Rhinebeck Bancorp First Quarter 2024 Earnings: EPS: US$0.10 (vs US$0.073 in 1Q 2023)

Rhinebeck Bancorp (NASDAQ:RBKB) First Quarter 2024 Results

Key Financial Results

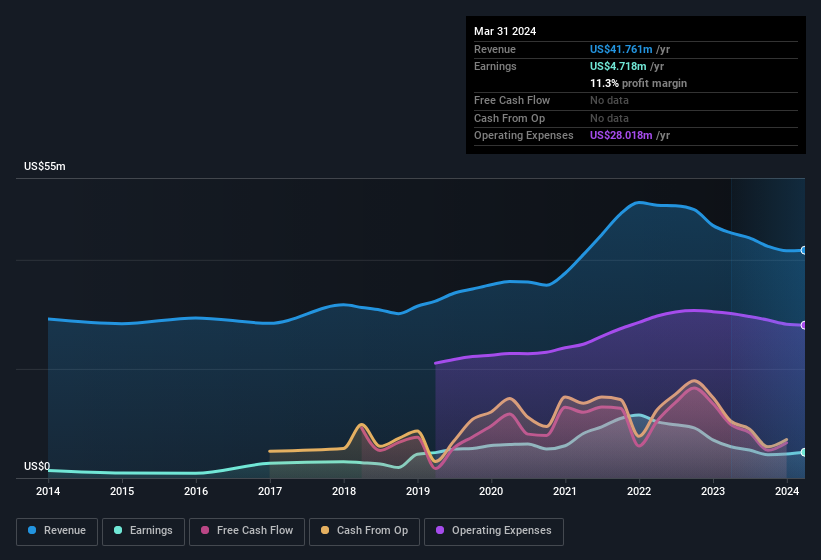

Revenue: US$10.3m (flat on 1Q 2023).

Net income: US$1.12m (up 41% from 1Q 2023).

Profit margin: 11% (up from 7.8% in 1Q 2023).

EPS: US$0.10 (up from US$0.073 in 1Q 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Rhinebeck Bancorp shares are down 1.6% from a week ago.

Risk Analysis

What about risks? Every company has them, and we've spotted 1 warning sign for Rhinebeck Bancorp you should know about.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance