RHB 'overweight' on S-REITs as peak rates near; foreign names with 'bombed-out valuations' offer most upside

RHB Bank Singapore favours CapitaLand Ascendas REIT, Keppel REIT, AIMS APAC REIT and CDL Hospitality Trusts.

Singapore REITs (S-REITs) have been severely challenged over the last two years due to steep interest rate hikes and have declined more than 20%. But now, the sector is reaching the tail-end of the downcycle as the global markets near peak rates, says RHB Bank Singapore analyst Vijay Natarajan.

Natarajan is upgrading the sector to “overweight” from “neutral” as S-REITs approach an inflection point. Valuations have become more attractive, he writes in a Nov 20 note, at 0.8x price-to-book value (P/BV) and at 2 standard deviations below the mean.

The recent sharp correction has led to good entry levels, he adds. “Negatives are largely priced-in and sector news flow is expected to turn incrementally more positive as we move into 2024.”

Among the sector’s names, Natarajan prefers REITs with “high-quality sponsors” and healthy balance sheets with gearing under 40%.

Natarajan favours CapitaLand Ascendas REIT A17u (CLAR), Keppel REIT K71U (KREIT), AIMS APAC REIT O5RU (AA REIT) and CDL Hospitality Trusts J85 (CDLHT). He has “buy” calls on all four S-REITs, with target prices of $3.20 for CLAR, $1.08 for KREIT, $1.47 for AA REIT and $1.23 for CDLHT.

By sector, Natarajan is “overweight” on industrial, office, hospitality and overseas S-REITs, but remains “neutral” on the retail sub-sector, citing a coming raise in GST and the impact of inflationary pressures on tenants. “We recommend investors to adopt a slightly more aggressive stance, with a balanced mix of industrial REITs for stable yields as well as a mix of office and hospitality REITs to ride on the recovery and rebound from the turn in the interest rate cycle.”

But investors with a higher risk appetite may also opt for mid-cap and overseas S-REITs, which offer the most upside due to their “bombed-out valuations”, he adds.

“We see high-risk high-return opportunities in some of the good-quality US office and European-focused REITs, such as Keppel Pacific Oak US REIT CMOU and Cromwell European REIT CWBU,” says Natarajan. He has “buy” calls on both S-REITs, with target prices of 48 US cents (64.3 cents) and EUR2.10 ($3.07) respectively.

DPU outlook ‘unexciting’

That said, Natarajan’s overall distribution per unit (DPU) outlook for the sector for FY2024 remains negative, with a recovery anticipated only in the following year.

The DPU outlook may be unexciting but emphasis is more likely on P/BV, he adds. “The ongoing repricing of S-REITs’ debt, coupled with floating debt exposure, would result in continued high interest cost pressures for S-REITs outpacing their top line growth next year.”

Barring the hospitality sector, the outlook for DPU in FY2024 is muted for the rest of the sectors. However, signs are emerging that financing costs are nearing the peak and based on management guidance during the latest briefing sessions point to this likely happening by mid-2024, says Natarajan.

“As such, we believe downside risks to DPU forecasts, from here on, are likely minimal. We also believe there is room for upside revisions to our and consensus DPU forecasts, should the US Federal Reserve pivot early.”

In addition, as we near the tail-end of the interest rate cycle and the sector’s operational performance remains robust, this should mark the potential end of asset repricing as valuations decline, says Natarajan. “Investors, hence, are likely to take cues from the steep trading discounts to S-in REITs’ book values and could look for bargains across the sector, instead of buying physical assets directly.”

Improving operational metrics

Operational metrics continue to strengthen across all segments in Singapore, says Natarajan, and the outlook for asset classes based on latest S-REITs’ reports and forward guidance remains positive. “While operational cost pressures persist, most S-REITs guided that these are almost at peak levels, with many hedging utility costs and passing through inflationary costs to tenants upon lease renewals.”

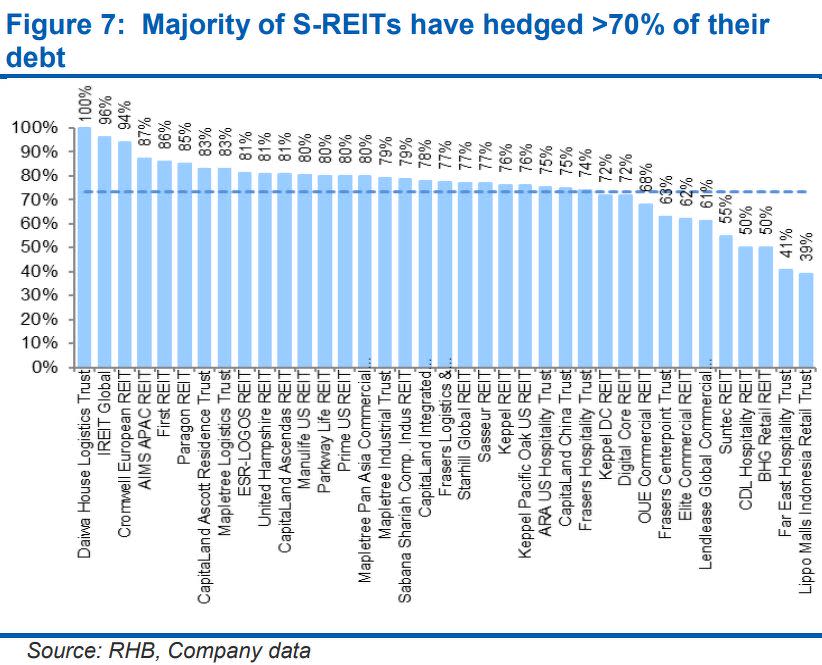

Interest cost pressures remain the key focus and concern, but he expects this to peak in FY2024. The foreign exchange effect remains a “wildcard”, he adds, but S-REITs generally remain well-hedged and well-diversified, “which mitigates this impact”.

Average gearing across the sector has risen by some 120 bps to 38.2% since early 2022. The increase in gearing can be mainly attributed to valuation declines and FX impact for overseas assets, as the pace of acquisitions have largely slowed down amid challenging market conditions.

RHB economists expect Singapore’s GDP growth to double next year, aided by the global trade recovery, while anticipating one more rate hike in December.

For now, investors should watch for a reversal in fund flows to the sector from investors repositioning, better-than-expected operational growth and peaking interest cost pressures in FY2024, leading to earnings bottoming, says Natarajan.

Divestment and asset redevelopments or enhancements are still the key near-term focus, he adds.

Many S-REITs have focused on divestments since 2H2023 to lighten their balance sheets and position for opportunities ahead. “We expect this to continue up until 1H2024, on top of very selective acquisitions being made,” says Natarajan. “On valuations, Singapore assets should remain largely stable across segments, except for hospitality assets, which are likely to see slight upside.”

Valuations in overseas markets remain negative, with up to 10% declines in valuations expected as a result of the 50 basis points (bps) to 175 bps expansion in cap rates. “But this is largely priced in, in our view,” he adds.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

RHB upgrades Bumitama to 'buy', maintains 'neutral' on First Resources with lower TP

Analysts mostly lift TPs on ComfortDelGro after further earnings recovery

Analysts see record year for Food Empire, expect higher dividend

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance