to 59% by the end of the first Trump presidency from 65% beforehand. Any further reduction of the dollar’s share of allocated reserves from the 58% at end-2023 would see a parallel shift from Treasuries to other safe assets.

For a look at all of today’s economic events, check out our economic calendar.

Dennis Shen is Senior Director in Sovereign and Public Sector ratings at Scope Ratings GmbH, and primary analyst for the United States’ sovereign credit rating. Brian Marly, analyst at Scope, contributed to drafting this article.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance